A newsletter a day keeps the losses away

Cryptic ball: alt season, last leg.

Yesterday Apple become the first company in the world to (momentarily) achieve a $3 trillion valuation. The entire cryptoasset market is (just) worth $2.25 trillion. So we're definitely early, even if we may see crypto at a lower valuation in the coming years - in case there's a harsh winter like before. But the next time they say crypto is bubbly, show them Apple's chart and ask which is growing at a more extreme rate (provided we replace decades for four-year periods).

And what will be interesting to see is when the entire crypto market cap overcomes not the leading traditional company but an entire sector or financial index. That will be a nice flippening for the next cycle. Meanwhile, for this cycle and as written yesterday, I'm growing more convinced we'll see ETH surpassing BTC's market cap this year - the original flippening meme that drove many to madness in 2018. On that note, remember when, last April, I warned you about when bitcoin lost its historical dominance support over ether and the rest of the alts?

That was a sign of euphoria, but 2021 consolidated such a ratio into levels only seen in the first half of 2018. Looking at that same chart below (which reached a local bottom during May's top), we can see that dominance has just broken down below May's levels. This shows the market is heavy on alts - something which doesn't happen if traders are truly feeling fearful. We're now clearly headed towards the absolute dominance bottom, reached during 2018's market top.

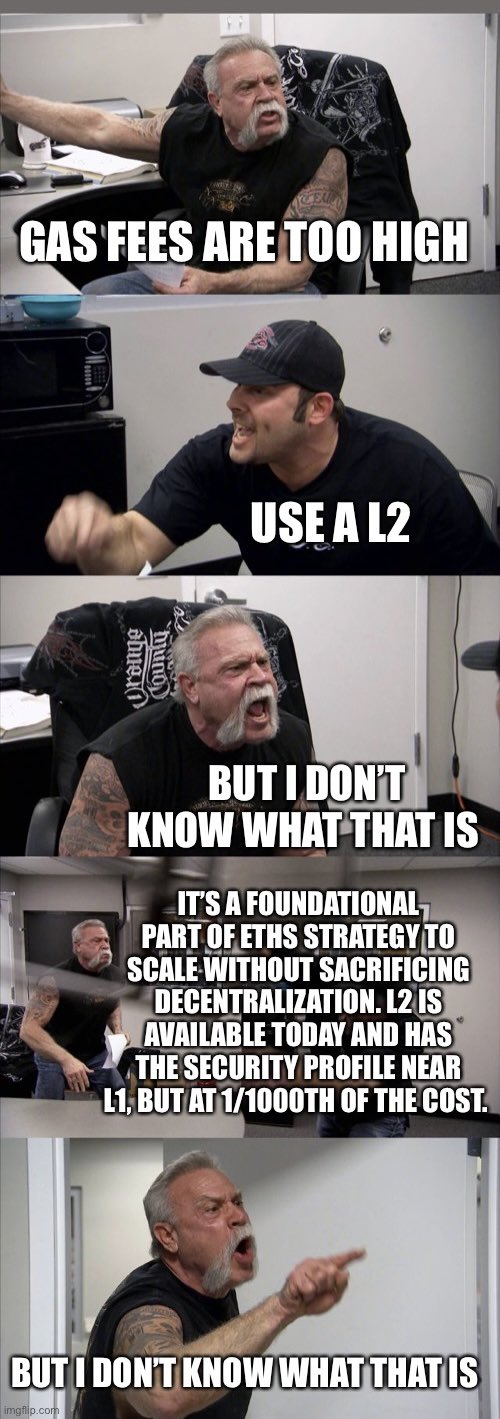

I feel traders will be paying attention to this level, and if we drop below it then alt euphoria will ensue. The Ethereum 2.0 narrative is being rescued as L1 ETH killers are struggling below their ATHs. Its Proof-of-Work blockchain's merge with the Proof-of-Stake beacon chain is also planned for Q2 and will likely generate a lot of hype. Will this the event that will coincide with the market top? Like 2017's bitcoin futures and 2021's Coinbase IPO (because the $69k meme top didn't count)?

Chart art: $45.5k tests, last bounce.

Three things: multichain future, last try.

- Curve's CRV is up 23% in 7 days. Learn more about the underlying interest in the protocol with Delphi Digital, as well as about the Curve Wars.

- The multi-chain thesis is behind many of 2021's pumps. But some argue it will also drive 2022's leg. Learn more about it with Emile.

- Gaming is all the hype. But Lars Doucet's blockchain gaming predictions for 2022 help separate the wheat from the chaff.

Tweet tip: watch out CT, last warning.

Meme moment: scaling solutions, last change.

B21 Universe: earn and spend.

Get started: download the B21 Crypto app!