The crossword puzzle

Cryptic ball: rhymes with iceberg (9).

So, did you think bitcoin would just continue climbing like there was no tomorrow after the gains of the last couple of days? Naturally, that wasn't the case and the total cryptoasset market depreciated 1.6% over the past day, with bitcoin remaining slightly more neutral than the average token. As we explained last May, we're still in the crypto doldrums, and not much is going to happen after what's considered a massive pump in any kind of market. Why?

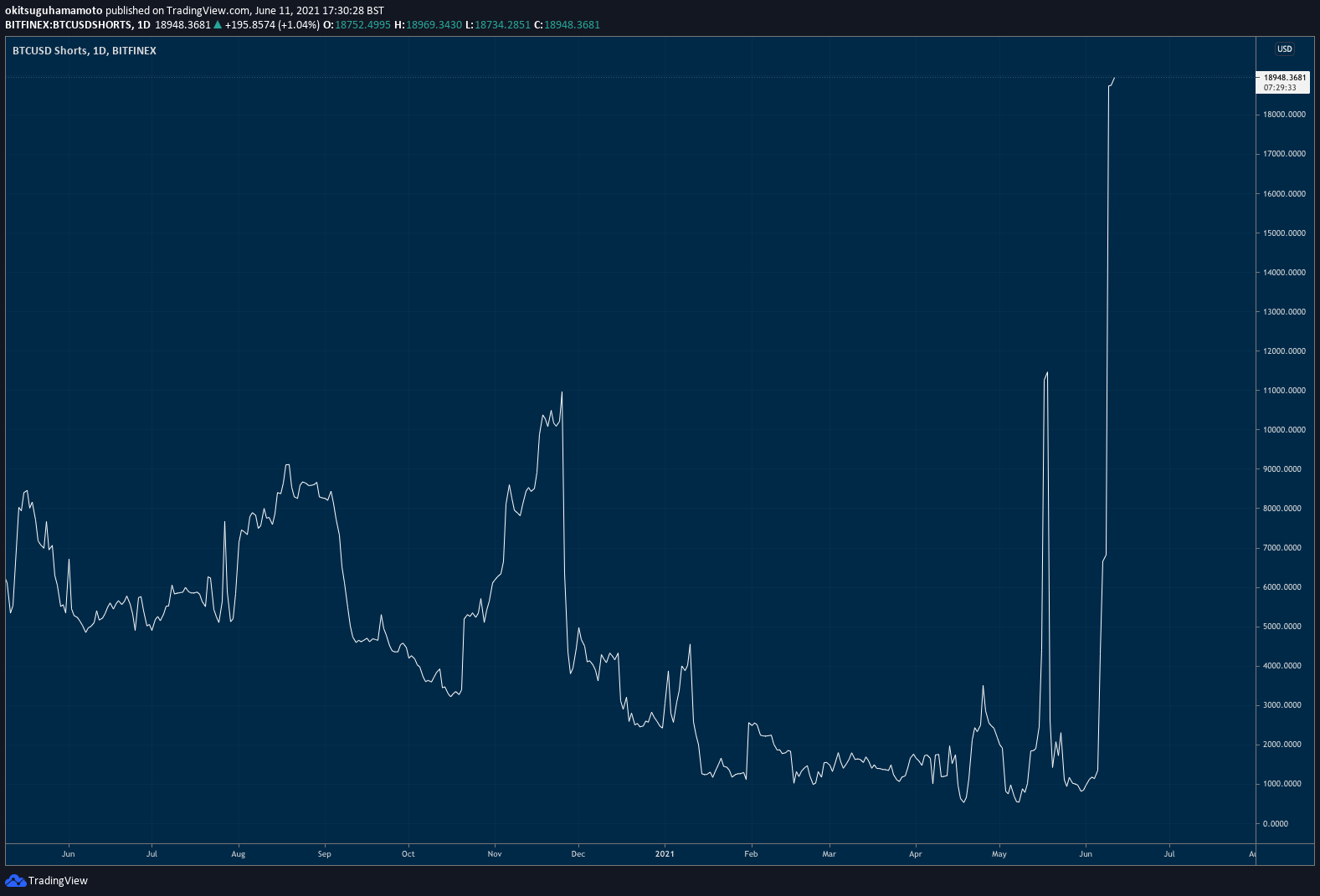

To begin, Kraken's OTC desk reported heavy selling after whales and funds (who typically use over-the-counter trading services to buy and sell on their behalf) realised those 20% gains achieved in just two days. Then, next Friday the 18th is when a possible bitcoin "death cross" may take place, which is making many investors anxious as even Bloomberg is covering the topic. While this trading pattern implies nothing else other than that a given asset is losing momentum, unfortunately many people are influenced by it. Should you be worried?

Chart art: don't short a "____" market (4).

Market musings: that time of the year when crypto is stale (5).

Well, not all is lost. If you need some hope going into the weekend, Pete Humiston, head of Kraken Intelligence, reminds us of the case of August 2013, when bitcoin was also in a multi-year bull market. After appreciating 25x in six months, bitcoin fell 75% between April and July of that year. An impending death cross was also scaring many traders away. But, in August, bitcoin started pumping before the moving averages crossed, and bitcoin went on pumping 19x until December!

