Comfortably dumb

Cryptic ball: is there any bull in there?

It seems yesterday's bitcoin dump indeed found support at $42k, as anticipated in the newsletter, putting a break on the bearish attacks plaguing the entire space. But now that many are rejoicing and claiming that the "BTC Chart Indicator Suggests Worst of Pullback May Be Over", it's time for us to present the other side - even if we agree that, for now, this is looking like a short-term bottom for the major coins. Why the devil's advocate? Because such a slow market can easily dip.

And because the bounce hasn't been as strong as required for us to be comfortably long, particularly given that the test of $42k was so perfect that almost seems surreal. It's almost like if bears wanted to prolong the scare, by showing what they were capable of without fully showing what they had in the sleeve. In other words, support seems feeble and we aren't out of the woods until we make a higher high. Meanwhile, those with alt profits may not be done selling their proceeds, but this can change if greed resumes and everyone wants to get back at trading sh*tcoins.

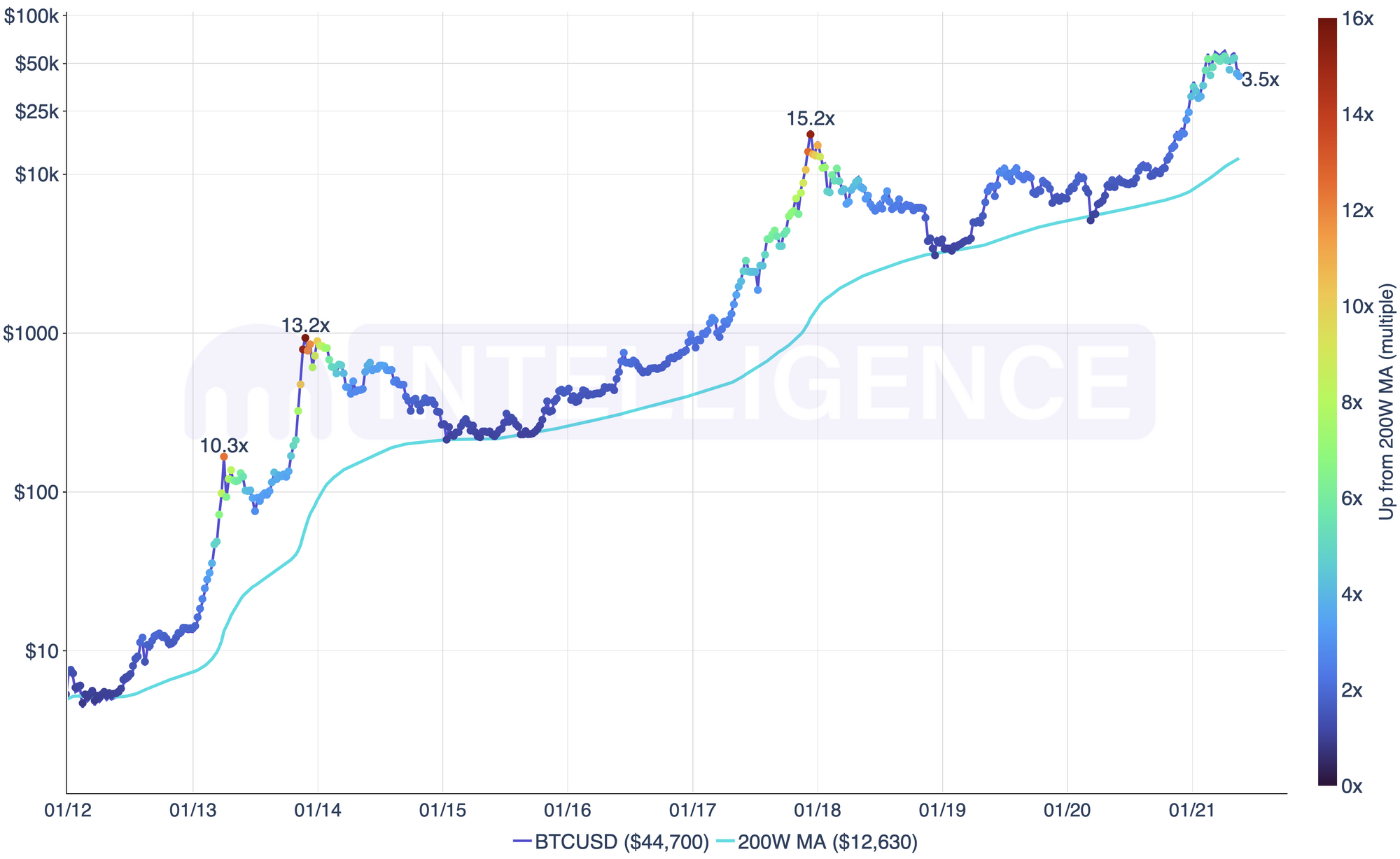

Chart art: I hear you're feeling down.

Market musings: just the basic facts.

