Sit tight

Cryptic ball: and don't short a dull market.

As anticipated last Friday, this was a very smooth weekend; except in England, of course. Bitcoin and the wider crypto market continues compressing sideways, testing the patience of (at least) millennial investors, and that's what matters. Why? With volatility fading like this - a typical summer phenomenon which we've been covering since April - it's good that bears haven't been able to short a boring market, as these dull times imply thin order books which are easier to crash.

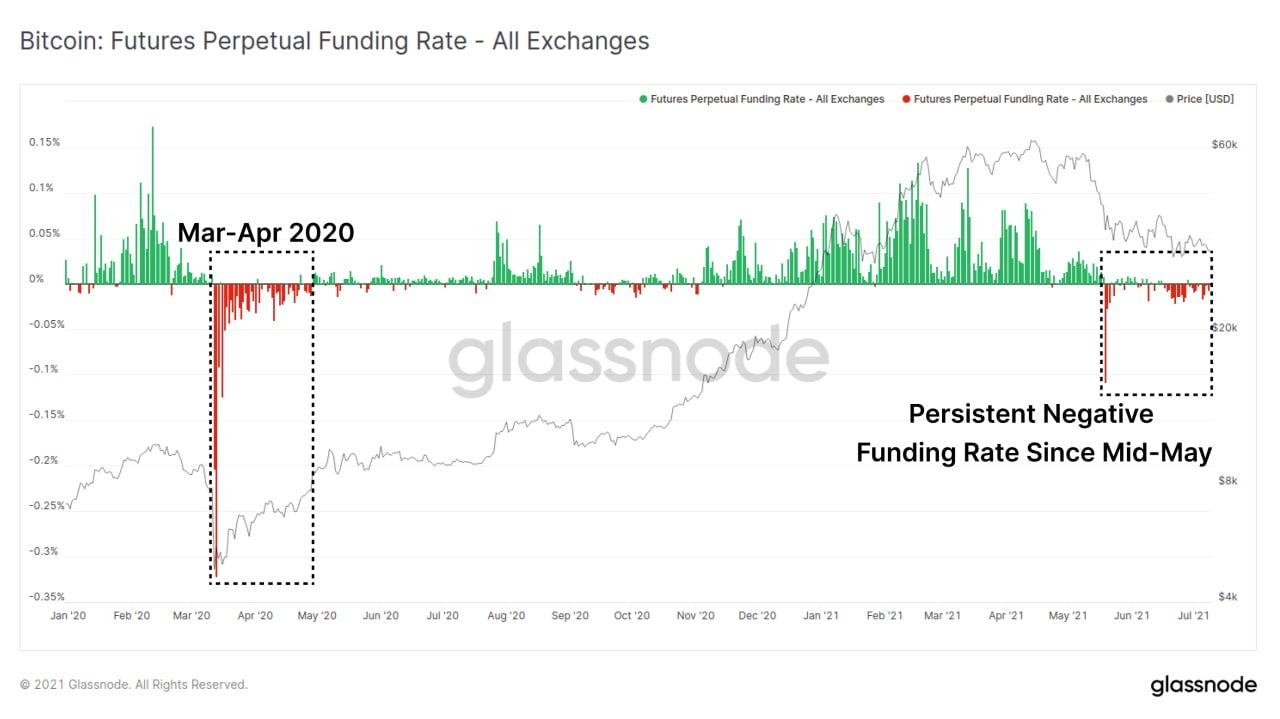

So, while sentiment on Crypto Twitter and on chat groups remains divided, your correspondent is fairly confident the worse is behind us. Just take a look below at the aggregate funding rates for BTC contracts on perpetual futures. They have been, on average, consistently negative since May's dump. If price was also consistently falling, this would be bad news. But with the $30k support holding steady it seems that funding rates will turn positive once the holidays end!

Chart art: because futures are incentivising longs.

Market musings: low trading volumes are normal in the summer.

Why is that? Funding rates help match the price of those leveraged casinos to that of spot exchanges, which deal the real orange coin. A positive rate means the price of the futures contract is higher than the price of the underlying bitcoin, and vice versa. So higher funding represents high interest from bulls in such markets, and it forces those who are long to pay a regular fee to the short sellers. Conversely, in bearish times we tend to see negative funding, a sign that shorts are piling up.

In that situation, those betting against bitcoin have to pay funding to those who are long. Typically, however, these funding rates are mildly positive, as most traders and speculative funds use futures, making them more popular than the spot market, and as few traders risk shorting bitcoin for a prolonged period of time. After a big crash, it's normal to see such bearish activity, as most bears are late to the party. But bears eventually get exhausted as they need to pay hefty funding fees to hold short positions for a long period of time.

That's why if the existing bears can't dump bitcoin further, we'll likely see the wider bullish trend resuming once more upbeat investors return to their trading desks. For now, a sudden move can happen anytime - which would likely entice some liquidations and fast price action in this low-volume environment (spot exchanges volume is down 73% since May). So be prepared for that and expect the FOMO to kick-in once people feel like they have been left in the sidelines!

