DAO or DAO not. There is no try

Cryptic ball: the multi-chain future is here.

Bitcoin has been mostly stagnant since Monday's pump, with total market cap barely changing since yesterday. However, that's just the average indicator, as some popular multi-chain projects have pumped hard, with Cosmos' ATOM - "the internet of blockchains" - jumping 22% and Polygon's MATIC - "Ethereum's internet of blockchains" - rising 19%. Both protocols aim to scale dApps through interoperability, although Matic is focused on Ethereum-compatible chains.

In other words, bulls are alive, just playing in the rotation game. Meanwhile, November's US jobs growth data was just released and is much worse than expected. Typically, bad numbers cause US stocks to dump, as they signal a poor economy. But it seems Wall Street is welcoming the news, as traders may expect this prompts central banks to ease tapering a bit, which would benefit equities as explained Tuesday - although some analysts are arguing the data is not that bad.

As always, one tends to read what they prefer to believe in, so let's see how the market reacts. Right now, I'm feeling a lot of uncertainty and I like entering weekends with my positions hedged so I can enjoy some free time. If a pump starts, I'm ready to enter one bid at a time. If a dump happens, I don't need to be worried about my stops. Anyway, I strongly recommend Ben Lilly's take on the market, shared in the section below, who believes it's likely the dump is not over.

Lastly, for those less concerned with the short-term, note there's no reason to panic. I agree with the first thesis of Ryan Selkis, also shared in today's three things, that the world's economy will get worse in 2022 and that, eventually, this will hurt crypto in the medium term. Curiously, he also argues, on another that, that we'll see a blow-off top next Q1. While 2022 is still not here, remember expectations are all that matter. Let's just hope there's still fuel left!

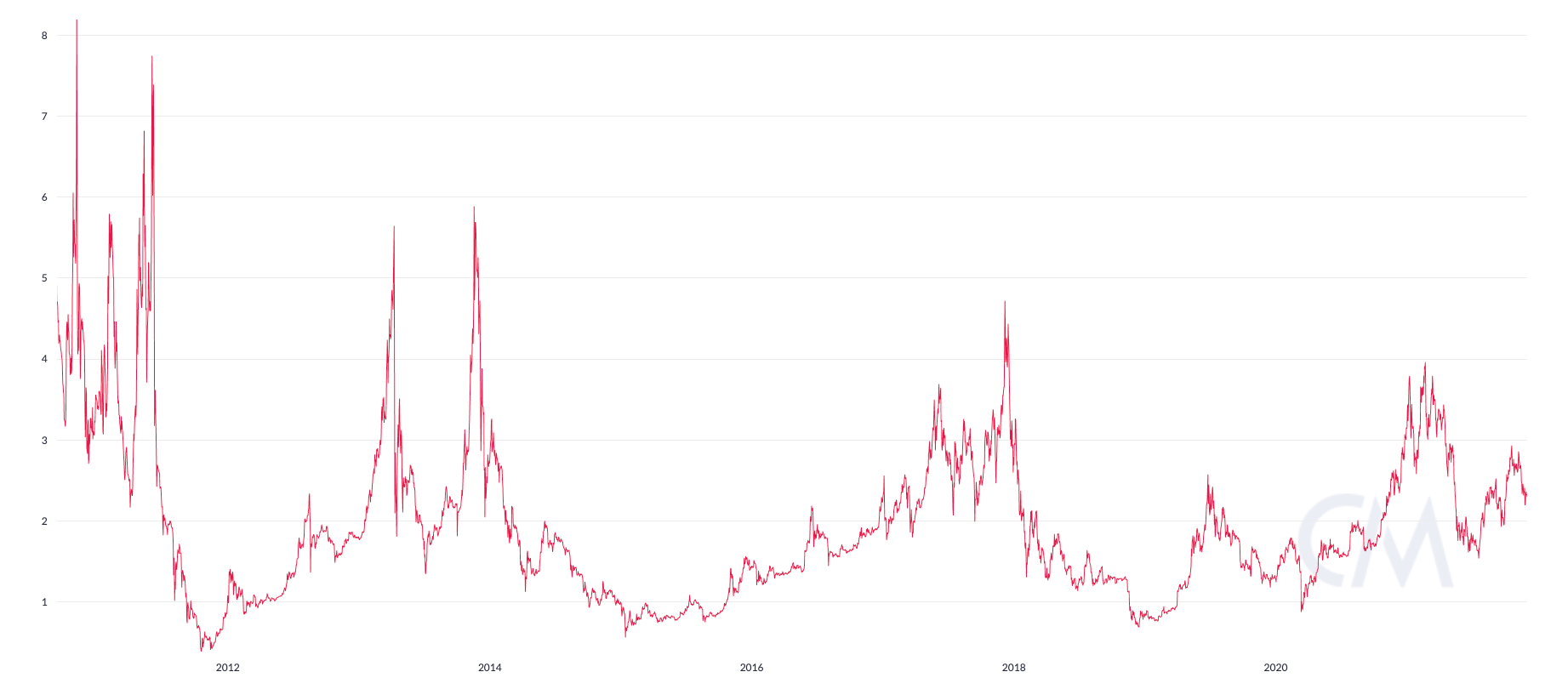

Chart art: a key indicator is here.

Three things: familiarity is here.

- Stop everything. Ryan Selkis, Messari's founder, has released his popular crypto theses for the year ahead. Check the 150-page report here!

- Stop everything. Ben Lilly, founder of Jarvis Labs, has released his update on the current market conditions after last week's dump. Have we bottomed and should you always try to find bottoms and tops?

- share

Tweet tip: a small dataset is here.

Meme moment: web 4 is here?

Meme moment, part 2: meta bears are here.

B21 Card: put your stablecoins to work.

Get started: download the B21 Crypto app!