X marks the spot

Cryptic ball: volatility is fading.

We're currently in crypto's equivalent of the doldrums. These calm, yet somewhat volatile equatorial waters are dreaded by many due to the nearly absolute lack of air movement which results from the convergence of different winds - a little bit like what bulls and bears are doing. There was a time when being stuck there often led to death by starvation. Fortunately, these days it's just a matter of winning or losing regattas and of making hundreds of thousands instead of millions.

But one trader's garbage is another's treasure, right? The doldrums are also a make-or-break place for ocean races, as knowing what to do when there's not much to do is key to overcome such a limbo where fleets catch-up and funding rates reset. So, while the current trading period is great if you're actively enjoying the volatility, trying to buy low and sell high, note that it isn't yet clear where the wind will blow from. As TheBoot, an epic BitMEX trader who got verifiably got rekt in the previous bear market but then recovered shorting it, nicely explains, it's all about recognising what kind of market we're in. Be patient and keep planning.

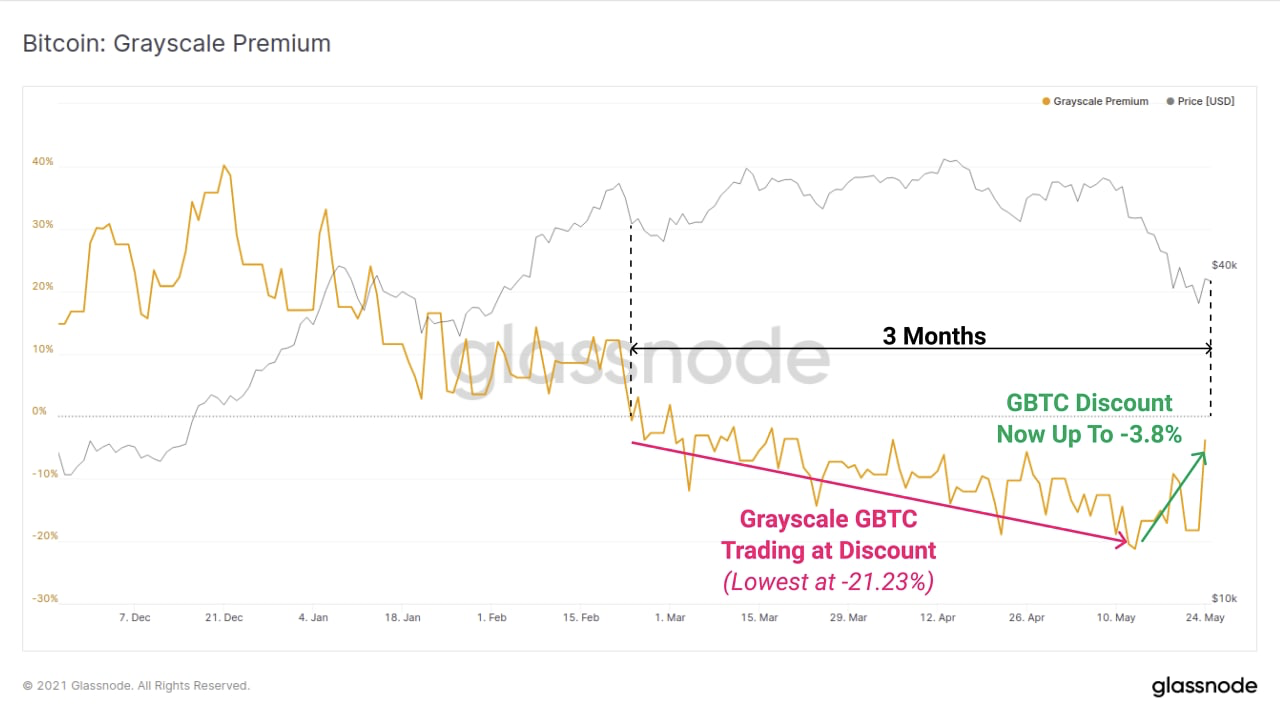

Chart art: Grayscale discount is fading.

