Der Pump des Nibelungen

Cryptic ball: good music, though.

Not much has changed since yesterday. Of course, not! We got the new all-time high that I promised here! We just needed a joke to lighten up the mood of the bears who got liquidated trying to short $65k. Some people even blew up $10 million positions on BitMEX's casino - let's just hope those were just a hedge, right? My feeling that this Uptober's ride wasn't going to hurt alts is also proving correct, with ether above $4k and all Ethereum killers bouncing hard.

What next, then? First, the two Bitcoin ETFs already trading have been an astounding success, proving there's plenty of demand for such an institutional trading asset (these futures-based ETFs are mostly used for arbitrage), which implies there's even more demand for a spot-based Bitcoin ETF to be approved down the road. Secondly, there'll be a third futures-based ETF next week.

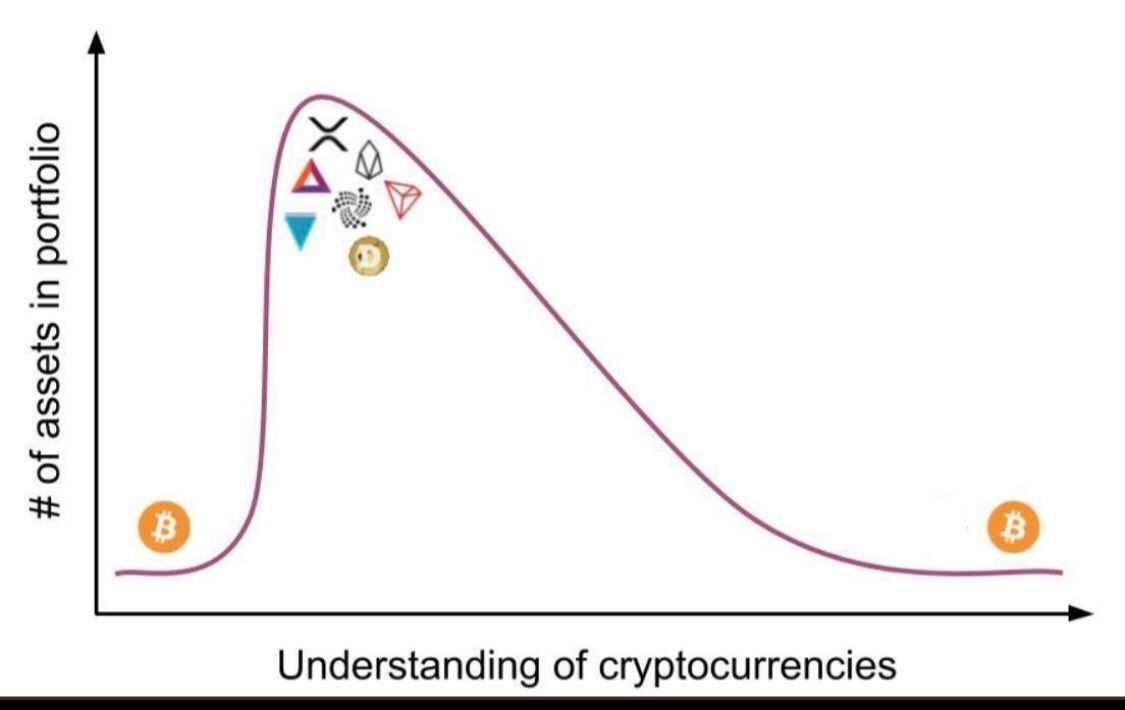

Thirdly, even the S&P 500 and other US equities indexes are almost back at all-time highs. Again, this is a slow, sustainable ascent that is benefiting all assets across the board. And bitcoin seems like it's slowing its parabolic advance, at least compared to past breakouts of such a significant ATH. This means alts will likely continue to pump, as BTC benefits from institutional demand and the rest of the market benefits from the greed of shitcoin traders. Enjoy Uptober!

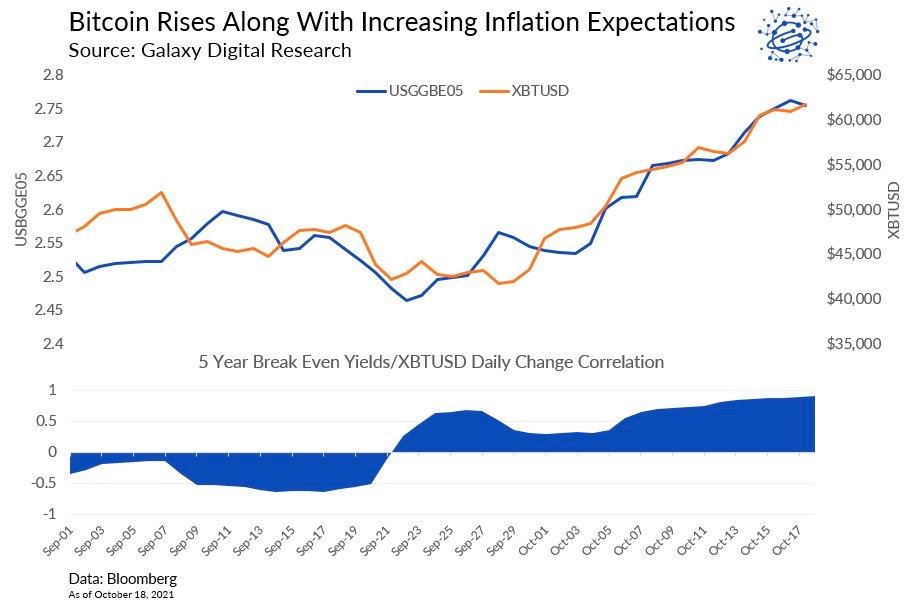

Chart art: good relationship, though.

Three things: good game, though.

- Are NFTs creating a generational divide in gaming platforms?

- Is Axie Infinity's digital economy deceptively simple?

- Is Total Value Locked a misleading proxy for financial analysis?

Tweet tip: good news, though.

Meme moment: good meme, though.

B21 Earn: stake with B21 and earn more.

Get started: download the B21 Crypto app!