Musical shibairs

Cryptic ball: the copycats are coming.

Since the moment yesterday's newsletter was sent out, more than 200 tokens - the majority being clones of shiba, the original dogecoin replica - have been listed on Uniswap, Ethereum's most popular decentralised exchange (or DEX). Dozens more were also listed in Sushiswap and Pancakeswap, meaning this musical chairs game isn't going to end well. After all, how many useless memes can do an 100x?

Meanwhile, Binance Smart Chain, where Pancakeswap runs, is also getting congested. Its low fees attract many new players who can't afford to pay $200 to $400 in gas fees for each trade on Uni. This means more and more people are trying their luck at this canine lottery. All-in-all, while we think the current alt season leg is cycling away from meme coins and into DeFi and Ethereum killers - especially given today's pumps of AAVE and SUSHI, and of Polygon's MATIC and Solana's SOL - it's worth considering today's Twitter tips from popular crypto OGs!

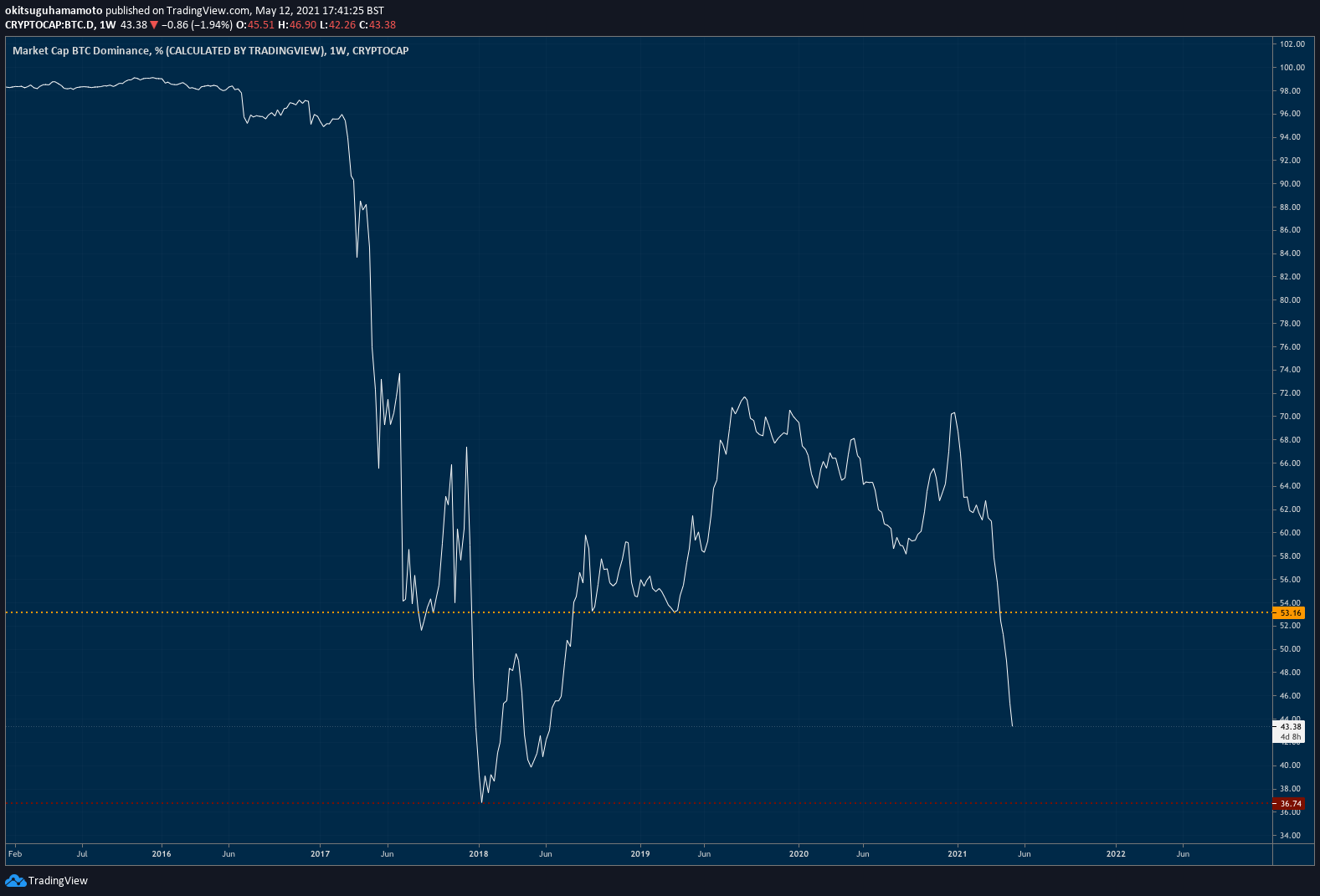

Chart art: the bubble is coming.

