Certainty is better than hope

Cryptic ball: meeting of the year.

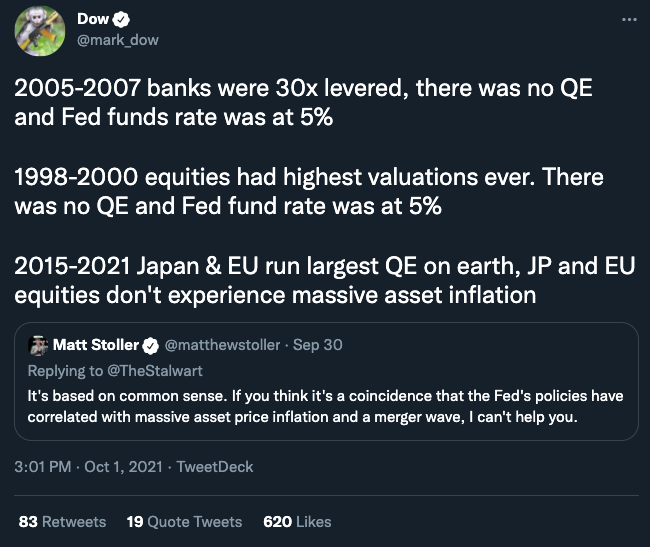

As explained yesterday, it seems the markets had indeed priced in most of the news announced by the US Fed, despite the confirmation that the central bank will tighten credit by raising interest rates in 2022 and will also fasten the tapering of its bonds and assets purchase program. While one typically talks about buying the rumour and selling the news for bullish events, the contrary should happen for bearish ones: sell the rumour and buy the announcement!

However, even if the markets reacted positively - with US equity indexes near all-time highs and BTC and ETH climbing up to 6% and 13% on the news, propelling some alts even higher - it's also the case most of this optimism is contingent on the possibility that the Fed may need to extend its stimulus further in case Omicron delays economic recovery or that inflation is not that bad, even if Jerome Powell claimed this COVID variant won't impact the Fed's tapering plans.

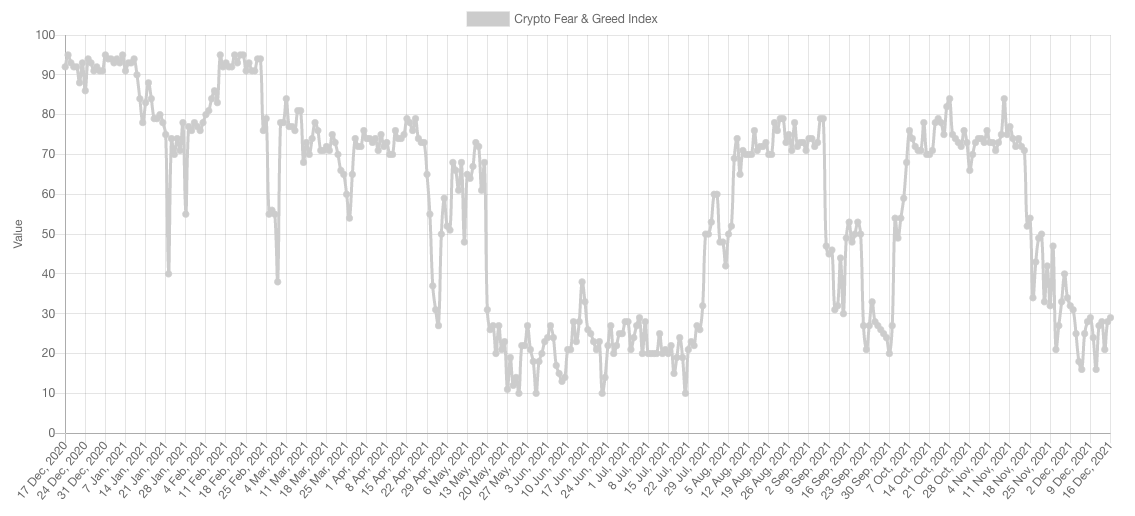

All-in-all, the scenarios outlined Tuesday will probably remain valid for the next months, so give that post a read in case you've missed it! In other words, remember we're still in a downtrend until BTC breaks out of $52k, which won't likely happen this weekend. And the current pump may also retrace over the next few days. Still, this bounce hints at a relief rally around Christmas - as panic is leaving the market and it's becoming more and more interesting to squeeze the late shorts, while defending bitcoin's important $46k support.

Chart art: chart of the year.

Three things: talk of the year.

- Darius Sit, from QCP Capital, talks about his outlook for 2022.

- The Economist talks to the founders of four crypto exchanges (you can't miss Arthur and Sam together with CZ and Brian Armstrong, right?).

- Cozomo de’ Medici talks about how NFTs change the art-making game.

Tweet tip: observation of the year.

Meme moment: twat of the year.

B21 Earn: earn interest.

Get started: download the B21 Crypto app!