We're still far from Valhalla

Cryptic ball: just a healthy flush.

What a day. Since last March I've been urging caution regarding overheated funding rates, and that's what we should have been doing today - even if few were expecting a rinse so soon. Why? Because it is easy to liquidate the leveraged longs who got late in the game. And while funding rates weren't that high in typical exchanges, they were up to 6x higher on ByBit - an exchange that before May was very popular with Chinese users and that it still seems it's widely used in the Middle Kingdom. How can you ensure you're prepared next time?

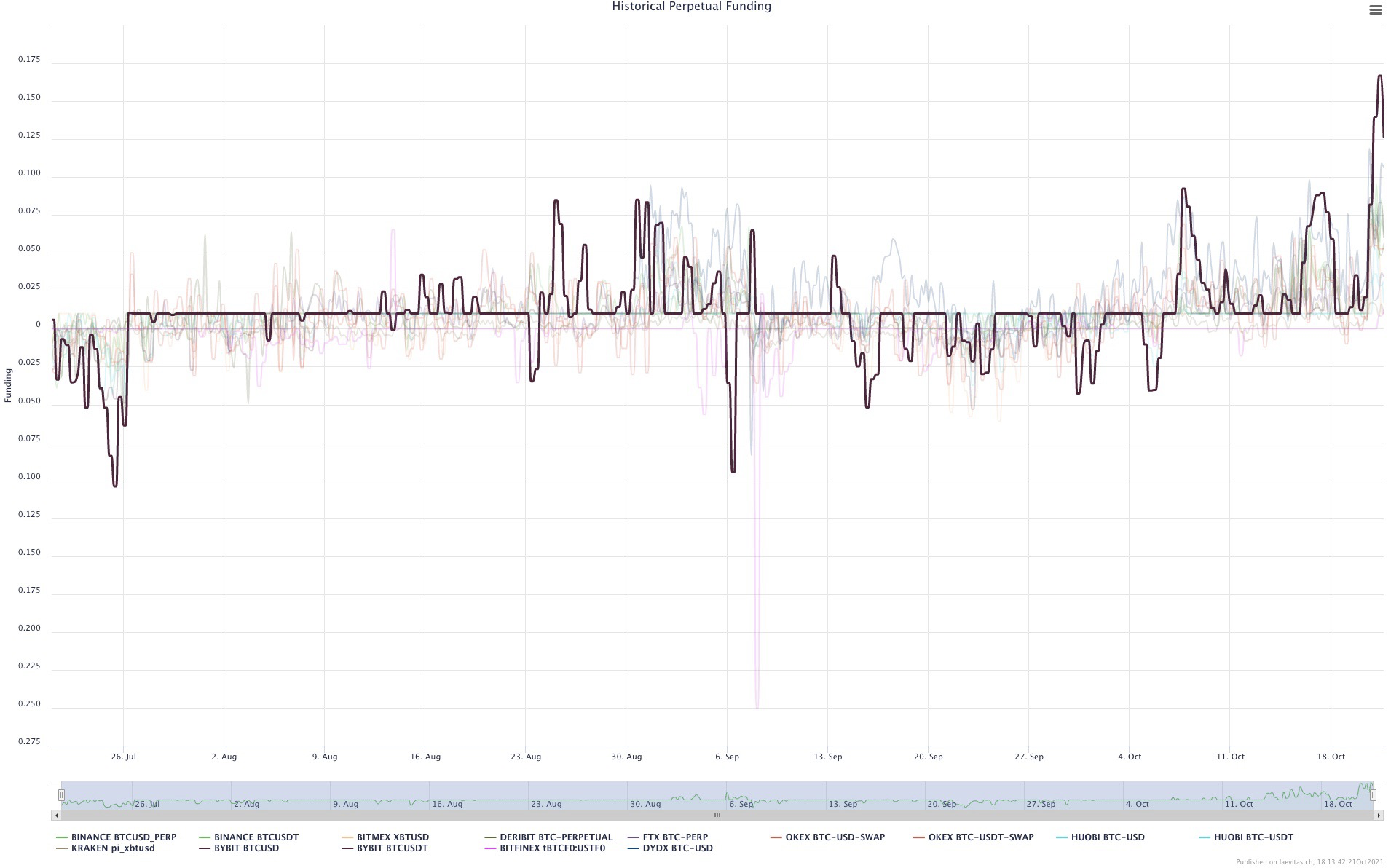

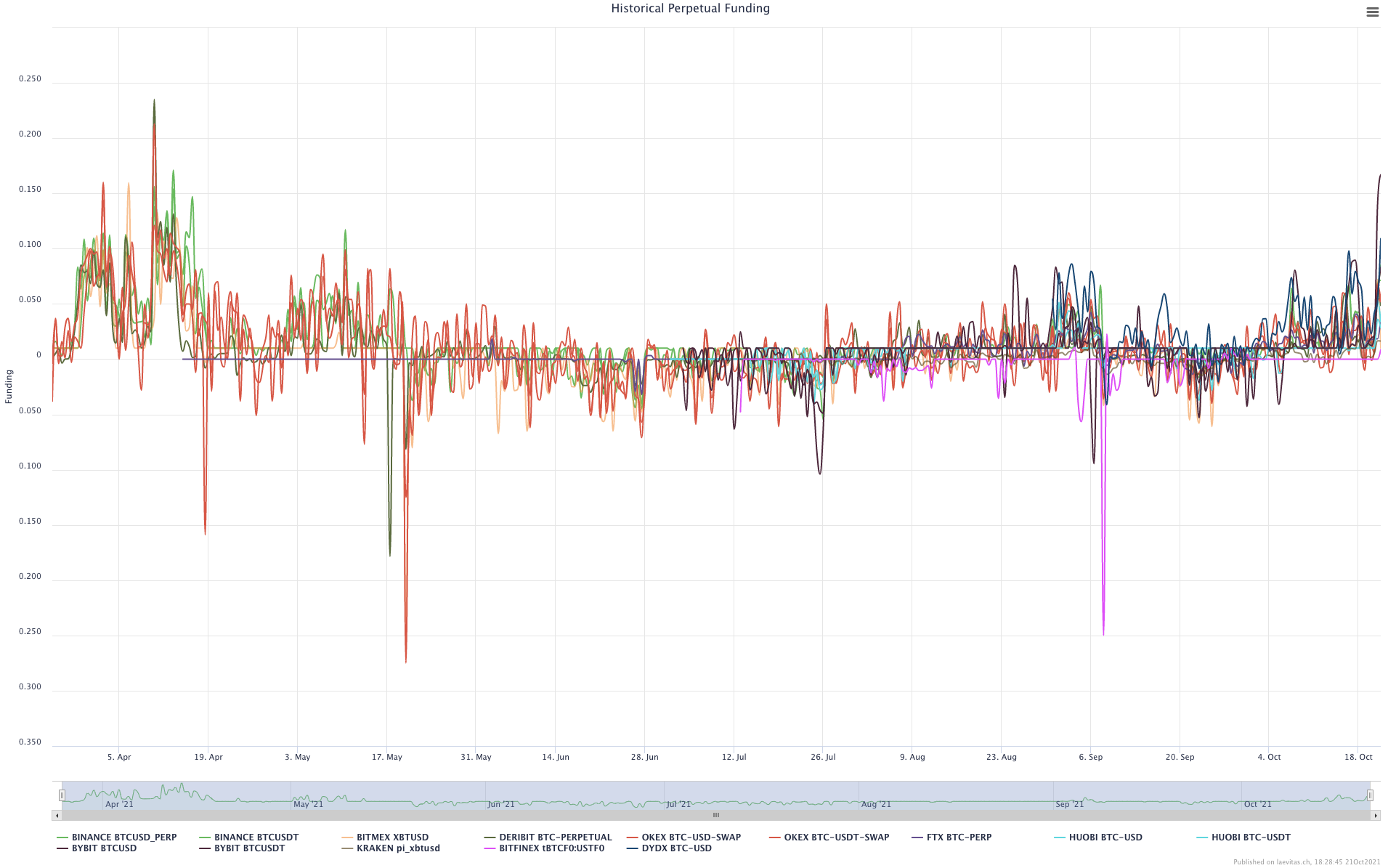

Check the chart art section! The first shows the past months of funding data, and today's overstep of Bybit. Below it, you find this year's history, with the likes of OKEX, Deribit, and Binance showing extreme values aligned with bitcoin's peaks and throughs. What's key is to understand that liquidations on one exchange quickly overflow to the rest as market makers arbitrage price differences away, further causing more liquidations. Fortunately, the fuel wasn't that much, and it seems bitcoin is consolidating above $62k. Slow-bleed ahead or not?

Well, if BTC confidently remains above $60k (which is likely given its historical performance after breaking an ATH), and with ether and many alts approaching their all-time highs today, I believe everything will continue to pump at their different rhythms. But the orange coin needs to hold that support. Conversely, if BTC bulls get excited with the debut of Valkiryes' ETF tomorrow (I've mistakenly written it was launched yesterday, but it was delayed, and, unfortunately, its ticker won't be BTFD after all) and VanEck's next week, then it's likely alts will pause their show for a little while as traders rotate their profits again. After all, did you see that SOL and other alts pumped +25% yesterday? Just wild.

Chart art: just funding rates.

Three things: just a digital croissant.

- Do you work for a DAO? Learn how you can get paid.

- Do you fear liquidations? Sam Trabucco argues they'll happen less.

- Do you think stablecoins are special? CroissantETH explains why.

Tweet tip: just a double bottom.

Meme moment: just profit-taking.

FV Bank: new strategic investment.

Get started: download the B21 Crypto app!