Market musings: the merge is coming.

The secret to any bubble is to time the top, which is naturally very difficult. But we're starting to get warning signs, with the US SEC resuming its statements that bitcoin investments are "highly speculative". Other regulators will likely follow and analysts will start paying more attention to this matter. We've argued our take in this newsletter plenty of times (alt season until Ethereum's London hardfork implements the widely-anticipated EIP-1559 this July, then a slow, smooth summer followed by new bitcoin ATHs and a final alt season leg).

But today we took notice of two other important catalysts to be aware of:

- 1) Ethereum's switch from Proof-of-Work to Proof-of-Stake, called "the merge" and anticipated for this Q4 or Q1 2022. We've briefly talked about this update before, but the gist of it is that miners would stop receiving the hefty fees they are currently awarded for securing the second largest blockchain. Many believe miners will collude to attack Ethereum, but it's more likely they'll just use their equipment to mine other coins or sell their hardware. So, this could be the biggest buy the news, sell the rumour event of late 2021/early 2022.

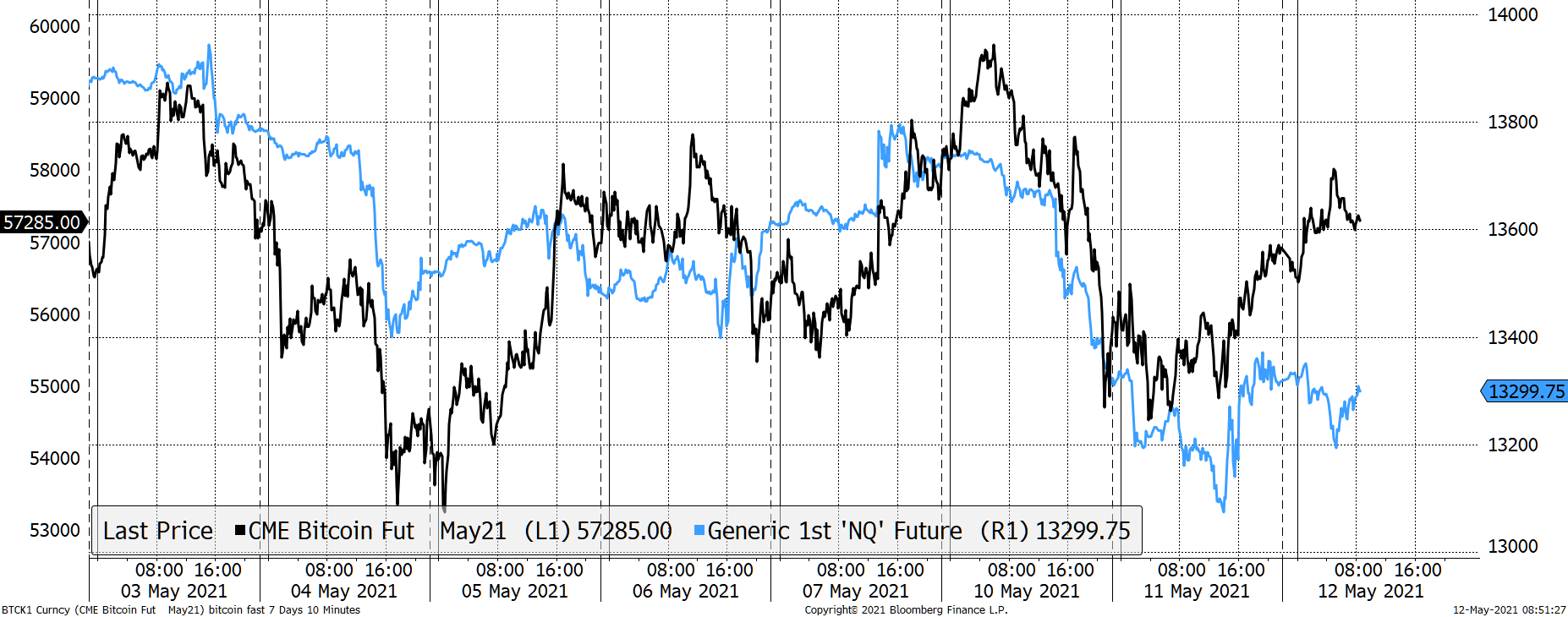

- 2) As more institutions adopt bitcoin due to its low correlation to other assets, it's only natural that bitcoin starts to become more correlated to other assets. This can be seen below regarding this Monday's dip, where BTC followed the behaviour of Nasdaq, the popular US stock index for tech companies. This means that if central banks start cooling down public markets then bitcoin can trigger a generalised crash in crypto earlier than expected. Or, alternatively, that it's even easier for some institutions to dump bitcoin hard! Let's see.

