Thankful for this Black Friday?

Cryptic ball: buying chanel no. 5.

Well, well, what a dip! This Tuesday I warned you that the end of the month was primed to be volatile due to the Thanksgiving hangover, with some possible Black Friday discounts later this week. And that's what we got, compounded by fresh COVID fears that have struck global markets again. The sell-off has mostly impacted the travel sector, which has crashed 9% to 13% - the percentage drop closest to bitcoin's 10% daily tumble, the same value total market cap fell.

Oil also had its worst day of the year, as traders speculate global demand will crash again if the new South African variant proves to impact global demand as much as the others did. But it's good to see the S&P 500 and American equities "only" dropped 2%, with Moderna - a vaccine producer - appreciating 24% while Zoom and Pfizer jumped nearly 6%. In other words, this is textbook trading around an "unexpected event" (as if the world didn't know about COVID), which makes me think the bounce will be strong once governments and central banks come to announce new measures to face eventual new disruptions in the economy.

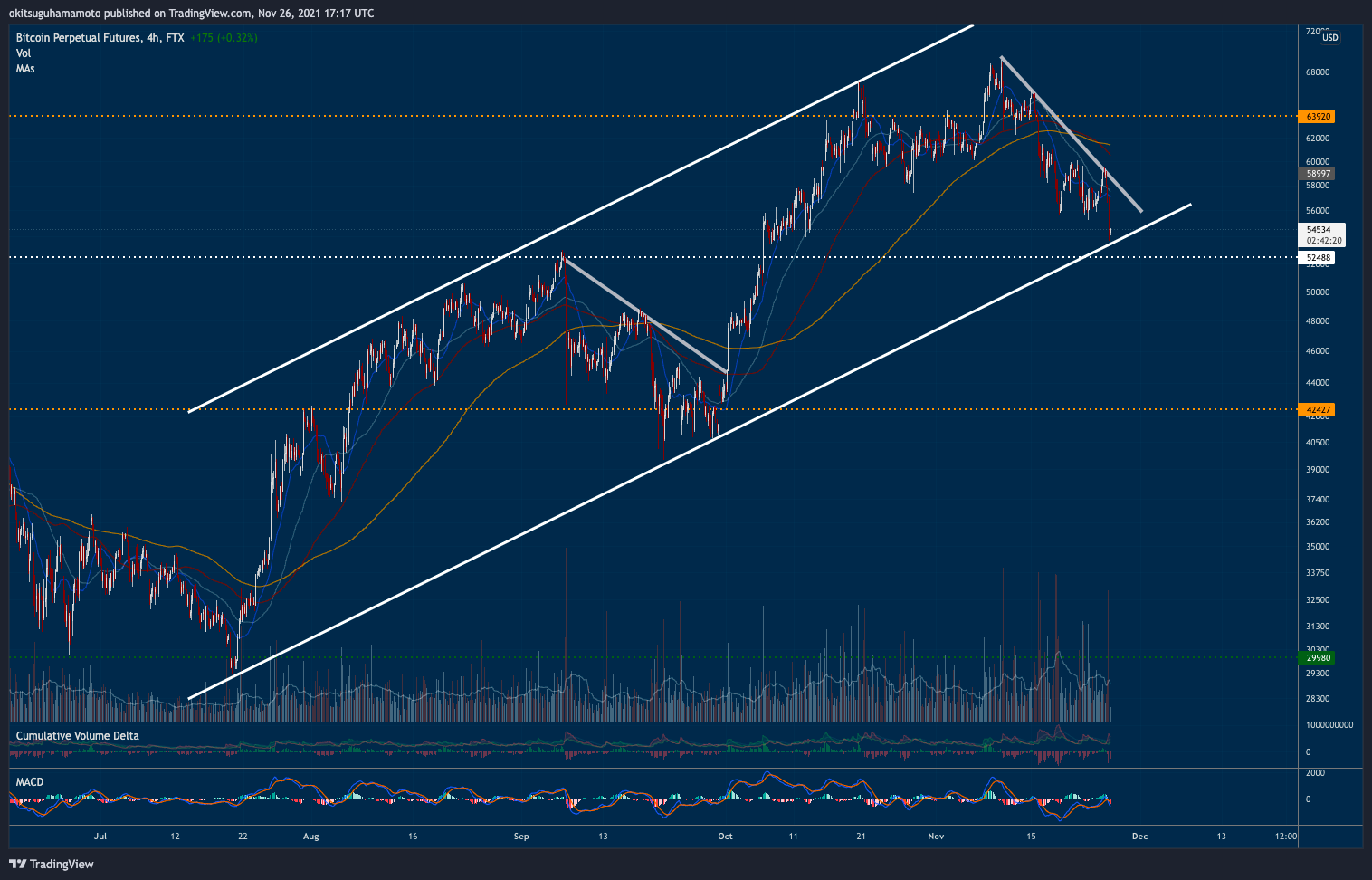

But crypto's dip was different. On the one hand, risky assets tend to crash when global market participants feel afraid. On the other, crypto sentiment was already in fear territory for the past week, as explained Monday. So, what to expect for the weekend and the last days of the month? Again, let's go back to Tuesday's chart to for indication - in particular the trend I'd highlighted that bitcoin has been forming since it found support at $30k last July. As you can see below, and remember this parallel channel was already drawn back then, bitcoin fell right to its bottom.

So far, the orange coin is bouncing, allowing the rest of the market to breathe. Now, this will be just a small relief rally - or a dead cat bounce - if we fail to break out of the smaller downtrend we're in. Note that in September bitcoin also dipped 25% from that month's top, and on the 1st of October bitcoin pumped hard, wrecking the shorts who wanted the dip to continue to $30k. Now, we're down 22% since the $69k all-time high and many are clamouring for $40k. If we get another pump that confidently conquers $60k, and then $64k - as explained yesterday - then the trend will have impact and December will be wild.

To conclude, as long as the important $52k support holds (the white, dotted line below), nothing changes in the view I've been outlining over the past weeks. If that fails, we'll fall to the lower end of the horizontal channel that dictated most of 2021's price action - and that may imply a wider crash, perhaps as significant as the one experienced last May, although I'm still assigning a lower probability to it. As always, enjoy the weekend, set up a plan, place your bids and remember bears will only stop after capitulation - so there's likely more pain until Monday!

Chart art: buying a hopium car.

Three things: zoom out.

- Benjamin, from Jarvis Labs, explains why they believe the bull market is not over. Note his charts are not in logarithmic scale, but we're aligned.

- Jason Choi, from The Spartan Group, explains "what the next crypto bear market might look like". The top may be the same, but the bottom won't.

- Fabian Schär, from the University of Basel, explains "why do people buy virtual land". It's not all about the metaverse!

Tweet tip: study history.

Meme moment: keep buidling.

B21 App: stay safe.

Get started: download the B21 Crypto app!