Inherently choppy, hyper boring market

Cryptic ball: don't take the worst and call it the whole.

Are you feeling the fear? So far, it's true that the pessimists are winning, with ether's weakness hinting at a (very) slow bleed across the board. For now, ETH followed bitcoin's bounce earlier today around $31k, recovering from a test of $1,850. But the show put on by the bulls looks quite feeble, so your correspondent expects the torture to last over the weekend, even if it won't hurt that much.

Why? Because not only volume has been falling for weeks, a sign of the summer, but OTC desks are also reporting practically no activity, as traders enjoy the holidays. That's why all the current bearish narratives don't make sense. Take the example of Jackson Palmer, the disillusioned creator of Dogecoin, who again confirmed he hates the cryptosphere of influence due to its "inherently right-wing, hyper-capitalistic technology", so he won't ever return to this space.

This prompted many to agree with developer, fuelling the nearly universal negative sentiment. But periods where an asset just trends sideways are perfect for both bulls and bears to justify their bias with any story that fits their point of view. So, for the next days you just need to watch out if bitcoin breaks down the current range or not. Just note that it can sweep the current low just to hit the stop losses placed by many traders right around $28.5k and then quickly bounce back-up!

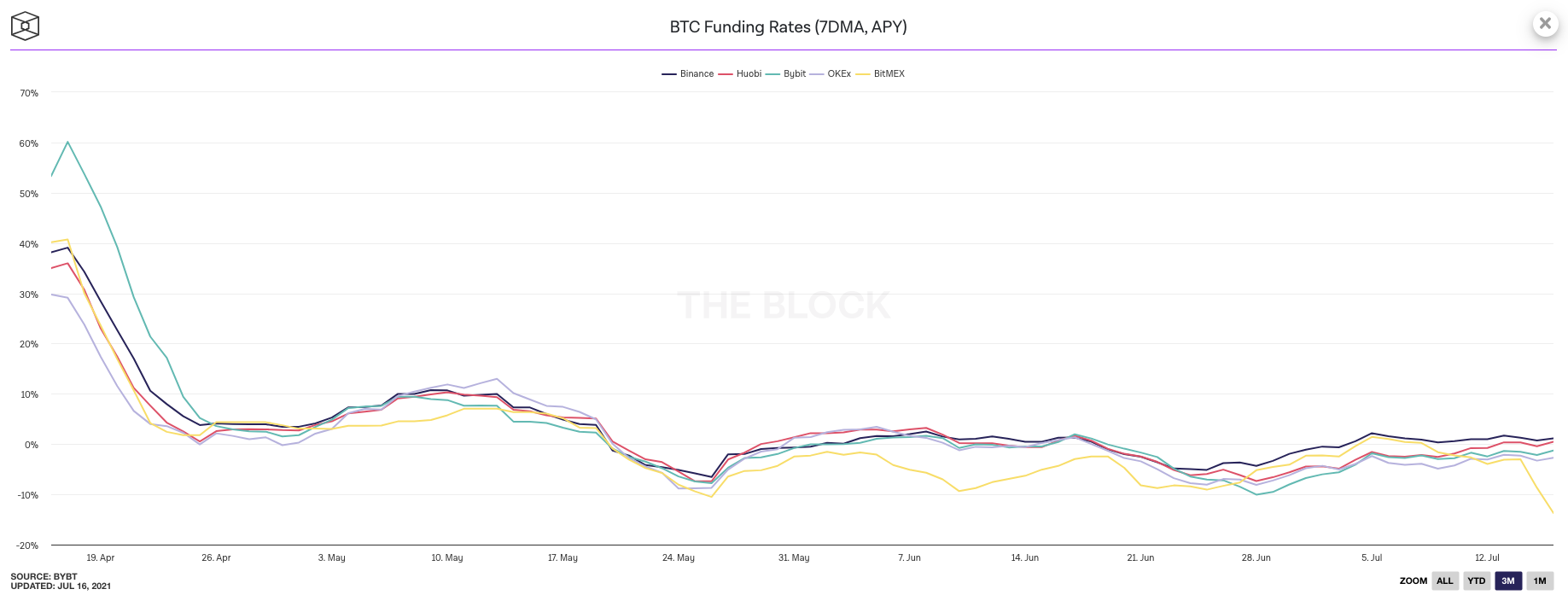

Chart art: except if you're looking at funding rates.

