Icarus or Aidos

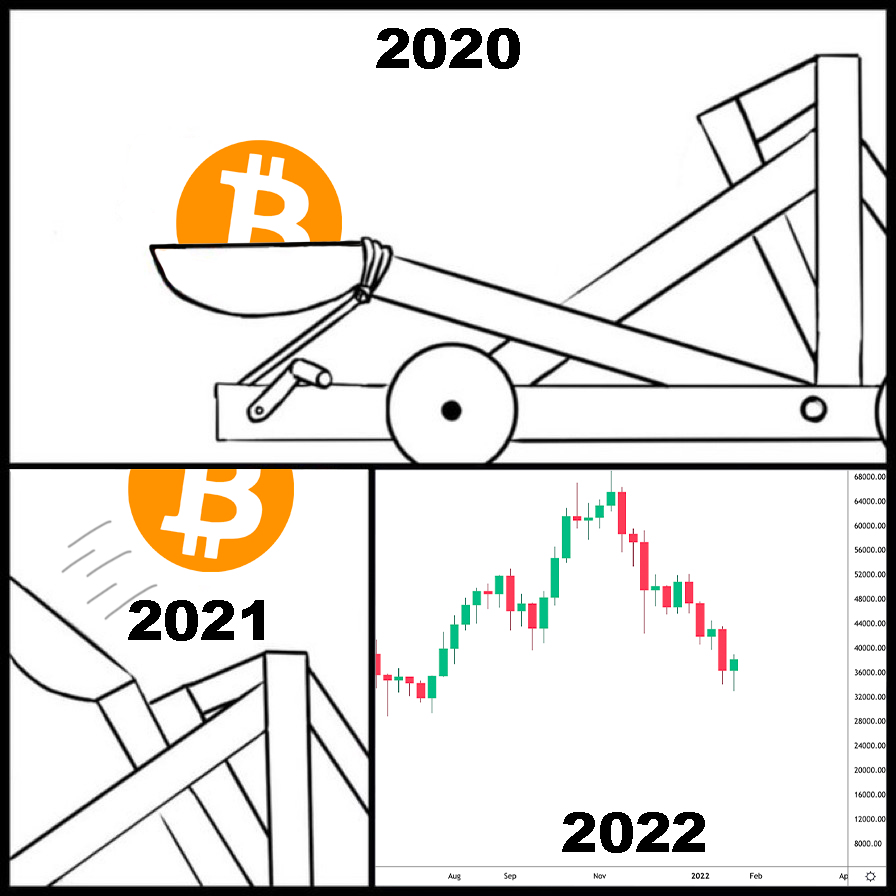

Cryptic ball: hubris or modest bounce?

What a day for bitcoin bulls! The orange coin is leading the market with a 12% pump like in the good old days and few alts have gained more than it. As explained yesterday, Amazon's Q4 earnings came out after the US close and were spectacular. Its stock popped as much as 16% so far, most of it right after the news - even if, to be fair, it had fallen 7% Wednesday impacted by Meta's poor results.

Naturally, such a performance ended influencing the rest of the market, helping the S&P 500 and the Nasdaq 100 recover part of the Zuckerberg-induced drop. Bitcoin also responded immediately, removing that uncertainty I wrote about and paving the way for that squeeze to $41k I've last described on February 1st to play out. After some hours stuck at $40.5k, bulls are trying to fly closer to the sun now.

Will they succeed and conquer $42k again? Or is this relief rally destined to fall from the sky like Icarus? It's unclear, but I believe the weekend will be volatile. The stock market is closed and even TradFi traders will be looking for the next +15% move like the adrenaline junkies they are. More interestingly, risky assets across the board are pumping even though strong job market data in the US just came out - which means the Fed will surely follow through with their tightening plans.

This could be the beginning of the decoupling from monetary policy bulls have been waiting for. But for that to work out then at least $39k must hold over the next days in case bears push back one more time. In the meantime, remember speculative alts are still suffering from excessive froth, so if you want more risk at least make sure you're betting on high-quality projects. Enjoy the weekend!

Chart art: resistance or new support?

Three things: or just two?

- Jeff Dorman discusses how to find signs a bottom is near and that's all you need to read this weekend!

- But there's one thing you should watch: Cred's updated trading video on market microstructure, explaining order types, liquidity, and order flow!

Tweet tip: or career advice?

Meme moment: or just Q1 2022?

B21 India: legal or not illegal?

Get started: download the B21 Crypto app!