Inflated expectations, part III

Cryptic ball: just wait a bit.

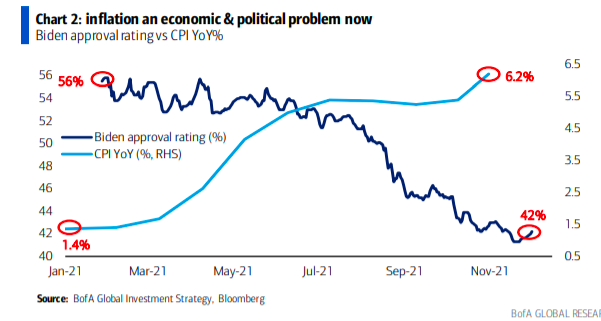

If you've been reading this newsletter for a while, you know how I like to praise the virtues of Arthur Hayes, founder and former CEO of the vicious BitMEX - the wildest casino the cryptosphere has seen and the leading arena of price action between 2016 to 2018. Well, now the man exceeded himself and produced the sanest piece of analysis of the year. As I wrote yesterday, the US leaders need to decide whether they will now please the wealthy or the bottom 90%.

But while I was of the opinion a delicate balance needed to be struck, Arthur argues the Fed will err on the side of caution and global markets won't be flooded with the kind of liquidity necessary to propel risk assets so soon - even if the S&P 500 remains in bull territory (i.e. without facing more than a 20% dip). However, crypto and overvalued tech stonks are already +30% down from their ATHs.

In other words, I remain convinced the macro bull cycle isn't coming to an end now, but I'm now seeing two scenarios playing out if tomorrow's press conference goes according to this updated expectation: 1) We either remain in this sideways range with a probable slow-bleed further down until at least next September, even if some sectors experience pumps (after all, DOGE rose up to 40% today after Elon tweeted Tesla will launch a merchandise store that accepts dogecoin).

Or 2), some panic happens over the next months. If global, this could prompt the Fed to extend its life support - in the form of extended asset purchase programes or a commitment to not raise interest rates by June 2022. If local to crypto, this could cement a bottom, and the reflexivity arising from the bounce would induce the FOMO we need to go up. Both alternatives would allow cryptoassets to go wild in Q1/Q2, giving us the promised blow-off top that would mark the beginning of the next bear market (which, as Kyle Samani argues, would likely be very different from the last, as Layer-1 protocols have a chance to flip Bitcoin).

Meanwhile, see how bitcoin held the $46k floor yesterday night. However, the lack of a bounce is worrying as Wednesday's Fed press conference comes closer. Kyle Davis, from 3 Arrows Capital, suggests retail traders don't have more coins to sell. But all the projects and DAOs out there have plenty of their treasuries to convert to stablecoins if they are also feeling wary of global market uncertainty. Watch out!

Chart art: just remember.

Three things: just learn how to crab.

- Sath teaches you "what to do in crab markets".

- Natasha shares her "top 3 bullish and bearish themes for 2022".

- Loomdart explains "why this isn't 2017 and why crypto markets won't see a big bear market".

Tweet tip: just hope.

Meme moment: just watch.

B21 App: instant ACH transfers.

Get started: download the B21 Crypto app!