Disbelief

Cryptic ball: short squeezed.

Aidos won, but wouldn't a goddess always triumph over a human? Especially Icarus, a mere son of a craftsman? If you are just catching up with our emails, last Friday I compared bulls to either the ambitious flyer or the greek personification of modesty. So it was great to see that the bulls managed to steer away from the sun and opted for a more respectful ascent to a - for the moment - humble moon.

As usual, what's next? First, let's recap that bulls have indeed conquered the key $42k level and bears were so weak they couldn't even get a test of $39k over the past days. Total market cap is up 9% since the last newsletter was sent out, and alts have been following the leader. Greed also seems to be back, with shitcoins heavily outperforming most tokens, from SHIBA's 50% pump to XRP's 25% rise.

Secondly, US equities haven't started Monday on the best foot, even if last week was indeed the best of the year. This is interesting as the crypto market is on the rise today, adding strength to the potential decoupling of these asset classes. But even if that was a confirmed reality, and without neglecting the very positive new trend forming here - the first time we're seeing clear higher highs and higher lows since the November 10th all-time high - let's look at where BTC is.

The orange coin is now facing some minor resistance at $44k, a key level in January's failed attempt to break the diagonal line highlighted below. In the end, don't expect it to cause much trouble, but it's likely we see some consolidation around this level for bulls to recover their strength before trying to hit the next, more difficult level at $46k. Keep watching for signs of exhaustion and remember bears are still denying the bottom is in - let's squeeze them!

Chart art: long bias.

Three things: some advice.

- Cobie is back with another must-read about the desire to make money in all markets and how VC incentives impact the common man.

- Web3 threads are back with Martin's take on "how to contribute to crypto/web3 without writing a single line of code".

- Epic advice threads are back with Jon's 131 tips "for the next generation of apes". Hit reply to this email if you don't understand some.

Tweet tip: incredible allocation.

Meme moment: key message.

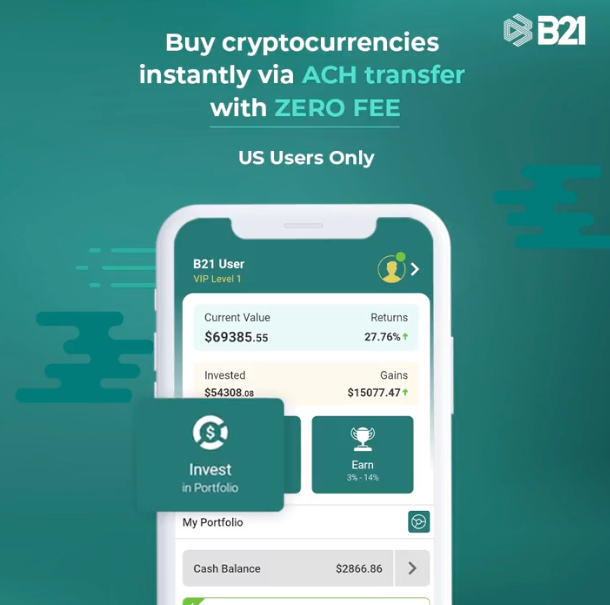

B21 App: instant transfers.

Get started: download the B21 Crypto app!