Not a bad start of the week

Cryptic ball: not reversal.

This was a fairly boring weekend for most projects, as Bitcoin's double test of $59k - something I told you might as well happen last Friday - dragged down the market a bit. Then, at midnight UTC, almost everything started bouncing and BTC rose up 7% this Monday. SOL was one of the few exceptions, having started to bounce with ETH this Sunday afternoon, UTC time. But whereas ETH appreciated only 5% in the last hours of the week, SOL jumped 10%. And more today!

Solana's native token has tested its all-time high for the second time this month and briefly overcome it! As I'm writing this newsletter, a small pullback is taking place across the board but I still feel the bias for this week is bullish. Remember it's the monthly close and Uptober is not over. But wait out for BTC to print a clear bottom on low-timeframes (say, 5 minutes) if you are looking for fresh entries. And note it must bounce above $61.8k to maintain its market structure.

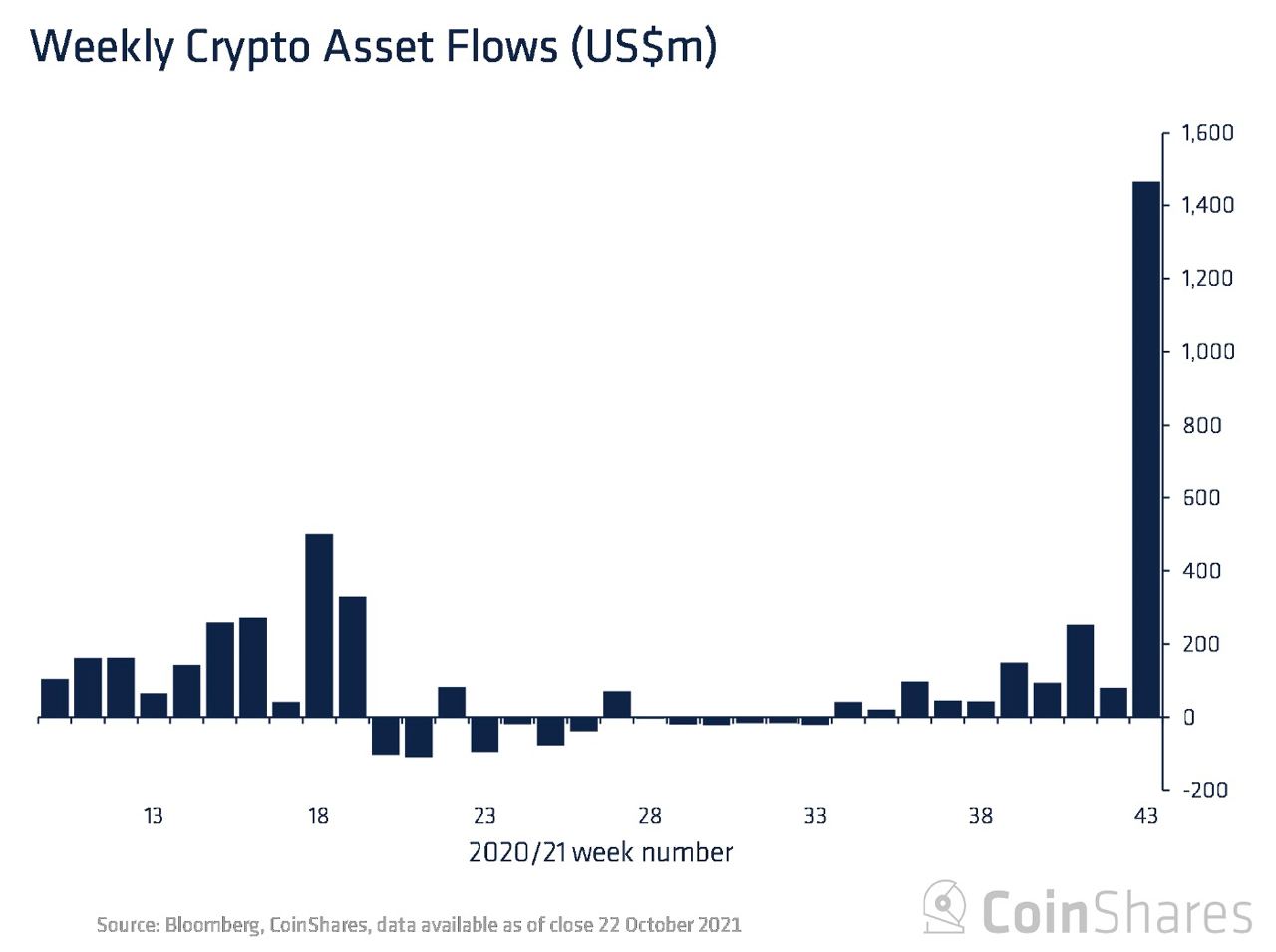

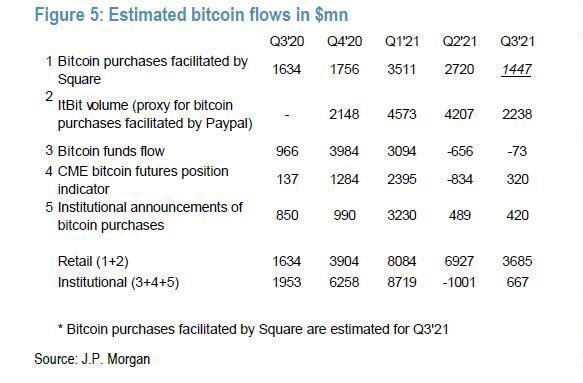

In other words, falling above that level means the orange coin has failed to print a higher low after the $67k top and could signal a change in trend. I'm assigning a very low probability to that, but some popular meme accounts are already joking about it, hopefully as a euphoria mitigation mechanism. While it is true that the two ETFs listed last week are akin to other historical "sell the news" moments in crypto, it's also clear from today's visual block that those record inflows weren't just caused by the ETFs and the other channels are still warming up!

Visual block: not the record.

Three things: not three things.

- Ari David Paul believes DeFi projects "have nearly peaked" relative to other crypto sectors. Learn why and where growth will come from.

- Glassnode argues traders longed the bitcoin all-time high, so the current flush is to punish them. Fortunately, open interest is healthier this time.

- QCP Capital believes we're in a supercycle and explains how one can try to fairly value cryptoassets. Another must-read.

- Chris Dixon asks what's next in Web3. Another good argument for why NFTs are not in a bubble (even though many projects will fail).

Tweet tip: not limit orders.

Meme moment: not a meme.

FV Bank: new strategic investment.

Get started: download the B21 Crypto app!