Rumour has it

Cryptic ball: a red week, indeed.

Yesterday we told you that, historically, if BTC failed to recover ground once ETH found its own top, then we tend to see a generalised crash shortly after. And, in the context of this week's negative bias for BTC, explained in Monday's post, it is only normal to observe the carnage of the past hours - with total market cap down 11%, and both bitcoin and ether falling 9% to 11%, respectively. But why?

Well, we just told you above! But many believe there must be a more powerful story behind radical moves like this one, other than simple trend exhaustion and continued selling pressure that isn't matched by an equal amount of buying force. Alas, people love looking into the news to try to derive meaning from otherwise natural movements - with Reuters being particularly good at ascertaining these kind of relationships that lack a truly causal relationship (so avoid them!)

Anyway, as you may know, the latest narrative is that this crash is due to President Biden's plans to tax long-term capital gains in the same way wages and short-term capital gains are taxed for the top 0.3% in the US. But this affects all asset classes and a minority of crypto traders, meaning it's not even the excuse bears needed to strike. However, could its consequences been compounded by some fake news which spread on Twitter? Read along to understand the extent of the impact!

Visual block: fake it until you break it.

Market musings: the answer to the ultimate question.

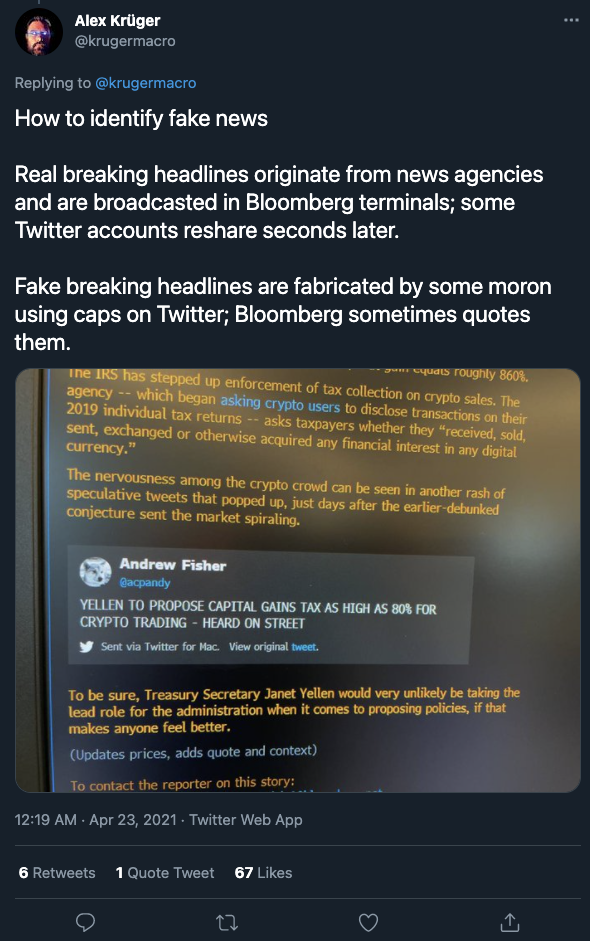

Volatility is what makes cryptoasset markets great. So, many participants try to cause unpredictable situations to foster it. Twitter a great space to spread such fake news - given that the cryptosphere is now, more than ever, followed by new watchful eyes. And, as you can see above, following Biden's news, a rumour about the US Fed planning to raise taxes for cryptoasset capital gains started to unroll. However, even this rumour was unable to significantly move the market.

That's because yesterday's alarm bells were different than those of the weekend. Liquidations were scarce this time, given that most of the selling happened on the spot market, instead of with leveraged futures - as Alex Krüger greatly explains here. In other words, if traders were scared because of a piece of news, they would have had all the incentives to aggressively short BTC and ETH on futures markets.

Instead, what's happening is that many people, because they are human, are naturally feeling this crypto pump has been too wild and it's time for a correction. But is such psychological caution warranted? On the one hand, naturally - it is. And we've been telling you to take profits. On the other hand, note that it's when most people are fearful that it becomes enticing to buy - remember, you want to buy when there are less sellers and vice-versa, and the moment with least sellers is when everyone who was afraid to hold a position has already sold!

