Q4 is around the block

Cryptic ball: there's a lot of fear out there.

The expected end-of-month and end-of-quarter volatility is here. Bitcoin and ether fell up to 8% and 12% from Monday's top and are again testing dangerous waters. The global stock markets are also tumbling, with Tuesday marking the highest drop in the S&P 500 since May and Nasdaq's worst dump since March. The move followed remarks from Jerome Powell, chair of the Fed, who said "inflation is elevated" and would remain so for some months. Why did this spook the markets?

Because the Fed will be more prone to pull back its economic stimulus program, a matter also known as tapering, if inflation is high. And it's the Fed that has been propping up equities and other assets in North America, thus allowing investors to feel like they can risk more - which consequently also benefits bitcoin and the like. Now the question is if Europe's natural gas crisis, which is also pushing oil prices higher, will accelerate tapering, as high energy prices make inflation worse.

Chart art: but we had similar action in 2017.

Market musings: still, fear makes people irrational.

To add to this worrisome quarterly close, the US dollar is also appreciating against other global currencies, with the DXY (a dollar index) having just reached a new yearly high. Typically, this index rises as stock markets pull back, due to its safe-haven status. In other words, it signals an increased demand for dollars because investors sell their assets for this reserve currency. But should you panic?

Of course not. While we believe volatility over the next days and into the weekend can be brutal, and bitcoin could even test $39k again - which would crash all alts - our thesis for Q4 remains as bullish as it was. And it would only change in case the Fed was fine with a global stock market dump for Christmas - which we feel it isn't. That's a possibility we'll closely monitor, but for now it's time to enjoy the fear.

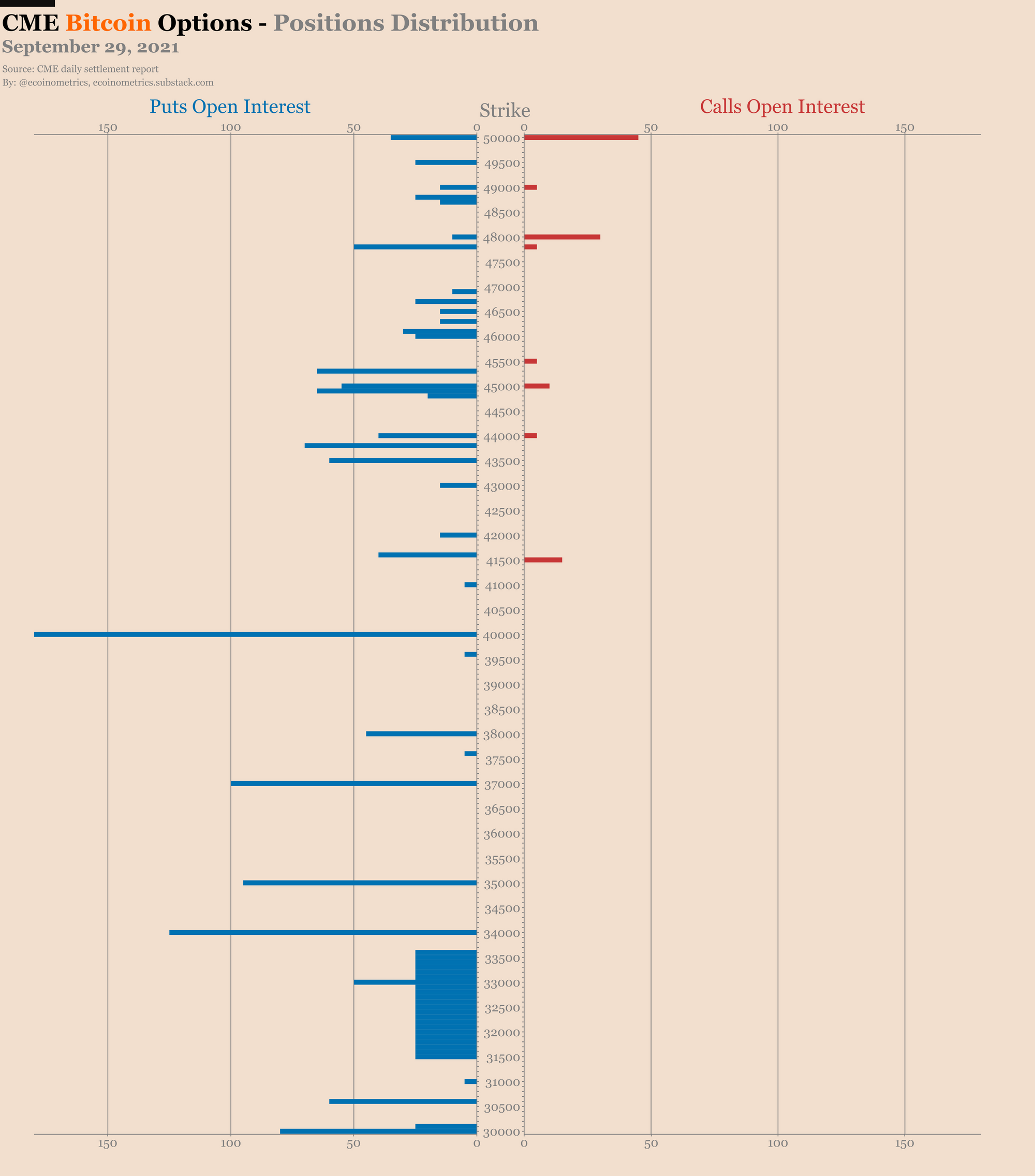

Visual block: and everyone is expecting a dip soon.

Three things: so be smart about your trades.

- Mr Goxx, the hamster, likely trades crypto better than you.

- Adam Cochran, a crypto OG, is not bullish on dYdX.

- Jeremy Allaire, Circle' CEO, expands on stablecoin use cases.

Tweet tip: and let's hope the US gets their sh*t together.

Meme moment: or else we'll face a flood.

Twitter Spaces: join our next session.

Get started: download the B21 Crypto app!