Whale watching

Cryptic ball: it's time to free willy.

What a nice weekend. Yes, bitcoin did fell up to 7% between Friday and Sunday. But it bounced strongly around $35k - eventually due to another tweet by Elon Musk - and that level is very important. Why? Because with BTC at $40k it's now clear we'll have our first test of $42k since May 20th, right at the peak of the carnage. That's another key level as it was a major support level which, once broken on the first hours of May 19th, led to the current bottom around $29k.

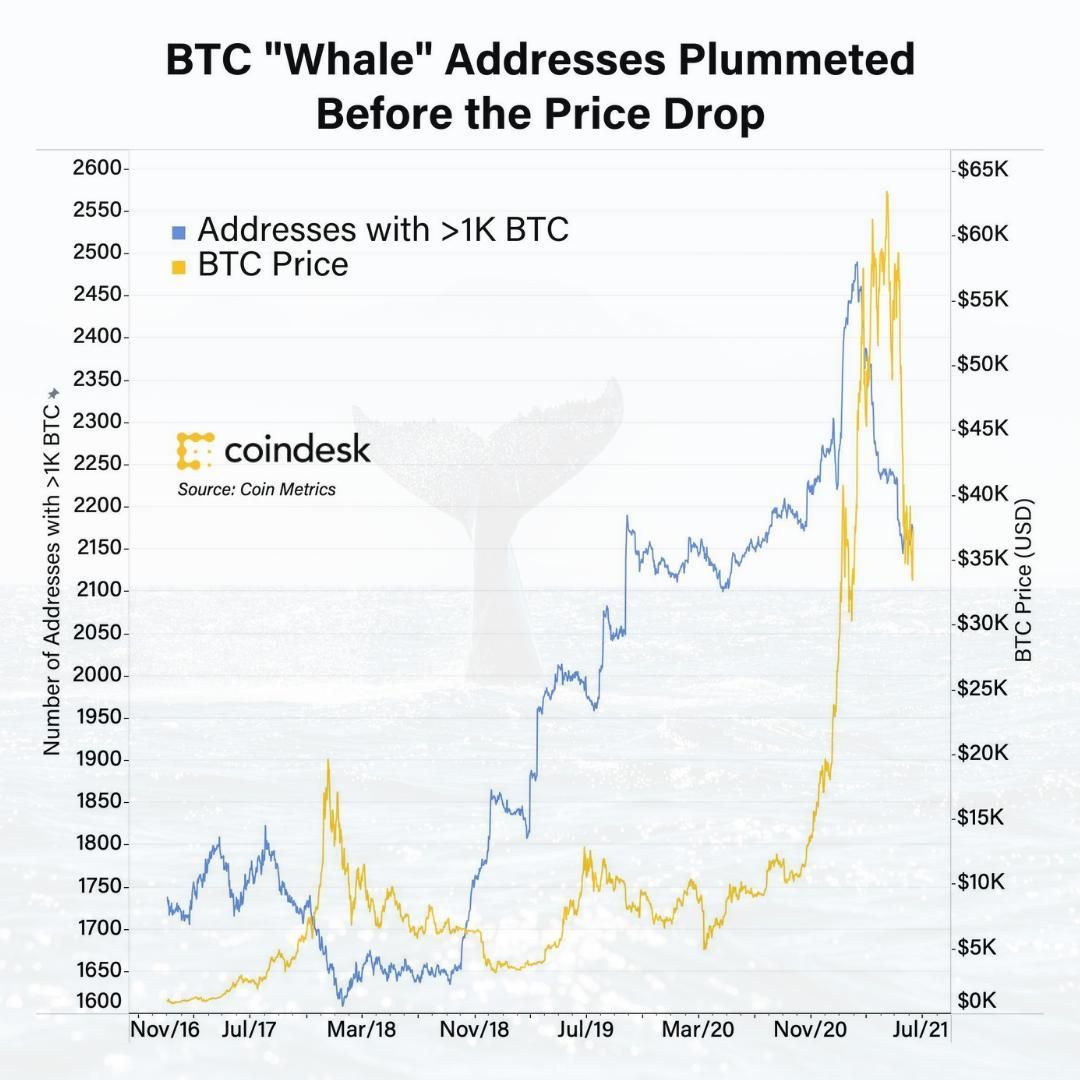

And while we still believe bitcoin is in chop territory, once it conquers $42k that may not be the case. To be fair, it's more likely we see some profit-taking for a brief while, while alts try to catch up with the king. But a new pump later this week is likely - as we need to avoid a death-cross, remember? Fortunately, we're seeing more and more whales convinced that the bottom for the year is in - provided we don't face any black swan. And whales swim against the tide, right?

