February brings the rain, thaws the frozen lake again

Cryptic ball: just some scenarios.

February is here! The monthly close wasn't as bad as many expected, but it doesn't exactly scream of a bottom. Still, this was the third red month in a row, just like what we experienced between April and June, before resuming the journey to a new all-time high in July. Unfortunately, $69k wasn't as exciting as it could potentially be and, together with the macro complications, we got where we are.

As always, what's next? The weekly chart looks good and makes me confident we're going to test $40k to $42k this week and get that higher high bulls need for the bounce to play out. However, this morning, UTC time, bitcoin faced some rejection around $39k. For now, it didn't harm the trend, but the daily chart is showing some signs of exhaustion, given the declining volume and long wicks. It could be because of Chinese New Year's diminished activity, or because bulls are tired.

Note also that the original orange coin is testing the 20-day moving average (in green), which has been acting as resistance since November 17th, bar that fake Christmas breakout. If bulls manage to conquer it then longs will rejoice - at least for a while. If not, and as explained yesterday, it's all about what happens on the wave down: bitcoin must find support around $36.7k or else bears will invert the trend and spread fear - although I must repeat I believe we first see some green.

Zooming further into the 4-hour chart, we can see BTC is also fighting the key 100-period moving average (in red) - which acted as resistance since December 28th, after it became clear Santa wasn't saving the holidays. Again, if bulls overcome it, expect a squeeze up to $41k. If not, let's hope $36.7k holds. In any case, bears are about to fight hard and my ability to provide scenarios without further development is about to end. So place your bets and enjoy the show!

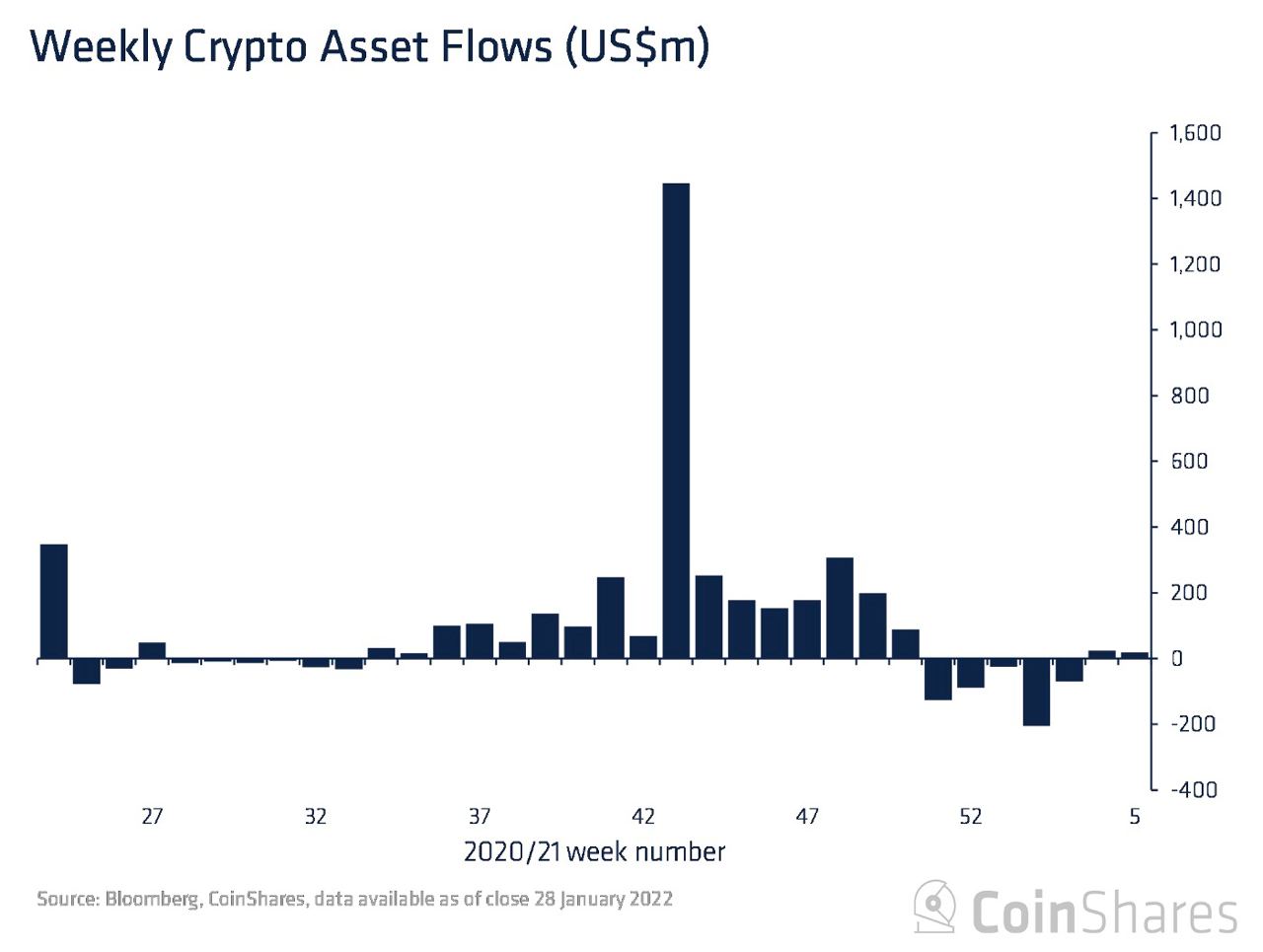

Visual block: just some flows.

Three things: just some events.

- Ted Talks Macro "picks apart which events in the economic calendar will have an impact on the markets this week".

- Jasoin Choi explains why "the current state of VCs in crypto is a confusing cesspool of pioneers, mercenary opportunists, populist rhetoric, and overinflated promises".

- Henri Lieutaud helps you "start understanding and writing smart contracts on Ethereum with a bunch of Solidity tutorials".

Tweet tip: just some correlation.

Meme moment: just some humour.

B21 App: just some clicks.

Get started: download the B21 Crypto app!