Then, it crashed again in what was the beginning of a two-years long bear market, with bitcoin taking three years before making a new all-time high. However, our take is that we won't see a similar bounce now, as the situation is quite different. This is not to say we'll see a dump too. As you should know by now, we agree with Pete that it's important to plan for the worse. It's just that this death cross narrative is not as important after a big crash, which already happened!

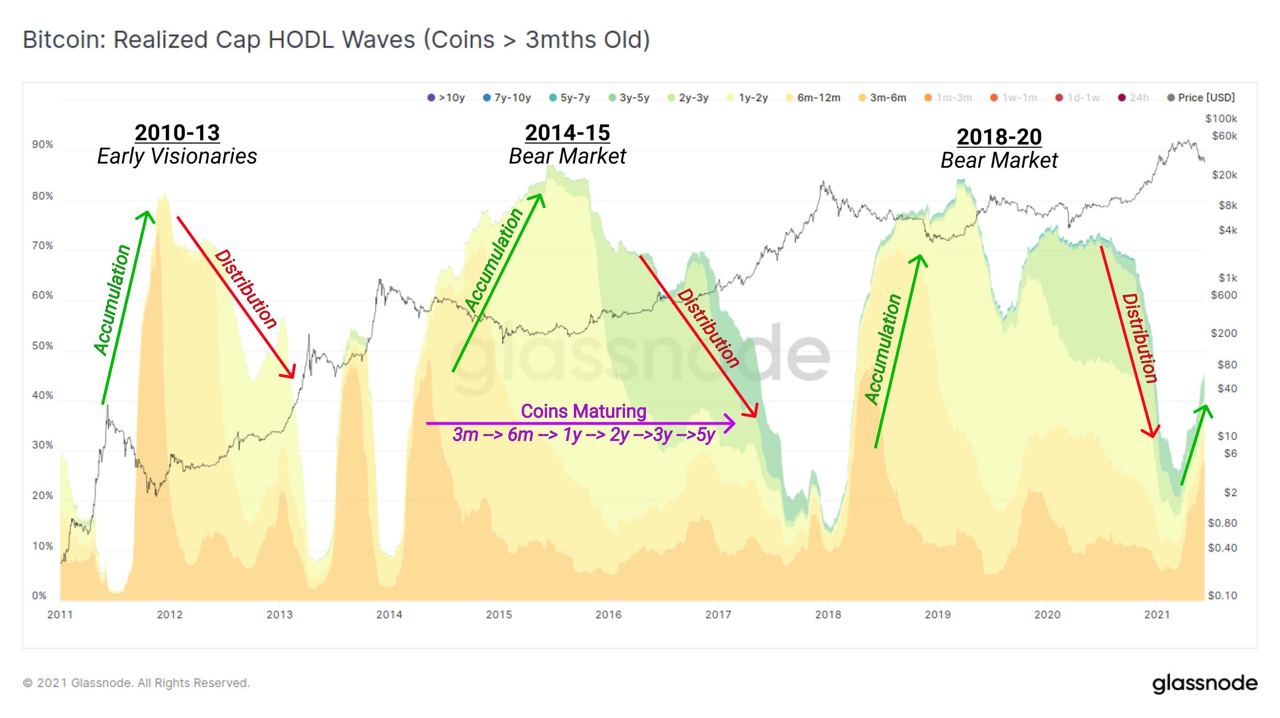

Visual block: where we are in the market cycle (4,4).

Three things: what the latest Bitcoin war was and wasn't (5).

- Have you still not figured out DeFi? Check this great DeFi Policy Maker Toolkit developed by the World Economic Forum and Wharton Blockchain.

- Have you still not figured out why Michael Saylor is raising $500 million to buy more bitcoin for Microstrategy? Arthur Hayes explains that and more!

- Have you still not figured out what Taproot is? Check out this great explainer of the Bitcoin most important update since 2017, which will be locked in today.

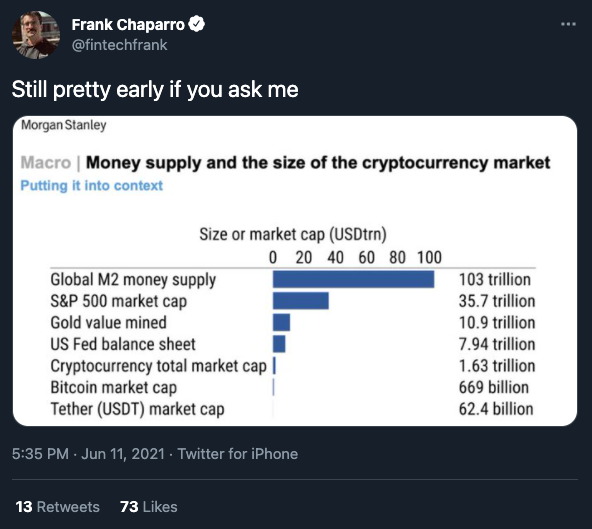

Tweet tip: it's not a bubble, it's an "________" (8).

Meme moment: what the future of finance will be (13).

The Desi Crypto Show: learn more about SushiSwap.

Special announcement: coming next week.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!