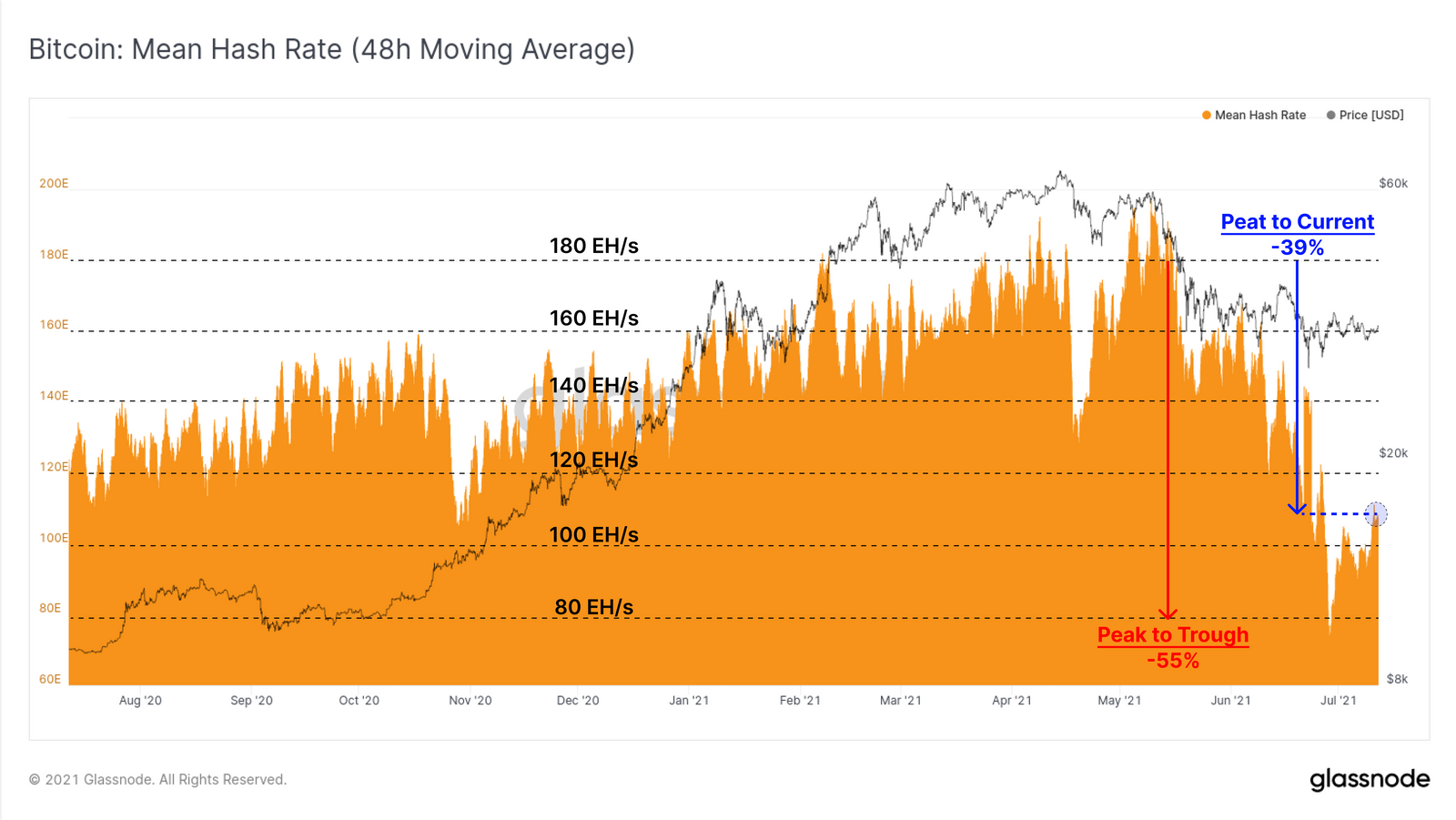

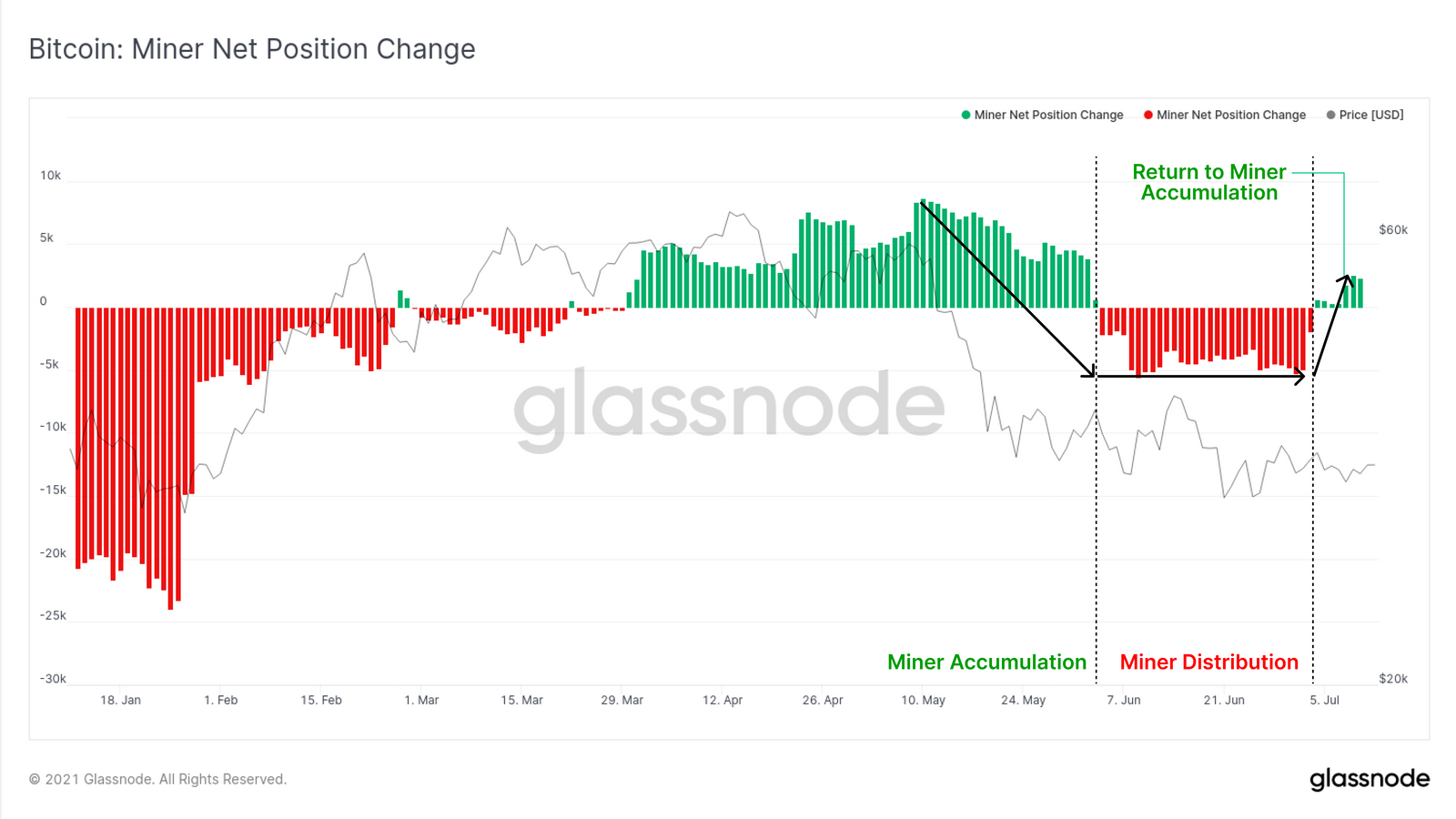

Visual block: hash rate crashed but miners are accumulating.

Three things: and we have Ethereum's hard fork this August.

- Ethereum's London upgrade is scheduled for August 4th and is poised to be the event that reignites the bulls. Learn more in The Defiant's latest podcast!

- One of Ethereum's most awaited scaling-related improvements are rollups. But Haseeb Qureshi is "Worried Nobody Will Care About Rollups". Must-read!

