BTF(D) is here

Cryptic ball: Bentonville is here.

Bitcoin has tested $60k right on the tick, falling nearly 6% of today's high, as anticipated yesterday. So far, it has bounced, but it doesn't look like it's doing so confidently - yet. SOL also continued its pump, appreciating 16% and then falling 5% right after testing its previous ATH. Naturally, the dump coincided perfectly with Jerome Powell's latest remarks: the US Fed's chair clarified - again - that he believes "it's time to taper". But he also said "it's not time to raise rates".

That's why I believe this looks like normal volatility that will fade soon, as big players are trying to spook the rest of the market. Alas, even the S&P 500 also dropped slightly on the news, which occurred right after the top equities index rose above its previous ATH for a couple of hours. In other words, what matters is that Powell is clear on his unwillingness to raise interest rates - and the market will recognise this next week, even if inflation concerns continue to rise.

As for the weekend, I'm expecting things to be calmer, as the ETFs only trade from Monday to Friday and funding rates have reset (even if Open Interest is approaching its ATH too). Just note that bitcoin could even test $58k on a quick wick, as long as it bounces rapidly. However, it's more likely that BTC recovers slowly and trades sideways, which will be the cue for speculators to further rotate into alts and watch their favourite projects march towards new highs. Meanwhile, note the latest news around Walmart: the giant retailer is "has quietly begun hosting Bitcoin ATMs" and it seems this time the rumour is real!

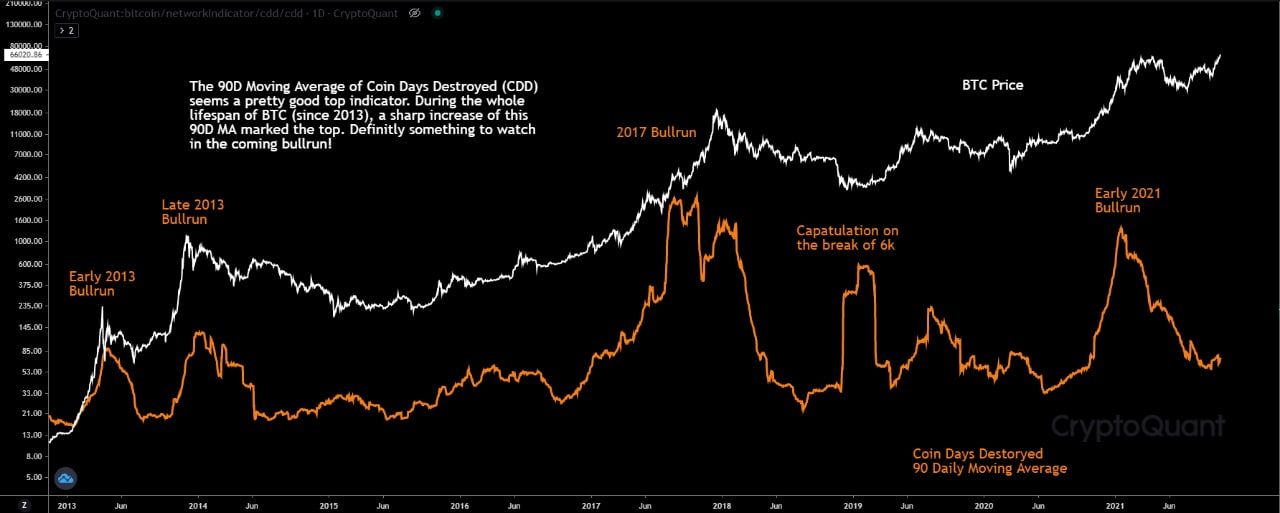

Chart art: the top is not here (yet).

Three things: regulators are here.

- David Morris argues DeFi should engage with regulators.

- Josh Olszewicz teaches how you can try to sell the next major top.

- Arcane Research covers the Lightning Network ecosystem.

Tweet tip: again, the top is not here (yet).

Meme moment: again, BTF(D) is here.

FV Bank: new strategic investment.

Get started: download the B21 Crypto app!