Laggard L1s

Cryptic ball: squeezeful thinking.

Another boring day in the cryptoshere. Market cap barely moved, but bitcoin scared everyone again after testing $45.5k again a few hours after the newsletter was sent. As said before, it's comforting to see bears can't break that support down. But it's also eerie that price remains hovering around that area, as it weakens confidence and removes momentum from any plays with riskier alts.

Meanwhile, as traders lose patience we'll likely see an increase in leverage. Hopefully, negative sentiment will entice noobs to open leveraged shorts and we finally have fuel for a squeeze up. The ideal scenario would be for BTC to reclaim $52k and remain stuck between that level and the previous ATH in order for alts to moon over the next months. That's my wish for Q1 2022.

Dreams aside, several alts continue pumping despite the tough conditions. ICP, RVN, and AR all gained more than 15% yesterday, although the rotation game isn't an easy one to nail (and some even argue you shouldn't try to play such a metagame). Anyway, for now, the Layer-1 blockchain projects which didn't pump as much at the end of 2021 are taking the spotlight - e.g. ATOM, FTM, and NEAR which I briefly mentioned yesterday. I still believe they will continue to outperform the rest of the market this Q1, but it's time to look out for the next sector.

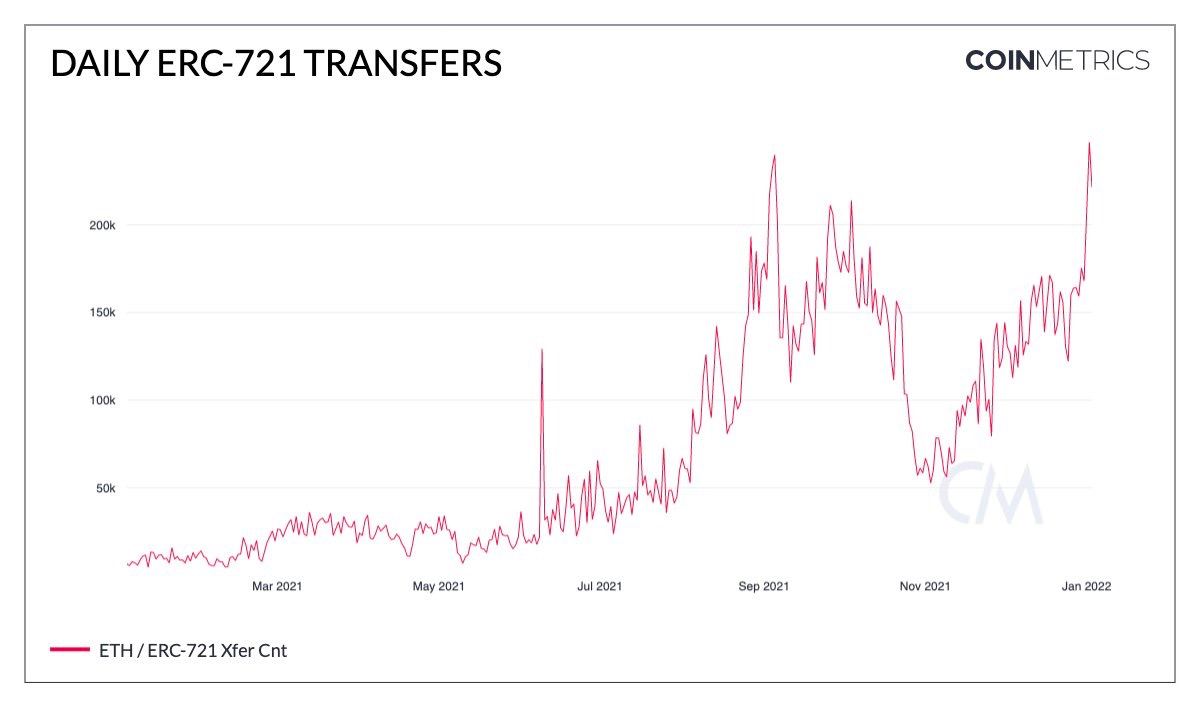

Chart art: exit liquidity.

Three things: beginners bliss.

- Delphi Digital analyses the top 10 L1 chains and dApps.

