And we're back

Cryptic ball: and the Merge is due in 24 hours.

Hello everyone! After a couple of weeks of pause, after being accidentally de-platformed by our newsletter provider, I'm happy to announce we're back - just in time for the Merge! Just note we'll soon transition to Twitter's Revue service.

- Meanwhile, what has happened since my last email on August 27th? Curiously, a lot. Yet, bitcoin is standing at exactly the same spot! BTC closed that day at $20k and today it touched that level, having currently bounced to $20.4k.

- As for ether, on August 27th it dropped below $1.5k for the first time since July, and after recovering a couple of days later, it is now trading slightly above that level again - just 24 hours before Ethereum's Merge upgrade is activated.

- All-in-all, these cryptoasset leaders and the rest of the alt market failed to take advantage of this summer's generalised pump to create a sustained uptrend. Instead, price structure looks weak and market activity is depressed.

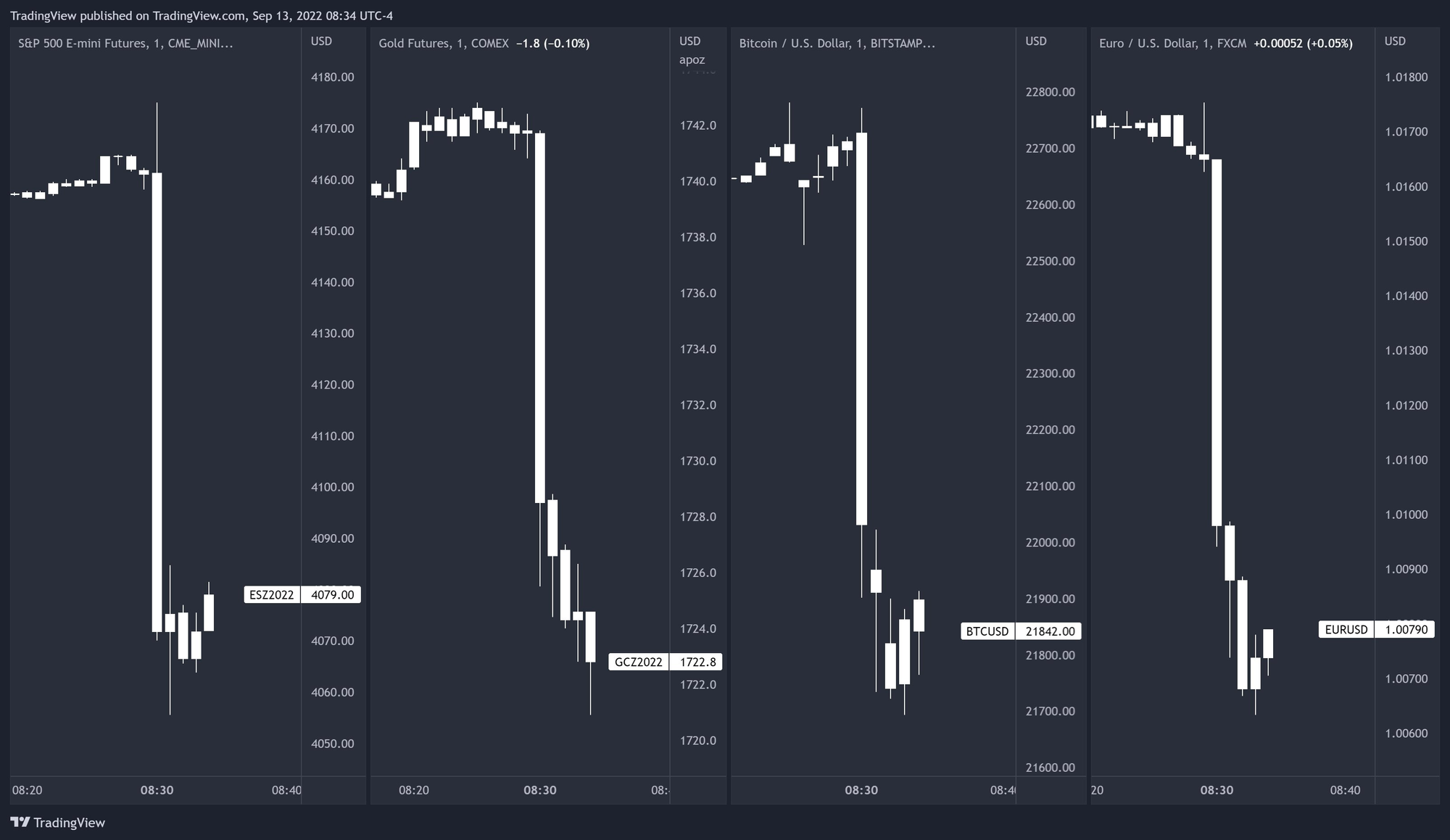

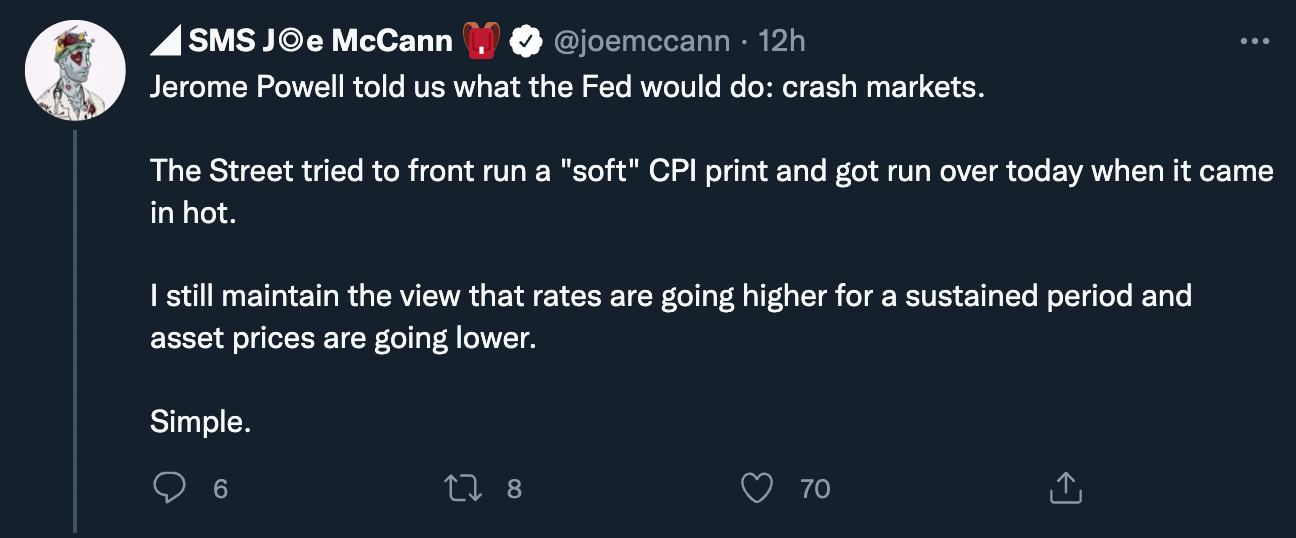

- This makes me feel we're due to begin a correction soon. Alas, even this Tuesday BTC crashed roughly 11% and ETH 9% - with major stock indexes falling roughly 5% - after August's inflation data came hotter than expected.

- Core inflation, which was decreasing since March, showed an increase and the stock market reacted with the most aggressive selling since March or June 2020, depending if we're looking at the Nasdaq and the S&P 500 respectively!

We'll see how the Merge goes, but as explained in August I'm expecting it to be a sell-the-news kind of event, giving another opportunity for bears to strike, just like they did last month. But this time we may have no narrative to help us bounce!

Chart art: and the interest rate hike is due next week.

Three things: and the trend change is due soon.

- Viktor explains how you can use underrated DYOR tools to find alpha.

- Mac explains how moving averages can help you swing trade.

- Igor Artamonov explains why the Ethereum PoW fork will fail.

Tweet tip: and the hopium is due to end.

Meme moment: and alts are due to suffer more.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!