BATman Begins

Cryptic ball: basic attention text.

Happy Thanksgiving to our readers in North America! It seems the holiday is treating the crypto market quite well. Both bitcoin and the total market cap are up 7% since Tuesday's local bottom, while ether bounced 12%. Was this the ultimate bear trap, i.e. a change in market conditions that lead many to believe we're going down when the macro trend is intact? I believe so. Overall, November 18th and 23rd's dips are forming a nice double bottom that should entice bulls to wake up.

This is also aligned with the accumulation / consolidation I've described this Tuesday and I'll feel more confident about this once BTC, ETH, and SOL conquer successfully conquer $64k, $4.6k, and $235 - ideally with enough strength to reach new all-time highs. Until then, we remain in sideways territory, although hopefully with less fear so that more alternative cryptoassets can pump left and right. And if we're talking about alts, it's important to note SAND is still running, even though it looks like it's about to retrace to its mean, after a new all-time high this morning.

Note I wouldn't advise anyone to jump at an asset which appreciated 16x in the past two months, especially without doing their own research and understanding that while the metaverse trend may remain alive for years to come, it may also be the case your metaverse plays will fall 50% to 80% in price before the next rocket to the moon lifts off. Still, it's important to remind today's tweet tip: in crypto, strong trends tend to continue even if an asset has raised substantially.

What matters - because other traders will be looking at this - is that its market cap is reasonable compared to equivalent benchmarks within the same sector or investment thesis. In the case of The Sandbox, SAND is now the cryptoshere's 39th most valuable token, with a total market cap of $6.2 billion (or $20 billion in fully diluted terms, but that's for another newsletter). Only Decentraland MANA's and Axie Infinity's AXS lie above, ranking 23rd and 25th, with market caps of $9.1 and $8.7 billion. In other words, SAND can likely only rise 1.5x more (or 50%) until it becomes the king of the metaverse castle. Then, it's all about bitcoin and ether rising valuations across the board for that asset to continue rising.

In other words, if you're buying into SAND thinking it can do another 16x in the next two months just forget it. That would place the alt at a higher valuation than SOL or Cardano's ADA. And that's almost impossible, as Layer-1 tokens are capturing the highest valuations right now. While any token can eventually do 16x in the next years, especially in the next bull market, remember to do these calculations before jumping into the latest pump. Or at least to review your expectations. Play the long-term game and try to find the next trend (maybe web3 bridges, like Braves' Basic Attention token, or this new DeFiLand game?).

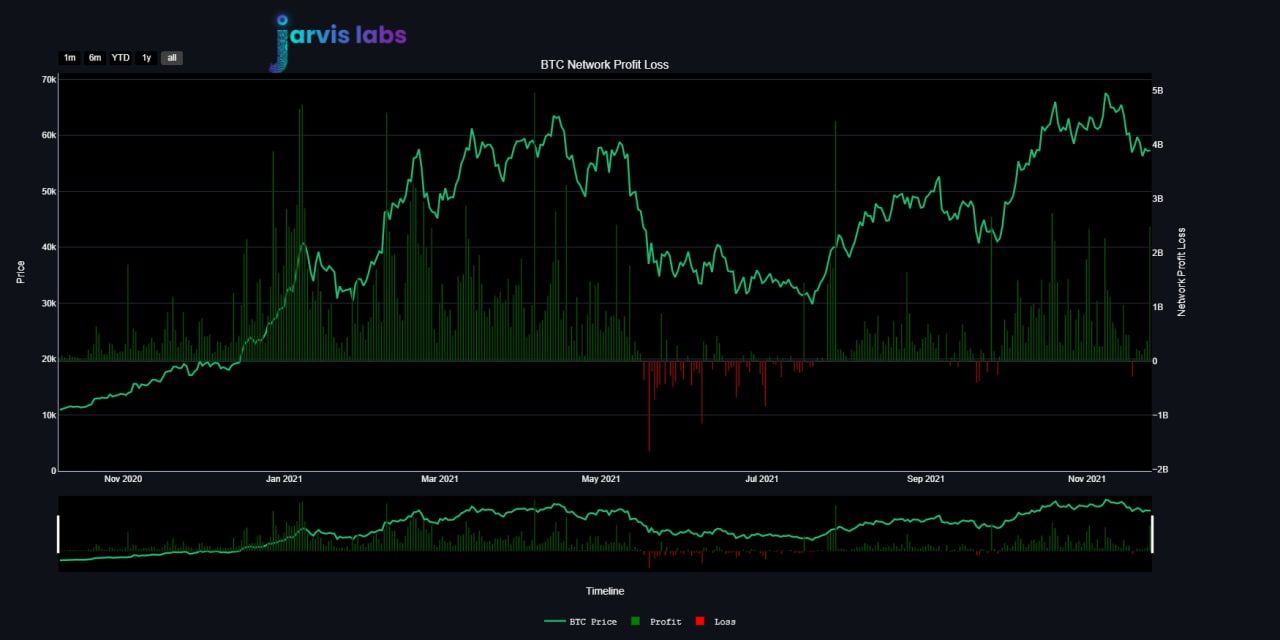

Chart art: complex fear visualisation.

Three things: these are must-reads.

- Looking for a list of great crypto data and analytics tools?

- Looking for a guide on "how to invest in an overvalued market"?

- Looking for "arguments to fluff your way through thanksgiving"?

Tweet tip: turtles follow trends.

Meme moment: not a meme.

B21 App: 2FA now available.

Get started: download the B21 Crypto app!