Bitcat and mouse

Cryptic ball: btc up, alts down.

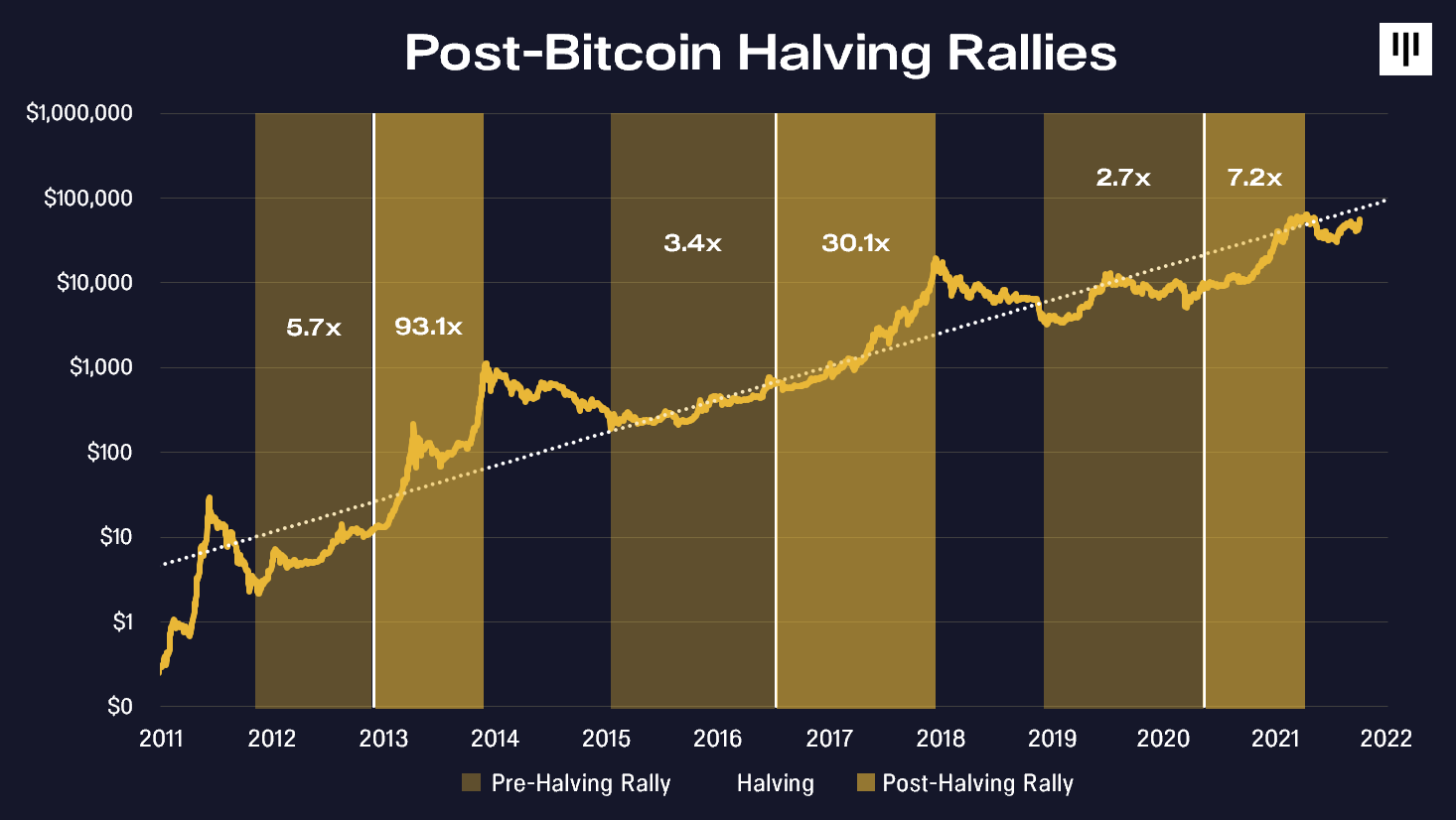

Another day, another bitcoin pump. What did I tell you about Q4 at the end of September, when many were crying for $30k again? That bulls were around the block! Now I must remind you about another important relationship first highlighted in this newsletter in April: alts tend to follow ether and ether crashes when bitcoin rises (in relative terms, ETHBTC is down ~4% today).

That relationship will be particularly evident once bitcoin crosses $65k, its previous ATH. Something which can happen the same day the $60k resistance is clearly broken. However, that will be a tough level to beat, because everyone knows that there's only thin air above it. So, even if things look strong right now, it may be the case a new ATH won't be seen right this week. Still, after that level is cleared we'll only see bitcoin stop (hopefully just for a pause) around $100k!

In other words, during those weeks - maybe a full month - where bitcoin is in price discovery mode, you should be careful about speculative alt plays. Even though some alts will continue to pump as bitcoin rises, overall the dominance of the original cryptoasset is always felt. And remember alts will all pump right after BTC starts consolidating after printing its first lower high - just like what happened last April 18th. And that will surely coincide with the ETF listing, just as 2017's top aligned with the CME futures launch and March's ATH with Coinbase's IPO.

Chart art: long cats, short mice.

Visual block: the king is waking up.

Three things: a game of Tom & Jerry.

- Today I've learned one of our readers bought AXS last July, when we first talked about Axie Infinity, at around $10-$15. It's now at $135. If you still don't know about it, check Blockchain@Columbia's great guide to the project.

- Today I've learned NFTs are the trojan horses of the new digital economy. If you still don't buy the hype, you must read Ben Yu's massive essay on this innovation. Check the chapters first, as the four parts take 1h to read!

- Today I've learned the "cryptocurrency industry is confronting an existential crisis" (joking, this is a constant threat). But this article excellently outlines what must be done to ensure regulation doesn't cripple us to death.

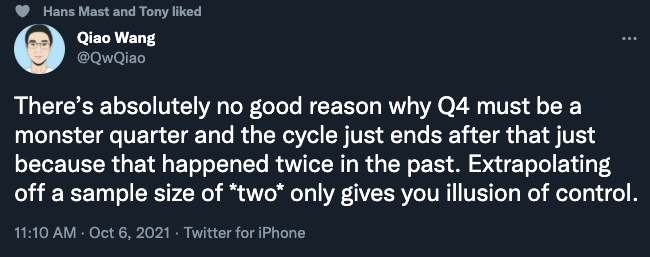

Tweet tip: crypto pumps for a living, not for a reason.

Meme moment: natural gas vs. bitcoin.

B21 TV: stay tuned (and long).

Get started: download the B21 Crypto app!