FOMC FOMO

Cryptic ball: buy the speech.

The event that will define December's P&Ls is here. Funny how some actor we used to shun is now so influential, right? Anyway, the US Fed will issue a press release of the two-day FOMC meeting at 2pm ET (that's 7pm UTC and half past midnight in India). And Jerome Powell will speak half an hour later. Most of my view has been shared over the past days, with yesterday's newsletter summarising my scenarios for the next months. But today will still be fun.

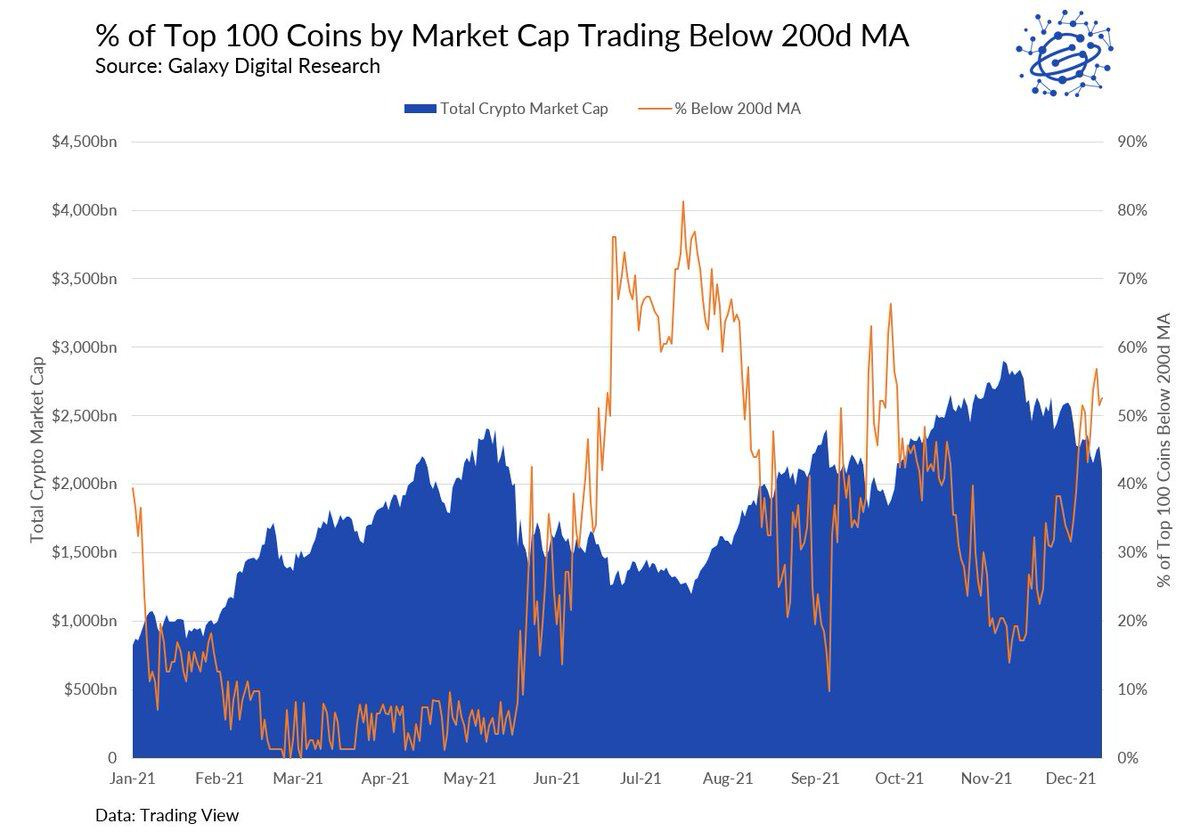

As Alex Krüger explains, global markets - including crypto - have been pricing in the recent change in the Fed's tone from dovish to hawkish. Note hawkish refers to policymakers who favour aggressively taming inflation with higher interest rates and tighter monetary policy, whereas dovish ones are focused on promoting growth (and peace) through expansionary policies, like printing money. The question is how much of this change has been priced in already.

Alex believes most of it has, as the derisking in tech stocks and crypto has been quite extreme already (retail doesn't typically want to sell at loss, even if only psychological). So, even if we get the accelerated tapering and interest rate hikes for 2022, we should at least see a relief rally for the rest of December. I want to believe in that, but it's also the case the current fear may lead traders to interpret the outlook as their biases tell them: i.e. panic. But that's unlikely.

Overall, I'm still mostly neutral since December 3rd's newsletter, and I'm expecting some volatility around 7pm UTC - as bitcoin gets closer to $46k. But I'm not expecting a break of $42k as there's strong support on the order books and most who wanted to sell have already sold. In other words, this volatility may provide good entry setups for traders, that can even turn into nice swing opportunities if, after Powell speaks, the market agrees that the situation is not so bad. But, as always, have a plan in case doomsday is here.

Chart art: buy the bounce.

Three things: buy the doomcember.

- Hayden Adams refutes Senator Warren's recent attacks on DeFi and stablecoins.

- Lattice Capital outlines "The Web3 Growth Playbook".

- Raoul Paul argues crypto bears suffer from PTSD and that 2022 will take us to the moon.

Tweet tip: but don't forget to sell the next top.

Meme moment: and to support crypto lobbying.

B21 Card: get yours today.

Get started: download the B21 Crypto app!