Welcome to Uptober!

Cryptic ball: did you enjoy the fear?

Hi there! I'm Nitin Agarwal, founder of B21, and I've been editing this newsletter since we started it earlier this March. I'll be taking a more active voice from this quarter onwards to better engage with our exchange's community. Firstly, note that you can hit reply to any of our emails with your feedback and questions and I'll try to incorporate or address them in future issues. It's all about utility, right?

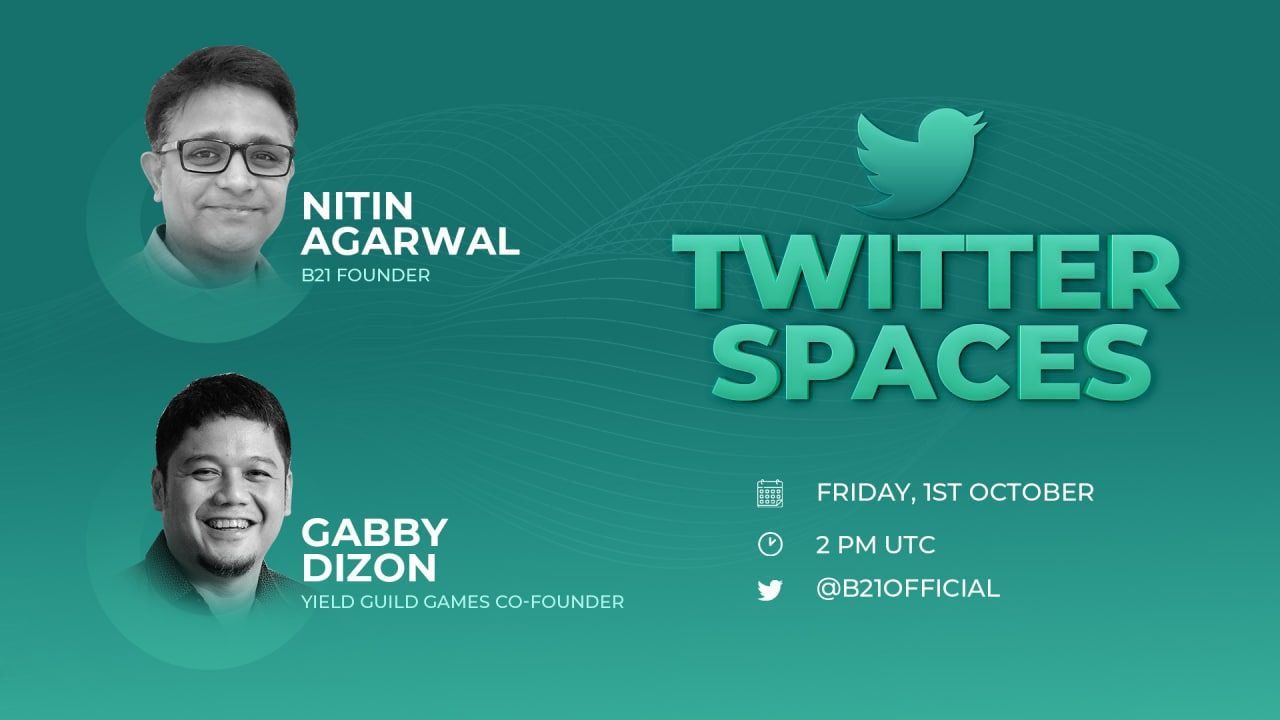

Remember also that I'll be in a Twitter Space at 2pm UTC, with Gabby Dizon, co-founder of YGG, to talk about NFTs and play-to-earn crypto!

Secondly, and against most expectations, the end of the quarter wasn't as volatile as it could be, at least not until the twelve strokes hit the UTC clock. Bitcoin is up 17% since Thursday's test of $40k, with most of the pump taking place over the past hours - as September and Q3 closed without much fuss. Naturally, the entire crypto market has been lifted and doesn't look like it wants to stop!

More interestingly, this happened against a bearish backdrop on global equities, led by another sell-off in US stocks yesterday, with the Dow index having its worse month in 2021. These stocks will likely bounce today, at least according to pre-market trading, which would contribute to a peaceful weekend in the cryptoverse. I wouldn't even be surprised if BTC even tests $50k/$51k (the white dotted line below) in the next few days, although profit-taking will happen at some point.

Thirdly, while many are looking at on-chain data to attempt sophisticated analysis that everyone else is missing, I believe that at times of uncertainty it's best to keep things simple (talking about simplicity, I've combined sections and we're back to a daily schedule on this newsletter). And, as John Lilic reminded me, bitcoin's hash rate growth is typically correlated with price growth. Well, this measure of computational power dedicated to mining is currently growing faster than during 2020/2021's run to new all-time highs!

Are miners also bullish on the hinted Bitcoin ETF? That's likely. Yesterday, Jerome Powell, chair of the US Fed, clarified that the US "had no intentions" to ban Bitcoin and crypto, as China did. And, today, the SEC postponed the deadlines for the approval of several Bitcoin ETFs for the end of this Q4. Could the mythical approval of such a potentially popular product mark the end of this bull cycle, just like BTC futures marked the 2017 top? We'll have to see, but the SEC seems committed to approving one soon. It's all about the rumours, right?

Chart art: did you buy at support?

Three things: focus on what's valuable.

- James McCall argues SEC's regulation "misses its goals".

- Kerman Kohli asks if you "creating value or making money"?

- Arthur Hayes believes the metaverse "is the next step of a global society willing to sacrifice personal liberty".

Tweet tip: are we're back to UpOnly?

Meme moment: will ether cement its leadership now?

Twitter Spaces: join our session, it's starting now!

Get started: download the B21 Crypto app!