Metadverse vs. Warmwhole

Cryptic ball: spatify vs. amazone.

What did I tell you? $36.7k is such a key level for bulls that bears have been fighting for it since yesterday night. Bitcoin's past five 4-hour candles have wicked below it but managed to close right above. While things aren't lost for those who crave green, this lack of conviction harms the clear uptrend and raises the chance we fall into the kind of sideways slow-bleed which plagued BTC from May to July.

What happened? Zuckerberg's Meta reminded everyone how weird VR is, prompting Facebook's parent stock to crash by 24% - the biggest one-day drop in the US stock market history. Still, it's great to see that only some tech companies followed the dump, even if Nasdaq 100 is down 2.5% and the S&P 500 lost 1% - nothing too serious given they were both at key resistance levels anyway. Also, Wormhole, a DeFi bridge, was hacked for $320 million - but the funds have just been restored - and, apart from Solana's SOL, prices weren't much affected.

What next? Some popular Wall Street analysts believe stonks need to fall more, arguing the market needs a +15% correction before bidding gets attractive again. After the US closes today, Amazon will report earnings and its results will surely influence whether or not that prediction is right nor not. As for me, I'll start hedging again as the weekend approaches and we are not seeing clear signs of strength. The bounce may continue but patience is of the essence here.

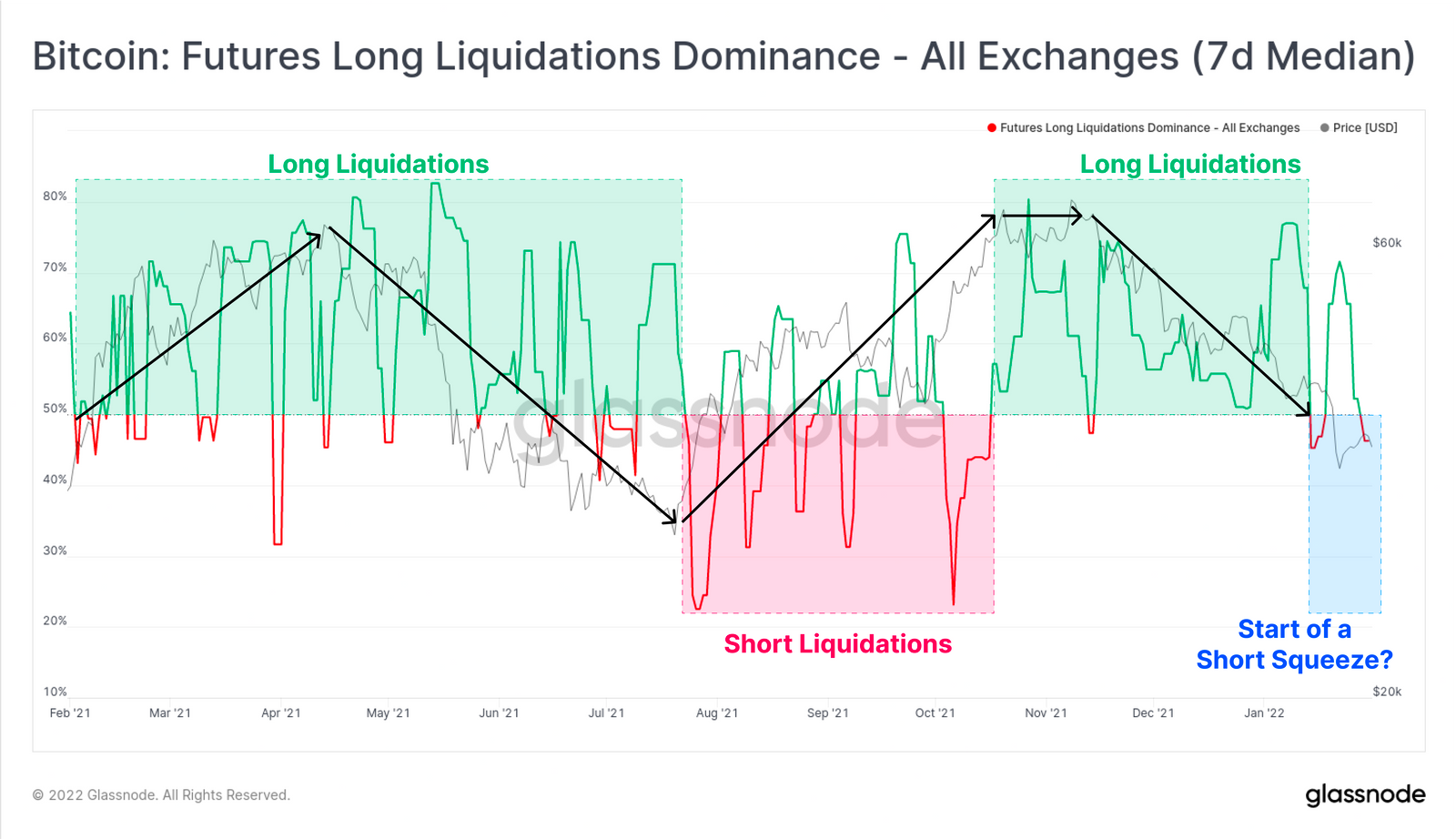

Chart art: hope vs. conjectures.

Three things: free vs. fees.

- Resonance, a proven trader, shared the best mental models and frameworks about crypto markets I've ever seen. What a must-read!

- Wangarian, another good trader, shared "a couple of thoughts I've had for awhile on decision making processes as an investo". Also a must.

- Logan Wozniak shared "a complete seven-step beginner's guide to Web3". A must if you want to change your career (and life?).

Tweet tip: distress vs. chess.

Meme moment: spending vs. saving.

B21 Community: join our Telegram.

Get started: download the B21 Crypto app!