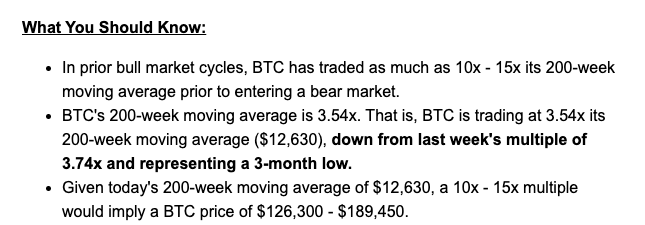

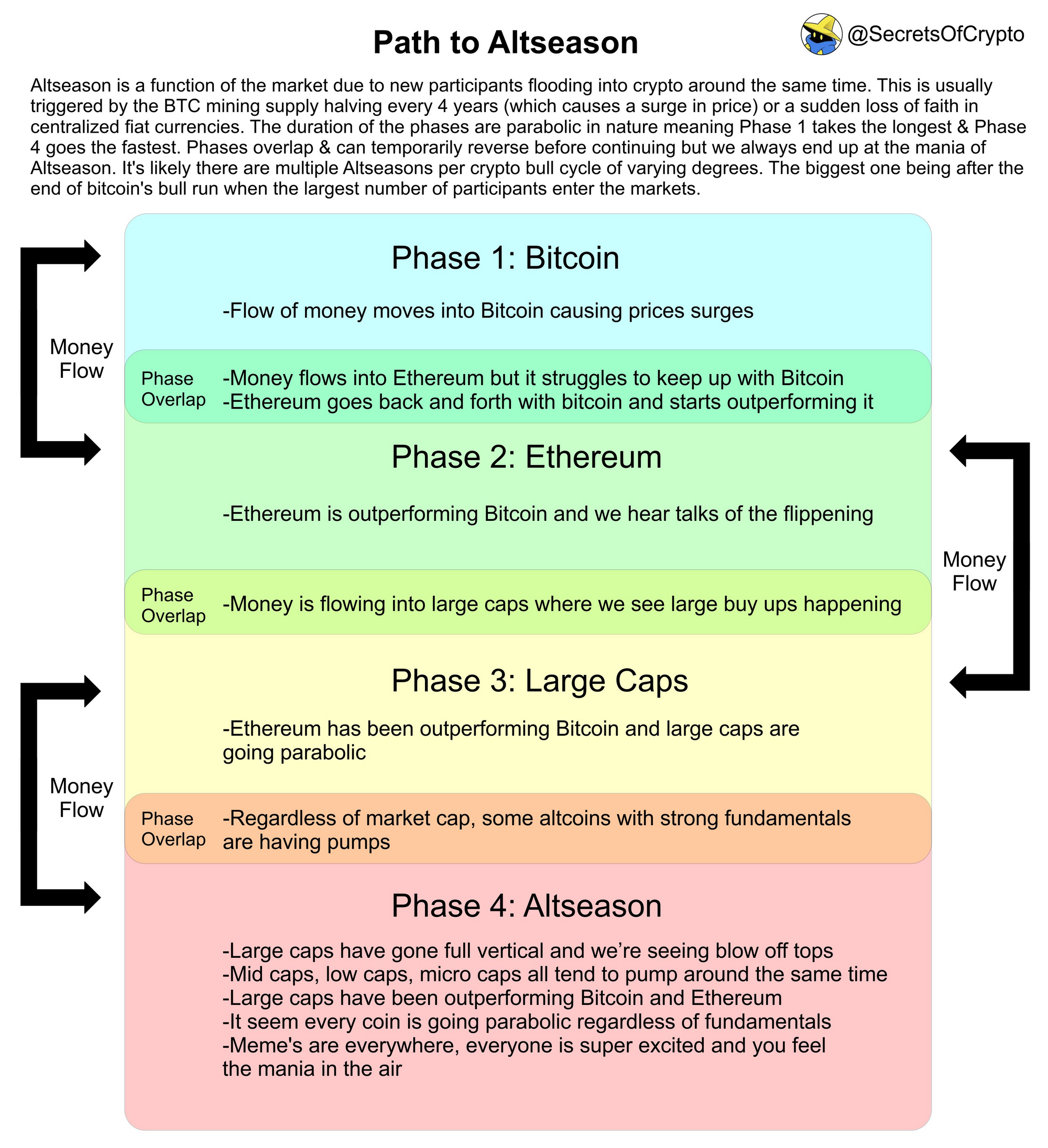

Zooming out, it's clear we're far from the end of the bull market. However, if institutional players, typically used to single-digit gains, are now happy cashing out at double-digit profits, then this could create a dent in the recovery. Especially if the narrative that bitcoin is dumping like other tech stocks did recently catches up. As explained above and before, what could change this is are alts and the continuation of the current alt season until July, which would prompt good old whales to get out of their stablecoins and pump the market. Is that happening?

Well, Sushi, the token of a popular DEX forked out of Uniswap, is up 20% today and looks poised to test its all-time highs. Solana, an ultra-fast blockchain, covered here in April, which aims dethroning Ethereum as king of DeFi, is up 16%. And Matic, the token behind Polygon - a blockchain which bridges other cheaper, faster blockchains with Ethereum, who also shares a co-founder with India's COVID Relief Fund and whose other co-founders are all Indian - is up +45%!

So, instead of looking at your portfolio, take advantage of these bearish days to investigate some alts. And ready a plan in case bitcoin tests $42k again - as if it dumps below support then it's likely that alt holders will also sell their bags. Particularly because China FUD is again fashionable! Reuters has just posted age-old news that Chinese banks can't offer crypto services to their citizens, but they can allow their citizens to transfer currency to exchanges, as it has always been!

Visual block: well alt season can ease your pain.

Three things: get on your feeth again.

- We've shared these Secrets' thread before, but maybe you've missed the specific section about researching alternative cryptoassets. Check it out now.

- We've shared the bullish narrative about Ethereum, but the flippening arguments recently laid out by Michael McGuiness are a new must-read.

- Few have seen a live 51% attack to a blockchain network before, so Anish Agnihotr performed one to an Ethereum's clone and recorded it for you!

Tweet tip: now I've got that feeling once again.

Meme moment: come on it's time to go.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!