Chop-chop

Cryptic ball: do you trade this chop?

What a bounce! As explained yesterday, bears have been trapped after bitcoin pumped 25% in two days, with alts failing to follow the leader for the moment. It's highly positive that bitcoin keeps showing resilience towards renewed FUD from China - from a money laundering related arrest to another ban of mining operations - as this implies it's less probable that bitcoin dumps soon.

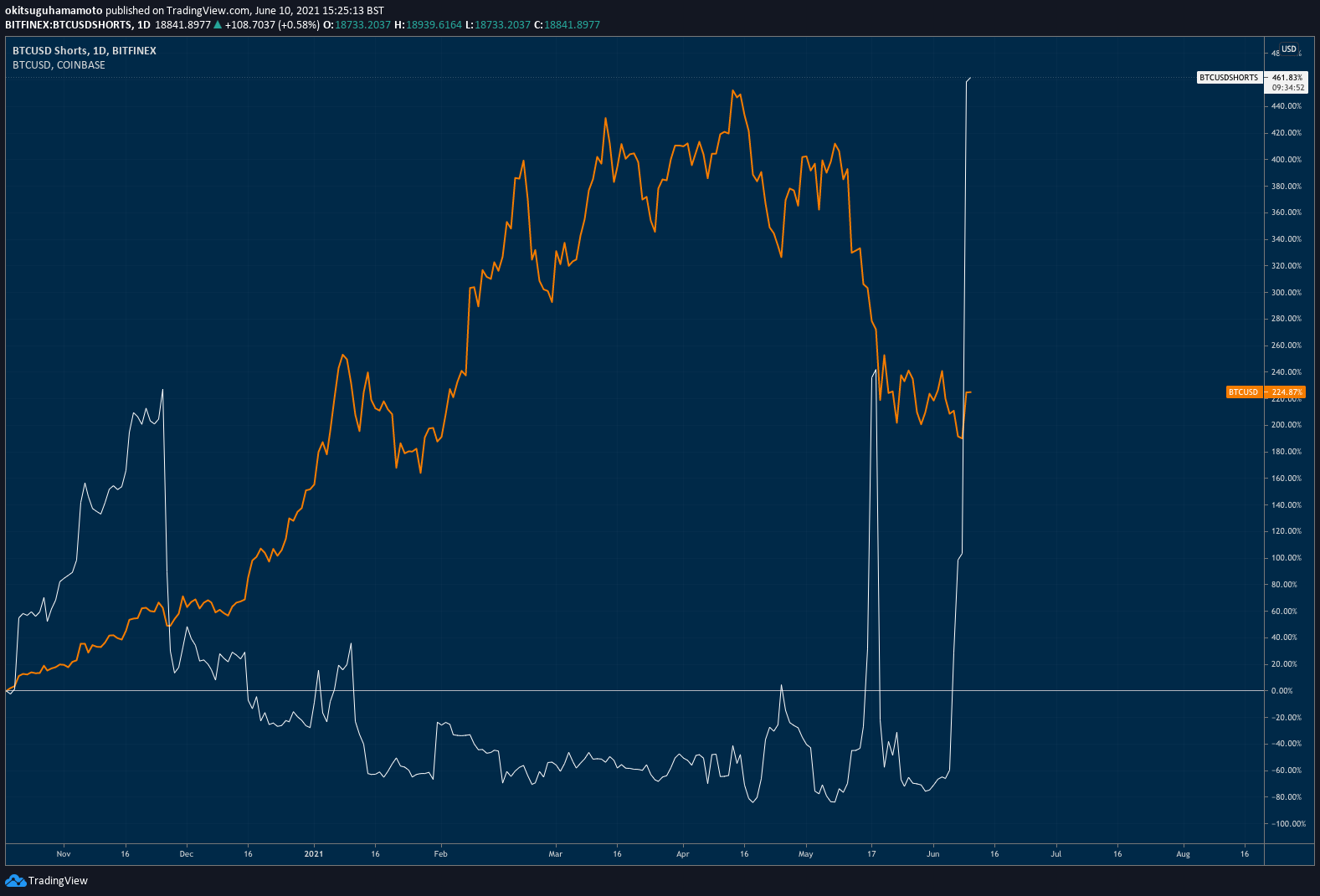

However, note that we're still in chop zone until bitcoin conquers $41/2k again or falls below $30k - a range which could last all summer. Moreover, some well-reputed traders believe that a loss of support at $35k will entice bears to charge again - a matter with which we don't agree given the current bullish momentum, but that's worthwhile considering as shorts keep rising. Squeeze incoming?

Chart art: do you short a double bottom?

Market musings: do you drop it like it's hot?

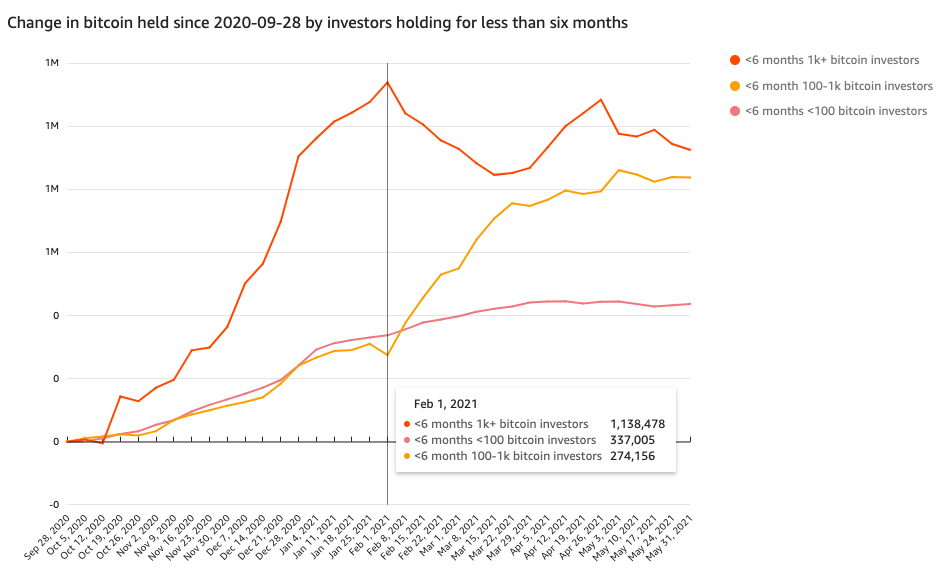

JP Morgan recently reported that bitcoin futures are displaying a "negative signal pointing to a bear market". This, together with the infamous narrative about an impending "death cross" of two important moving averages - a typical bearish indicator - require some reflection. So, let's look at a recent on-chain examination of the current market cycle by Philip Gradwell, Chief Economist at Chainalaysis.

Two important conclusions stand out. On the one hand, first-time investors who had bought more than 1000 bitcoins - likely those who started the bull run - started selling in February. On the other hand, outflows from fiat exchanges increased drastically in March, before the April top, and are now stable. These factors hint that the current all-time high occurred at a time when the market was fairly illiquid, which helps explain the dumps experienced in May. But also that these remaining large investors are hodling - which suggests they are still bullish.

Why is this good to know? Because you can follow these indicators the next time bitcoin feels hot. Well, at least if you have a Chainalysis subscription!

Visual block: do you know new investors?

Three things: do you call Bitcoin a bubble?

- Rumour has it that "India may move to classify Bitcoin as an asset class", as regulators are becoming less hostile to the cry2ptoshere.

- Rumour has it that "the NFT market bubble has popped" last month and this report from Protos Media claims they have the charts to prove it.

- Rumour has it that we shouldn't call Bitcoin a bubble, because "it is an epidemic" instead. Read John Authers' case in this great Bloomberg piece.

Tweet tip: do you have a plan?

Meme moment: do you feel the FOMO?

The Desi Crypto Show: learn more about QuickSwap.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!