Summer has come and passed

Cryptic ball: "the innocent can never last".

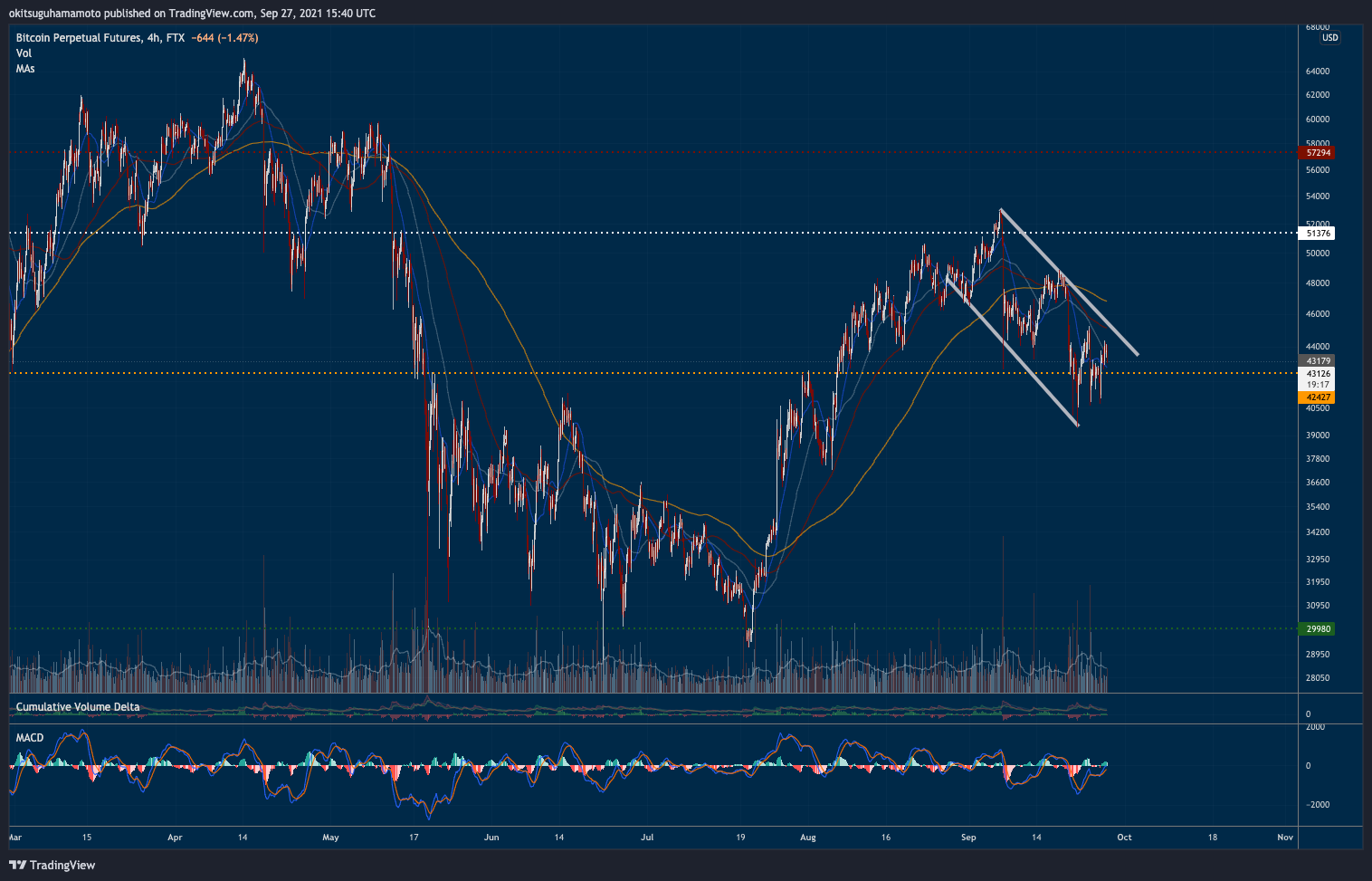

Bitcoin closed its weekly candle above $42k, the first hurdle it had to overcome following the renewed China ban. With September coming to an end this Thursday, we're expecting some volatility as bulls and bears fight to defend their views. Overall, it feels like bears will lose this battle, something you'll be able to ascertain once BTC resolves to break out of the bullish flag shown below.

Meanwhile, alts are also showing signs of recovery. The latest darling in the block is dYdX protocol, a leveraged decentralised exchange (DEX) with a slick UX that partly operates on top of an Ethereum's Layer 2 solution: StarkWare. This allows for low fees and traders are loving it - especially in China, where crypto trading, both spots and derivatives, is "now" deemed illegal. But you can't ban a DEX, right? Let's hope so. Lastly, note its price nearly doubled over the weekend, as trading volumes surpassed that of all other DEXs, so you can expect a retrace!

Chart art: "ring out the bells again".

Market musings: "like we did when spring began".

