Follow the breakout

Cryptic ball: let's see how these alt pumps go.

It seems like fearful crypto traders read Monday's digest, understood what's going on with the Grayscale FUD, and bought the dip at $33k. Bitcoin hasn't retested that level again and is at the very end of a new meme triangle that, once broken, could at last provide some clarity over the market's sentiment amidst the sideways chop. Check the image below to see how compressed BTC's price has become.

Given how alts are pumping left and right, with 11 alternative projects in the top 100 by market cap appreciating 10% to ~40% over the past day, it seems the bias is for bitcoin to pop upwards. However, it's likely the move won't be violent as that would ruin the relief felt in the riskiest corners of the cryptosphere. Alas, the degenerate sentiment is so bullish that Ethereum's fees have climbed to its second highest value since May's dump due to ShibaSwap! Remember Shiba?

We first talked about this now popular token in April, before it was cool. And covered its spectacular rise and fall the following month, in our Musical Shibairs issue which anticipated the crash which took place the next day and catapulted us to these couple of months of bearish reign. Well, the doge-like project has finally launched its decentralised exchange, a simple replica of Uniswap, which has captured $1 billion in liquidity over the past day! Feeling the animal spirits?

Chart art: let's see how this breakout resolves.

Market musings: let's see how DeFi is used.

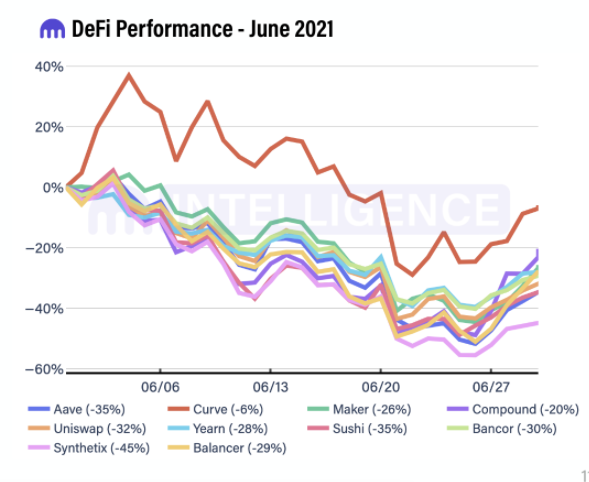

But there's more than gamble to this week's pump. DeFi-related tokens are appreciating more rapidly than other sectors, which is reigniting dreams of another DeFi summer, following the boom of such projects which ignited the bull season this time last year. And while many are quick to dismiss DeFi as a more subtle form of gambling - which, to be fair, isn't necessarily incorrect - it's also the case that more institutions are considering such decentralised innovations.

While when one typically talk about institutional adoption of crypto they mean some sort of bitcoin exposure, from investment funds or through a company's treasury, we're talking about a new beast here, which lies at the heart of DeFi's vision: capital markets. In other words, Circle's CEO recently confided in a podcast that companies and organisations are hungry for access to the finance products being offered by these protocols to benefit from high yields and alternative credit.

This is the kind of behind the scenes movement which lulls those with sidelined funds into re-entering the market, as most investors and whales don't ape in - like Microstrategy did in their recent YOLO all-in move, just before the fall from $40k last month. However, there's one thing you should keep an eye on, and that's fresh FUD concerning Binance. The world's largest exchange was just forced to suspend deposits all across Europe as regulators have been criticising their compliance!

Its CEO has reacted with a open letter re-stating previous remarks that "compliance is a journey" and defending a well-developed legal and regulatory framework in the long term (which) will be a solid foundation that truly makes crypto essential in everyone’s daily life". So, it seems clear that the exchange will sort out the situation, but the question is always what can happen before that.

Visual block: let's follow these DeFi projects.

Three things: let's follow these uncertainities.

- Uncertain about the future of bitcoin, ether, and NFTs? Fast Company collected the testimonies of more than 30 experts. Check it out.

- Uncertain about how inflation could look like in a "hyperbitcoinized world"? Alex Farrington explains that and more about such a scenario.

- Uncertain about the economics behind different cryptoassets? Learn amore about the tokenomics of the top 100 projects in this great post.

Tweet tip: let's follow these new fads.

Meme moment: let's follow the road less travelled.

Spend your crypto profits: with B21's international card.

The Desi Crypto Show: let's follow NFT gaming.

Get started: download the B21 Crypto app!