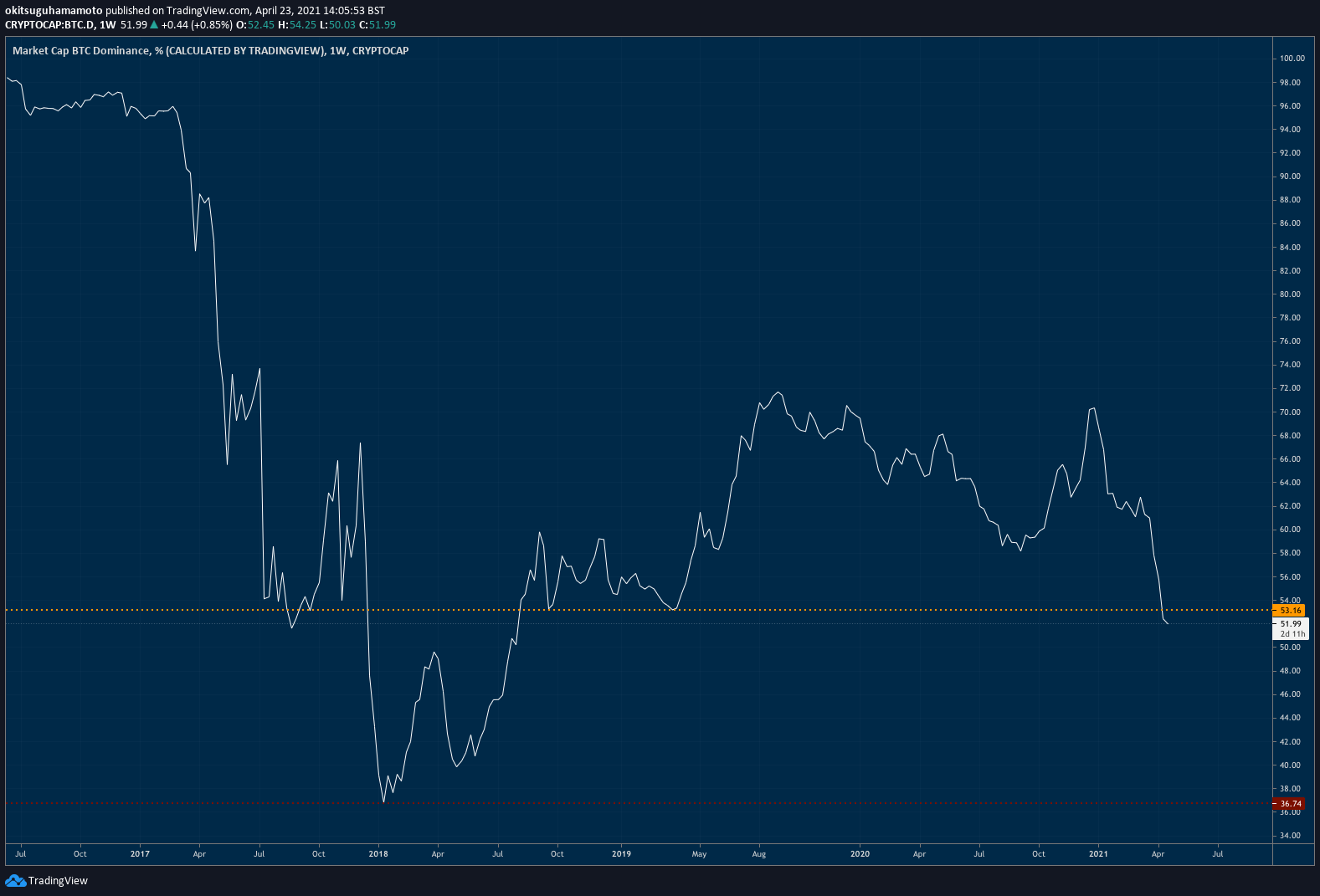

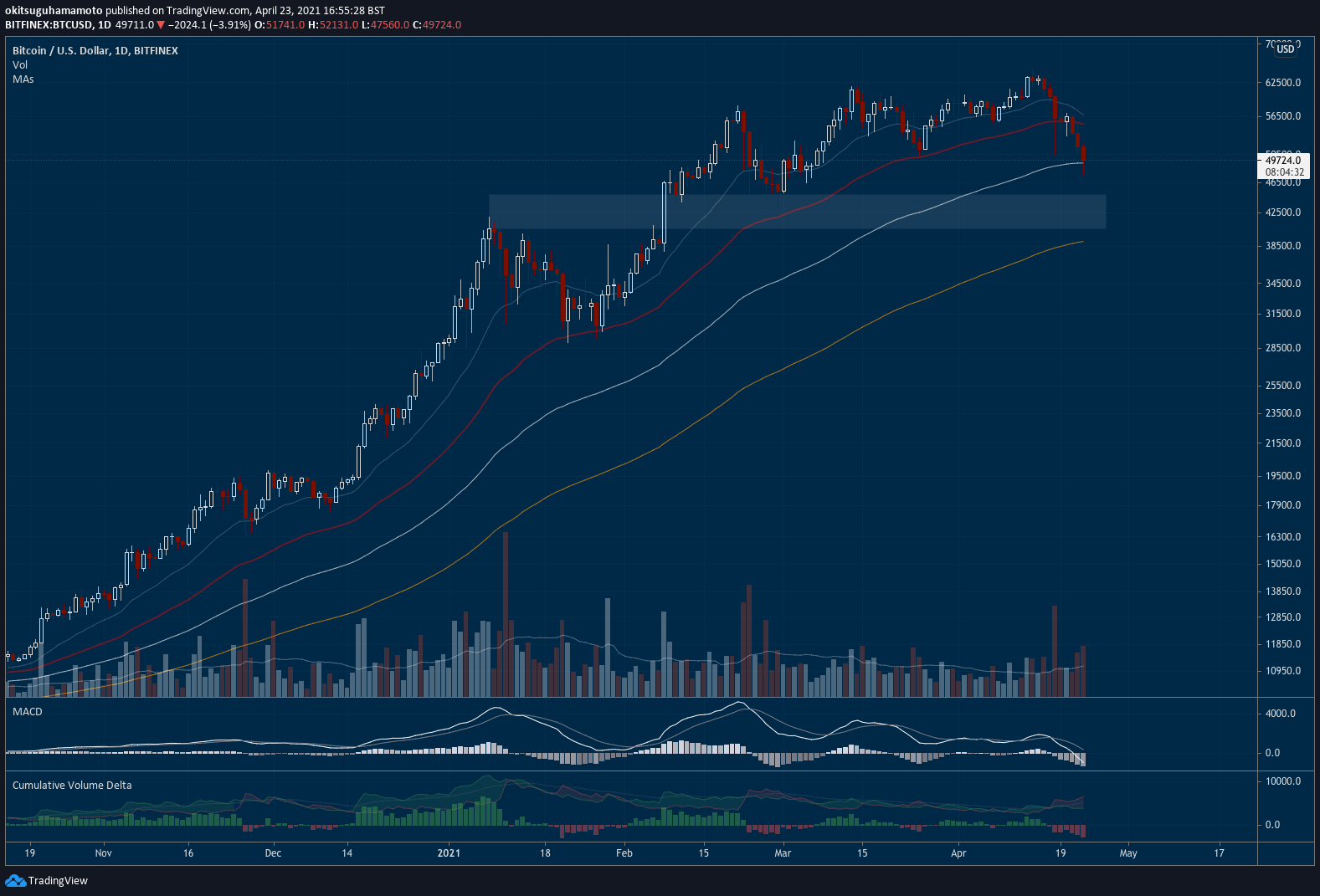

Still, like Monday, we're not necessarily advising you to buy. This may not be the bottom of this short-term correction it. We just want to make sure you understand we're far from a cycle top. That would likely be when all the shitcoins out there theoretically drop Bitcoin's dominance back to the euphoric levels of January 2018, as you can see below. Lastly, for the weekend, look out if BTC finds support near 42k! That's a key level to watch out for, but note we may find relief earlier.

Chart art: watch the red line.

Three things: avenues for an insightful weekend.

- If you want to follow BTC over the weekend check out CryptoQuant's Telegram channel. They also believe this correction is technical, not fundamental.

- If you want to know more about Ethereum's scaling plans, which are making ETH more enticing for investors but less for miners, explore this and then this!

- If you want to know more about why "Bitcoin is Key to an Abundant, Clean Energy Future", check Square's latest whitepaper on the topic!

Meme moment: it's just a ride.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!