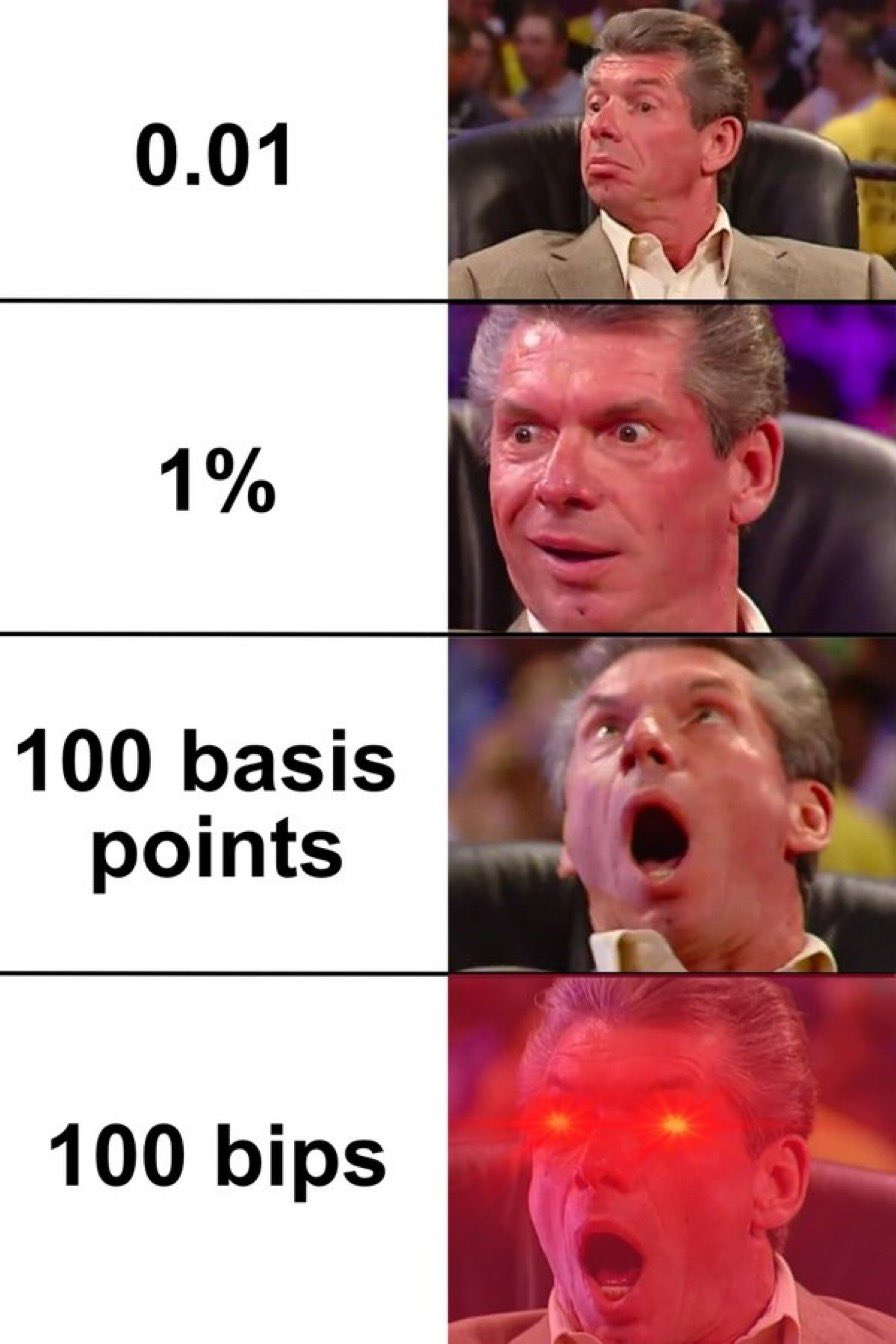

- Regan made a Beginners Guide to Crypto Jargon.

- Qiao Wang shares his views on Web3 and China.

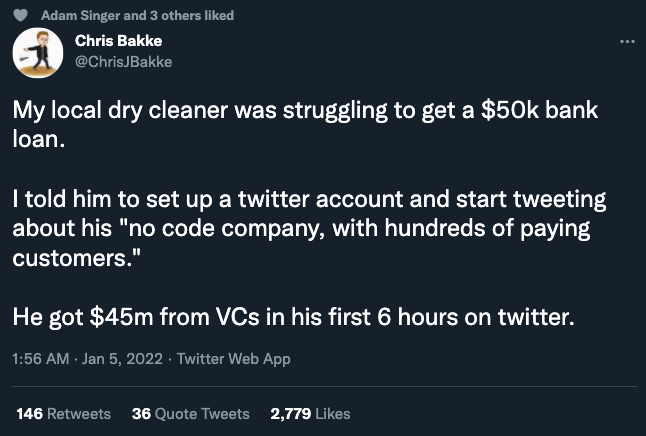

Tweet tip: funny truths.

Meme moment: pedantic snobs.

B21 App: extra security.

Get started: download the B21 Crypto app!