Market musings: don't take profits and call yourself a whale.

The above means that you shouldn't wait for bitcoin to fall below $30k to flip bear. If you can't handle the lull then just get away from the market until a clear trend is established. After all, the best time to flip bear is when everyone is euphoric, not when fear reigns free. Conversely, if you really believe the end is near then you should put your money where your chart is instead of waiting to short support.

Meanwhile, it's important to look at the rest of the market. Several alts are pumping and attracting many to that field. AXS, the governance token behind an NFT-based online universe focused on digital pets, even pulled a 10x over the past month. That's great, and you can find more if you follow these tips, but remember that if you don't take profits you may be stuck with that bag for the long-term.

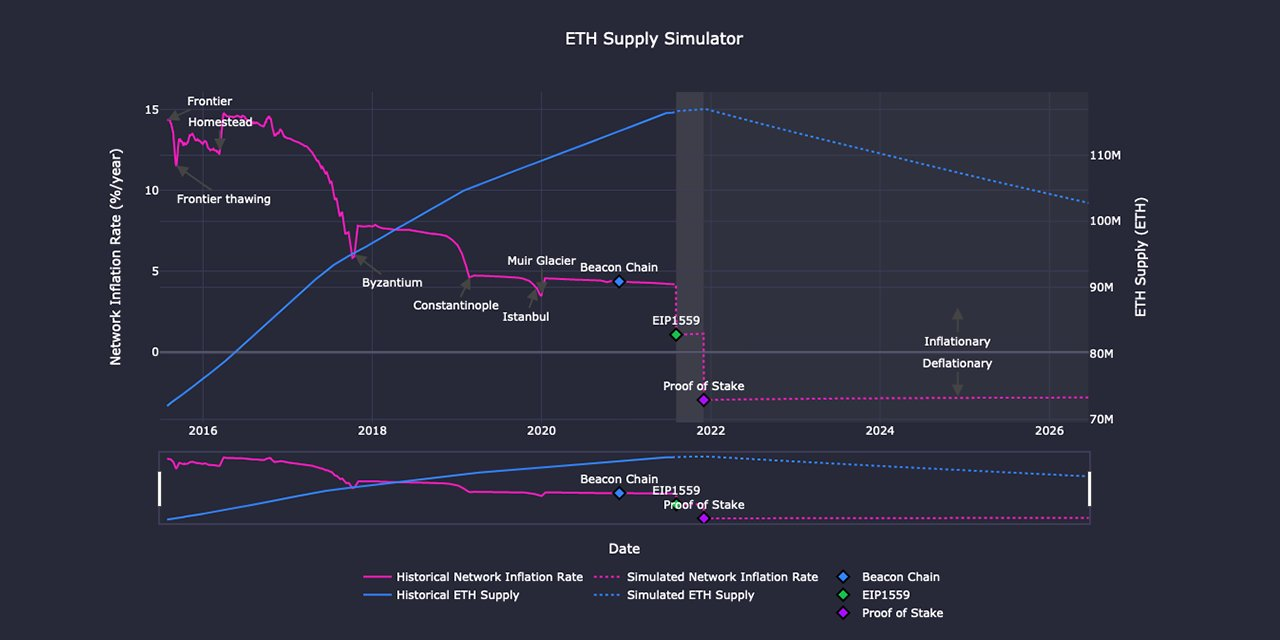

And, overall, it's good to think long-term. Look at the below chart modelling Ethereum's supply over the past and next years. The anticipated reduction in the amount of ether available is what's driving many to believe it can flip BTC in market value one day. Whether or not that's true, typically the best cryptoasset investments are usually those which you can bear to hold on for some years. But remember that many of those can be worthless if you don't take profits too.

Visual block: except if you're looking at a really solid project.

Three things: don't take the takes and cut to the chase.

- Evan Greer offered the best rebuke of Jackson Palmer's criticism of the cryptoasset ecosystem. But Brian Armstrong's reply is also worth it.

- Arthur Hayes offered the best take on the future of stablecoins, including Tether, and how CBDCs will come to destroy commercial banks. A must!

- Token Terminal offered the best take "on what crypto and blockchain is all about". Learn more about the internet-native economy with this great thesis.

Tweet tip: except if you're summarising narratives.

Meme moment: don't trade the chop and expect it to be easy.

Last days to meme and win $100: it's all about B-21 and B21.

Get started: download the B21 Crypto app!