- Decentralized autonomous organizations are back in fashion. Learn how the DAO "investment landscape is evolving" with Jacquelyn Melinek.

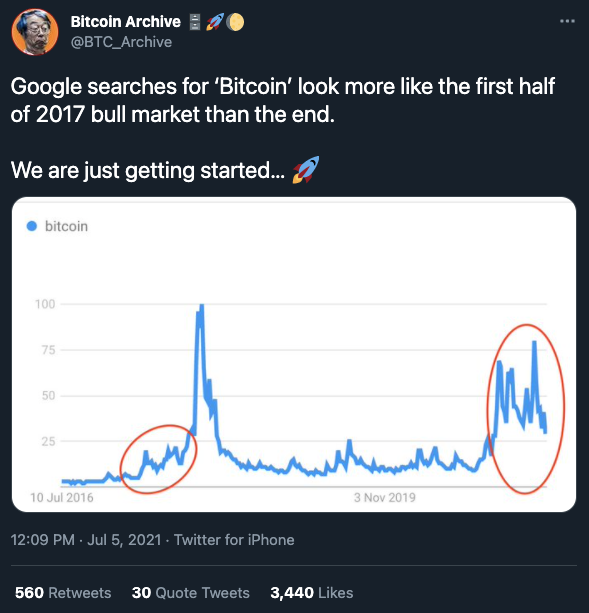

Tweet tip: anyway, here's one extra piece of hopium.

Meme moment: you'll remember bitcoin at $33.3k, dearly.

Exclusive crypto card: a new partnership with NFTrade.

B21 Token: a low cap project with many use cases.

Get started: download the B21 Crypto app!