Chart art: whale you sell before the top?

Market musings: like a whale in a china shop.

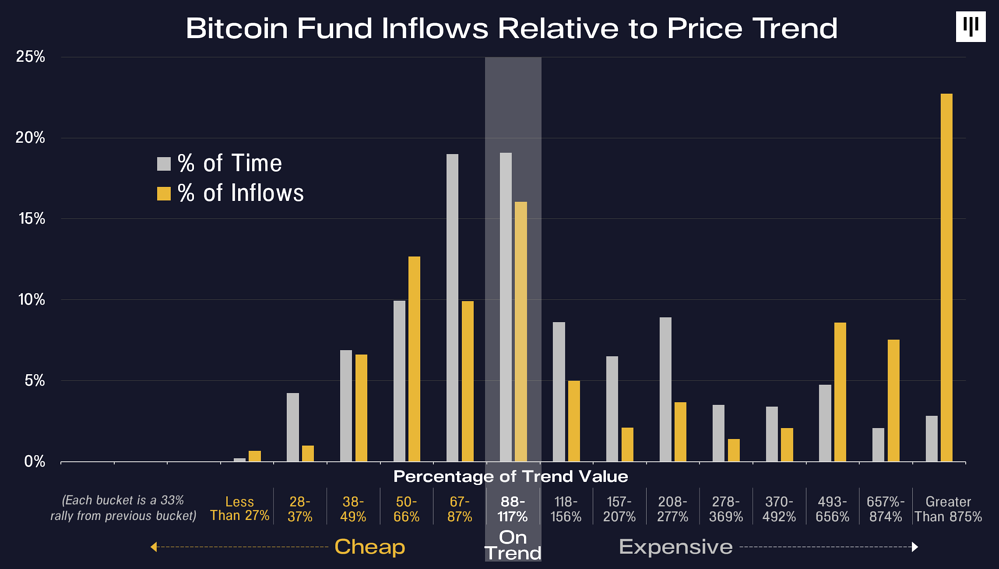

Pantera Capital is one of the oldest cryptoasset funds, in business since 2013. In their June investor letter, their whale owners remarked how much human nature is pro-cyclical. We've briefly covered that in April, with the example of how greed and fear has been a great indicator of tops and bottoms. But this new analysis is worth highlighting. In brief, let's assume BTC's 11-year average as its fair value.

Bitcoin has only been up more than 500% its fair value for 10% of its history. But did you know 39% of all inflows used to purchase BTC occurred in those periods? If you look at the chart below this is even more staggering! The middle column named "on-trend" represents that 11-year average. Below that you see the % of inflows used to buy BTC when price was "cheap", typically in bear markets.

And vice-versa. Look how the majority of inflows took place when bitcoin was in bubble territory! Now, contrast that with how whale addresses drastically dropped in the chart above, right before May's top. These experienced investors are more likely to fight their greed and sell when everyone's buying, instead of following the herd, who typically buys the top and sells the bottom. So, this summer, keep following the whales - as it seems they are back accumulating!

Visual block: whales go for the krill, which is you.

Three things: spin the whale of fortune!

- How safe are your crypto holdings? Check Bobby Wong's compilation of best practices in this basic, but must-read thread.

- How well do you understand Taproot? Check Aaron van Wirdum's summary of Bitcoin's most meaningful update in the recent years.

- How frequently do you use moving averages? Check Rakesh Upadhyay's brief overview which should allow you to understand this technical indicator.

Tweet tip: that's cruwhale

Meme moment: whale, whale, what do we have here?

The Desi Crypto Show: learn more about SushiSwap.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!