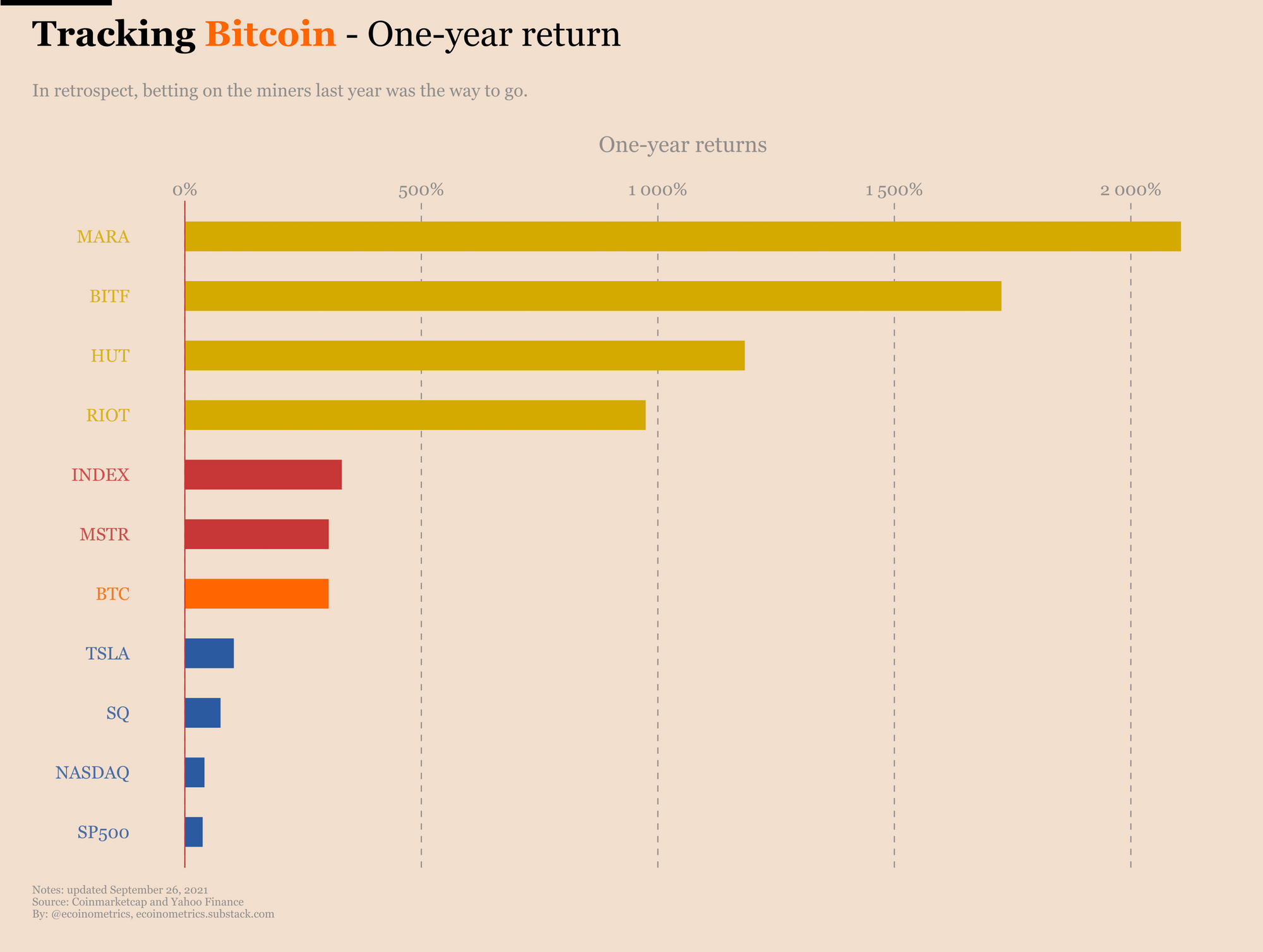

What else for the month ahead? Despite recently becoming the least sexy asset in the cryptoshere, it's clear there's still a huge demand for bitcoin - if not from retail investors, surely from institutional ones. Take a look at Ecoinometrics great chart below, showing how several publicly-listed Bitcoin mining companies in the US had outsized returns in comparison to the orange coin itself.

That's because many funds still haven't wrapped their head around the operational and legal implications of directly buying BTC. So they go for indirect exposure, at least until an ETF gets approved and more custody services make their way to this audience. What does this mean for prices across the board? That there's plenty of money on the sidelines to guarantee the pump. It just needs a trigger. And that's what we will be looking out for this October. Maybe a Bitcoin ETF is coming?

Visual block: "here comes the rain again".

Three things: last one is from Doomberg Little.

- Do you like good slide decks and new blockchains? Check out Block49 Capital's great take on Terra and its popular token, LUNA.

- Do you like combining work with crypto? Fine, but note that while DAOs "may be the future of work", it's unlikely they will be the "the next big asset class".

- Do you like combining inflation analysis with tips on which Rolex you shouldn't buy? It's all about "What Does Price Mean When There’s No Supply".

Tweet tip: octoberth is going to be good.

Meme moment: except for the CCP.

B21 Cards: get yours today.

Get started: download the B21 Crypto app!