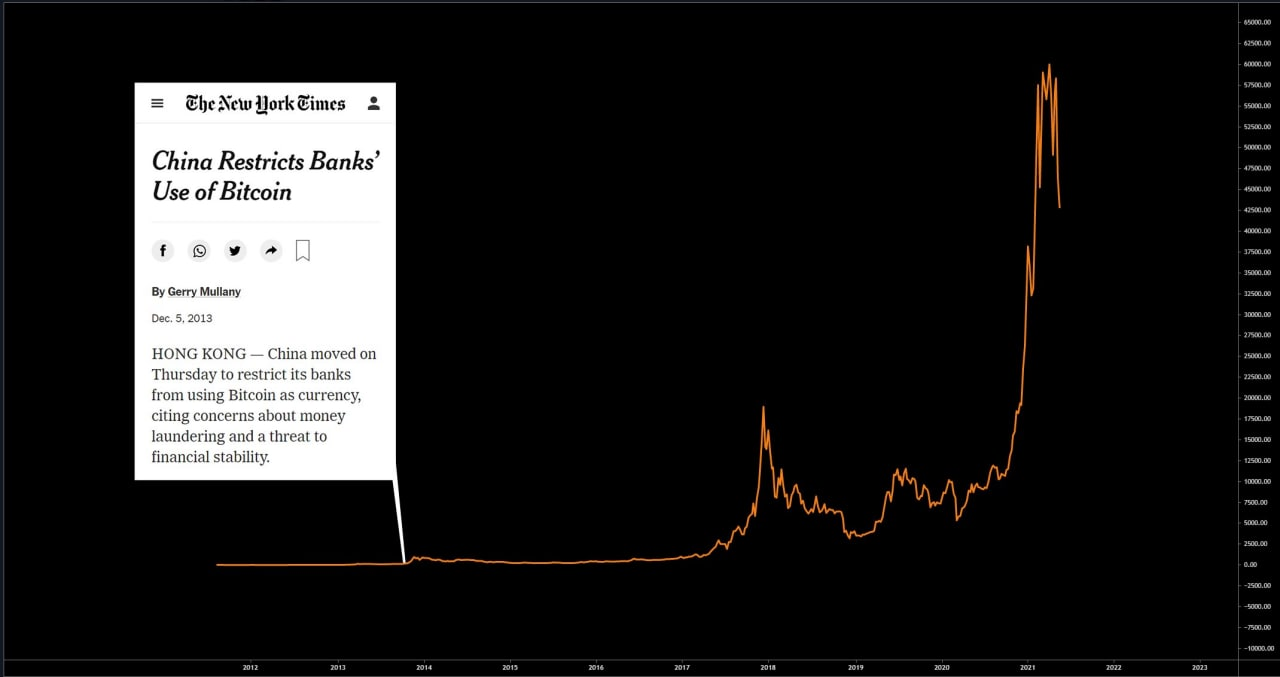

Market musings: FUD is fading.

Meanwhile, note that we're likely going to remain trading sideways for a while. As long as bitcoin continues hovering around this level, akin to a 40% drop from its ATH, we're in what's considered a normal discount zone for a bull market - considering an average dip of 37% with the current history. But if we fail to sustain this level, then miners and other players who are currently holding will likely feel enticed to short the market and make more money betting against reckless longs.

Your correspondent feels the fear levels felt yesterday were the lowest we'll see this year. Elon Musk is back shilling Bitcoin miners and their potential to drive renewable usage, Ray Dalio has finally confirmed he owns some bitcoin and prefers the original cryptoasset to traditional bonds, and it seems the FUD coming from China was already more than qualified as the typical routine it has been for years. Nevertheless, keep an eye on failed breakouts around $42k, the level we must climb above if bulls want to stand a chance. If the selling there is strong, it's likely that we'll see a new test of $30k - although not likely not in the next days.

Visual block: fear is fading.

Three things: the dip is fading.

- CoinMetric's latest State of the Network explains this May's crash and argues the worst is likely behind us (provided coordinated FUD stops). Check it out!

- Deribit Insights' latest analysis tries to read "the 'Tea Leaves' hidden in Derivatives Data". Good catch-up on the state of cryptoasset options.

- Glassnode Insights' Week On-Chain also studies how the recent bearishness affected various fundamental indicators. It was just a healthy dip!

Tweet tip: losses are fading.

Meme moment: China FUD will never fade.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!