Inflated fears

Cryptic ball: blame it on the FED.

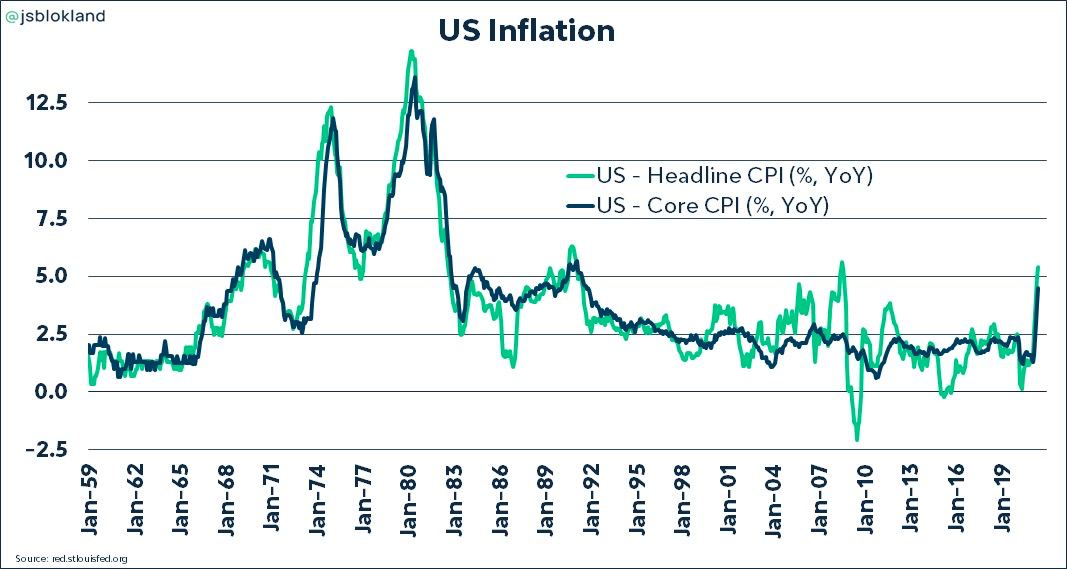

Market sentiment continues turning negative, as a small dip in bitcoin's price led ether and alts to lose support. The second most valuable cryptoasset even tested $1.8k this morning, but has since bounced 8% and is back above the round $2k level. All this was, again, due to the U.S. Federal Reserve's actions, as continued inflation pressure is making global market feel like the Fed will hit the brakes on its actions to boost the economy sooner than expected.

Officially, the Fed is still defending it won't. Even today, its chairman, Jerome Powell, said “conditions in the labor market have continued to improve, but there is still a long way to go" and that the US economy is "a ways off" before the most central banker change their mind. This is aligned with surprise news that the People's Bank China, which has announced measures interpreted as dovish, i.e. as more supportive to the economy, given that COVID's impact is still strongly felt.

Chart art: blame it on inflation.

Market musings: blame it on tech.

So, what can you expect regarding cryptoasset prices? Well, it's clear we're still in the slow summer. That's typical and we've been covering that effect since April. For the optimistic ones, it's great that ether and alts didn't suffer a major crash once the not-so-key support was breached. For the pessimistic ones, this is just another sign of the ongoing slow bleed, which is affecting meme stocks too.

But, looking back to the bright side, it seems tech stocks are pumping again, with some infamous analysts even suggesting they were being used as an inflation hedge - a narrative typically attributed to bitcoin, which is clearly not boding well on the front. Back in May and June we told you about the relationship between crypto and tech, with the former usually following the latter. So, if tech continues to recover, you can expect cryptoassets to follow-up. If not, the only bullish scenario is if tech investors are taking profits and re-investing them in crypto!

