The not-so-final post

First some housekeeping. This week, I'll be transitioning this newsletter from Ghost to my new Twitter's Revue account. The new emails will also be delivered under a new banner: The Crypto Musings. Make sure you don't miss the change!

Cryptic ball: the vicious cycle.

Anxious traders didn't react very well over the weekend, as bitcoin nearly set a new yearly low in the first hours of the week, trading close to $18k. Fortunately, this Monday we saw some interesting, market-wide recovery. But is the panic over?

- After crashing 10% since Friday and more than 20% since last week, the original cryptoasset quickly bounced some 9% today, following similar - even if less extreme - behaviour in the stock market as the Fed's FOMC looms.

- As it's typical, ether's downfall amounted to a 26% weekly loss, but given the challenger cryptoasset had been on a run before, it is still further away from the yearly lows achieved last June in the aftermath of Terra's chaotic unwinding.

- So, what is this volatility all about? As explained Friday, this is not about the Merge. It's "just" a reaction to the Fed's inflation fight and how it may keep hurting asset prices around the world in case recession fears come true.

- You see, as inflation expectations become entrenched, people are more likely to spend more in the present as they anticipate prices to be higher in the future. This vicious cycle further compounds inflation and complicates the Fed's job.

- That's why everyone is anxious about Wednesday's FOMC press conference, where Jerome Powell, the world's most powerful central banker, will either calm or agitate the markets. What to do? Well, it's all about Powell's speech.

- Currently, the market is pricing in a more "reasonable" 75bps interest rate hike, compared to the more radical 100bps increase that was being considered as consensus a few days ago. If that happens, the bounce should continue.

But, even if Powell sounds nuanced enough, it's clear the market trend won't change until hard inflation data shows inflation is truly slowing down. Until then, we'll likely continue to slowly drift lower and if BTC loses $18k we're in for a ride.

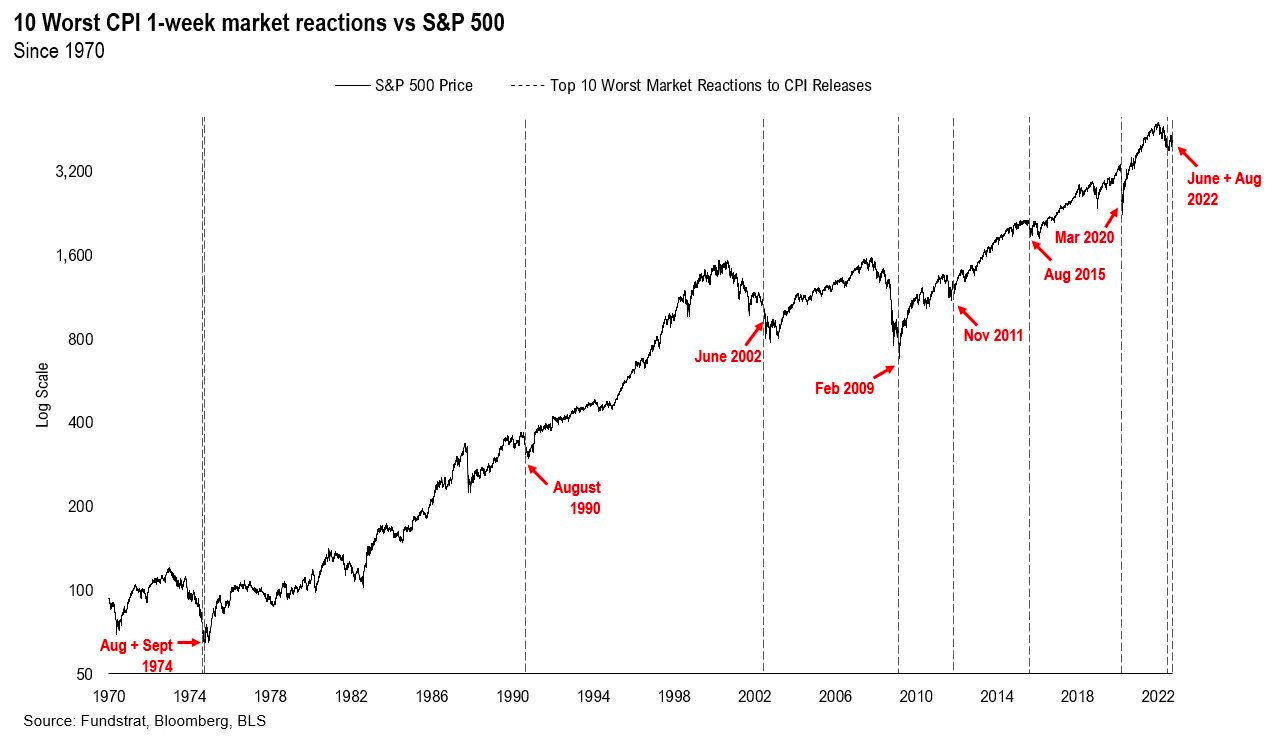

Chart art: the sweet hopium.

Three things: the ruthless attack.

- The Jarvis Labs Janitor excellently analyses Ethereum's "miner migration".

- Glassnode visualises the "Merge's impressive feat of engineering".

- Adam Cochran summarises the "is ether a security now" debate.

Tweet tip: the aggressive test.

Meme moment: the not-so-final hike.

New newsletter: The Crypto Musings.