Visual block: stocks correlation is coming

Three things: upgrades are coming.

- How secure is your cryptoasset storage? Check Kraken Intelligence's excellent Wallet Security 101 guide which just came out.

- How confident are you of ETH's bullish case? Check this State of the Nation episode with the popular investors Su Zhu & Kyle Davies to know more!

- How aware are you of Bitcoin's privacy problems? Check Edward Snowden's latest criticism regarding the original cryptoasset's upcoming Taproot upgrade.

Tweet tip: the herd is coming.

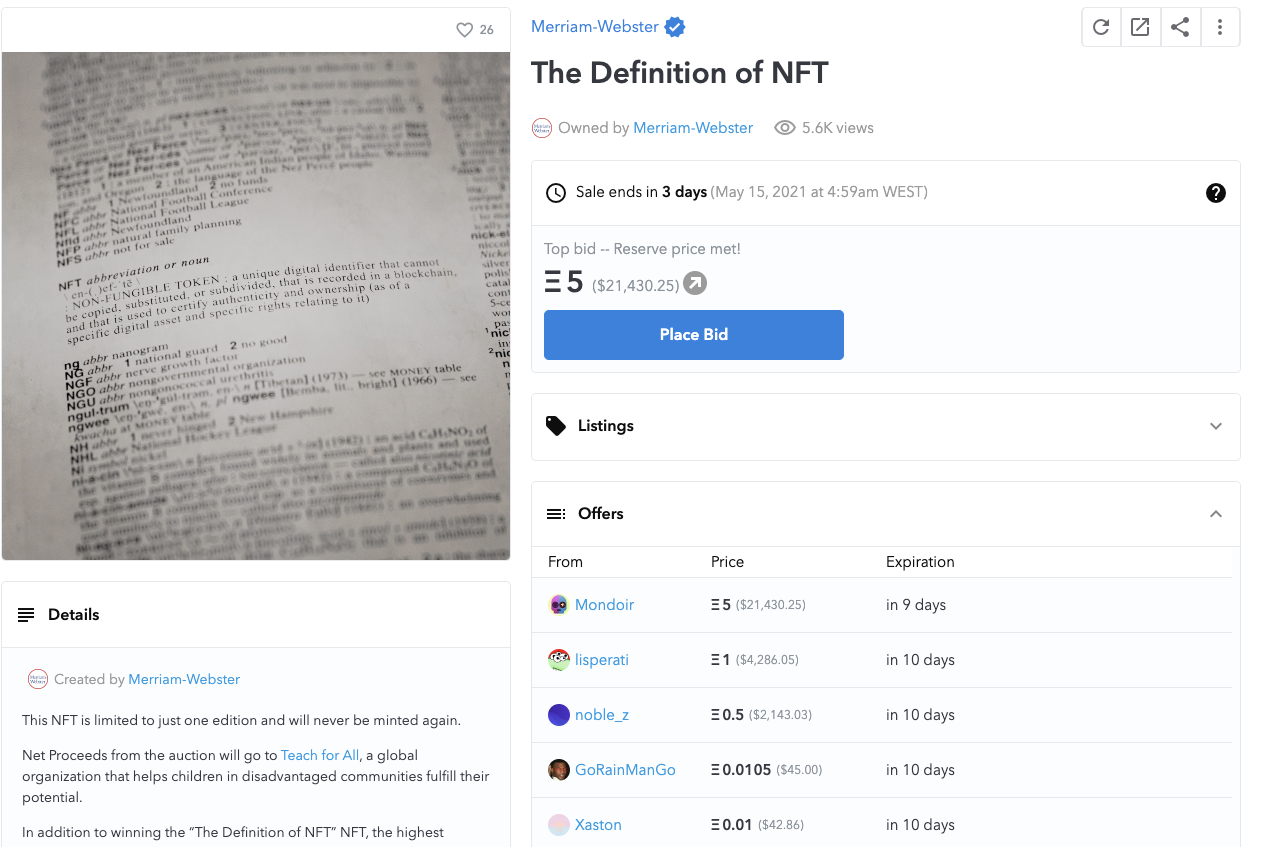

Meme moment: NFT inception is coming.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!