Tipping the Grayscale

Cryptic ball: remember the summer range.

As anticipated, this was a fairly uneventful weekend and that's exactly what one wants. However, it seems that BTC is approaching that $33k test scenario laid out last Thursday, as it fell 7% over the past 24 hours since failing to overcome the 200-period moving average on the popular 4-hour chart. For now, there's some support at $33k, which incentivises both bulls and bears to tap that level for liquidity, i.e. to drive price below $33k to capture the stop orders placed there.

What happens then is key. If there's enough demand and that was just a move aimed at getting longs filled at a nice price, then it's more of the same: i.e. we remain sideways while aiming to pull a slow ascent. If not, then it's possible bears try to liquidate leveraged longs to see how low the liquidation cascade can take us. Fortunately, there's not much leverage in the market right now. However, there's fresh FUD around the corner - which could have a similar gravitational pull.

Chart art: things will be uneventful until we get a clear move.

Market musings: this could be what fuels such a move.

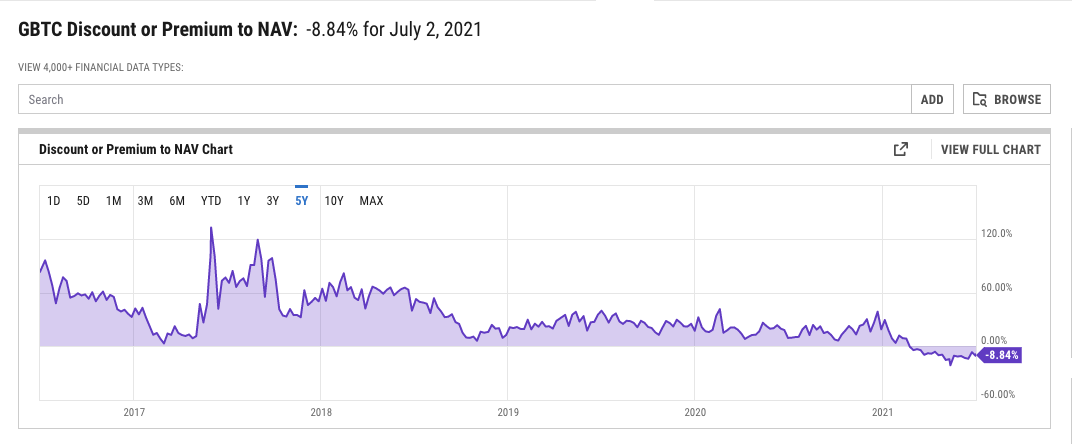

The current FUD concerns Grayscale's Bitcoin Trust and pairs nicely with the overall weakness displayed by bitcoin's price while it remains rangebound. Grayscale is the world's largest cryptoasset manager and its Bitcoin Trust (GBTC) allows traditional investors to gain exposure to BTC since 2013. Historically, GBTC shares were always traded at a high premium to the value of bitcoin held in the fund - a sign of high institutional demand - until that changed this February.

Since 2015, non-accredited investors can buy shares in GBTC - which are sold by accredited investors in exchange of bitcoin deposited in the trust. These deposits have a six-month lock period to ensure investors that want to accrue those hefty premiums in a risk-free arbitrage can't dump their new shares right away. Well, back in December those premiums reached 40% and JP Morgan reported that $3.7 billion flowed into GBTC between December and January, as many wanted in.

The investment bank had already warned about this two weeks ago, hinting that the end of the lock-up periods over the next weeks would "exert further downward pressure" on the market. But that was largely ignored, given that the easy arbitrage opportunity has faded away since the end of February and that its net effect was mostly neutral, as Arca's Jeff Dorman recently explained in his take: Debunking Bear Thesis #9. Why are we talking about this then?

Because the new narrative, popularised by Alex Mashinsky, founder of Celsius Network, argues that because those unlocked funds can't benefit from the arbitrage trade - given there's no premium to collect - they will then will dump their GBTC shares (without crashing the market), and then use that money to short BTC one more time before loading up on discounted GBTC in the end. Yes, it's farfetched, and we don't agree with it. But if bitcoin continues moving towards $30k over the next ten days, when the last unlocks take place, this could be it.

Visual block: who knew Grayscale could be a source of FUD.

Three things: sub-title

- You still don't know "What the Duck is DeFi"? Watch Robin Schmidt's great slide deck and presentation and make sure you master such a key content.

- You still don't hold an NFT? Check Bailey Reutzel's round-up of what's happening in this "Insane Money and a Hype-Drunk Market".

- You still haven't profited from a single crypto trade? Find some comedic comfort with Keifer Atwood, a Twitch trader who streams his losses!

Tweet tip: we're with the DonAlt on this one.

Meme moment: specifically that small boat.

Spend your crypto profits: with B21's international card.

Bitcoin.com Interviews: B21's CEO is the latest guest.

Get started: download the B21 Crypto app!