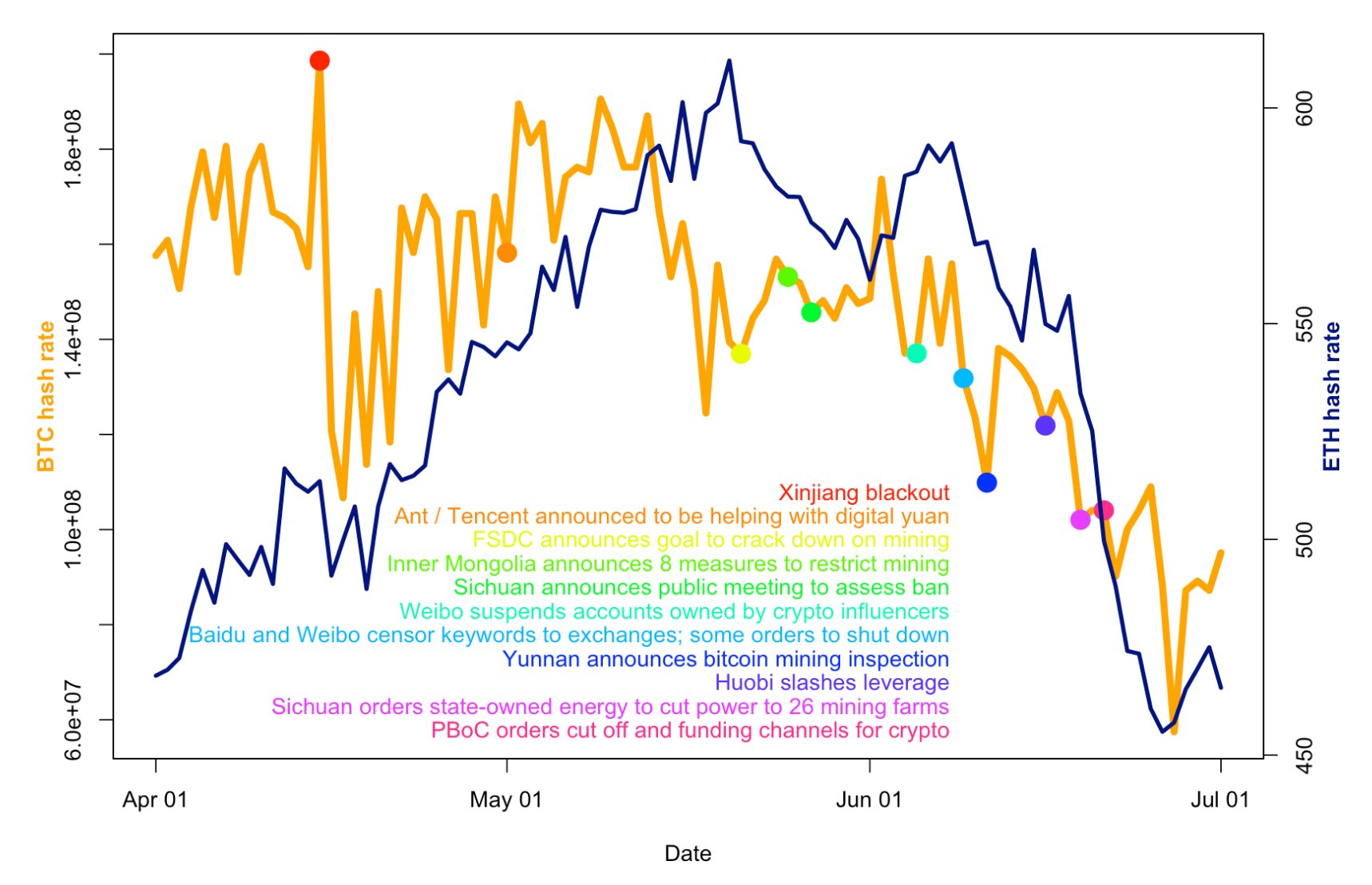

Visual block: blame it on China's crackdown..

Three things: blame it on the NFT bubble.

- NFTs and Web3 are all the rage, so check Messari's Mason Nystrom report about all that happened in these exciting pockets of innovation in Q2 2021!

- Blockchain's potential to make data free is all the rage, so it's great to see that cryptoasset exchanges also make their data free. Learn why with SBF here.

- Bitcoin mining locations following the China exodus are all the rage, but will the future be even more sustainable? Meltem Demirors explains why it will.

Tweet tip: blame it on failed forecasts.

Meme moment: but don't blame it on the memes.

Meme and win $100: it's all about B-21 and B21.

B21 Token: a low cap project with many use cases.

Get started: download the B21 Crypto app!