Inflated expectations

Cryptic ball: super cycle or not, here I come.

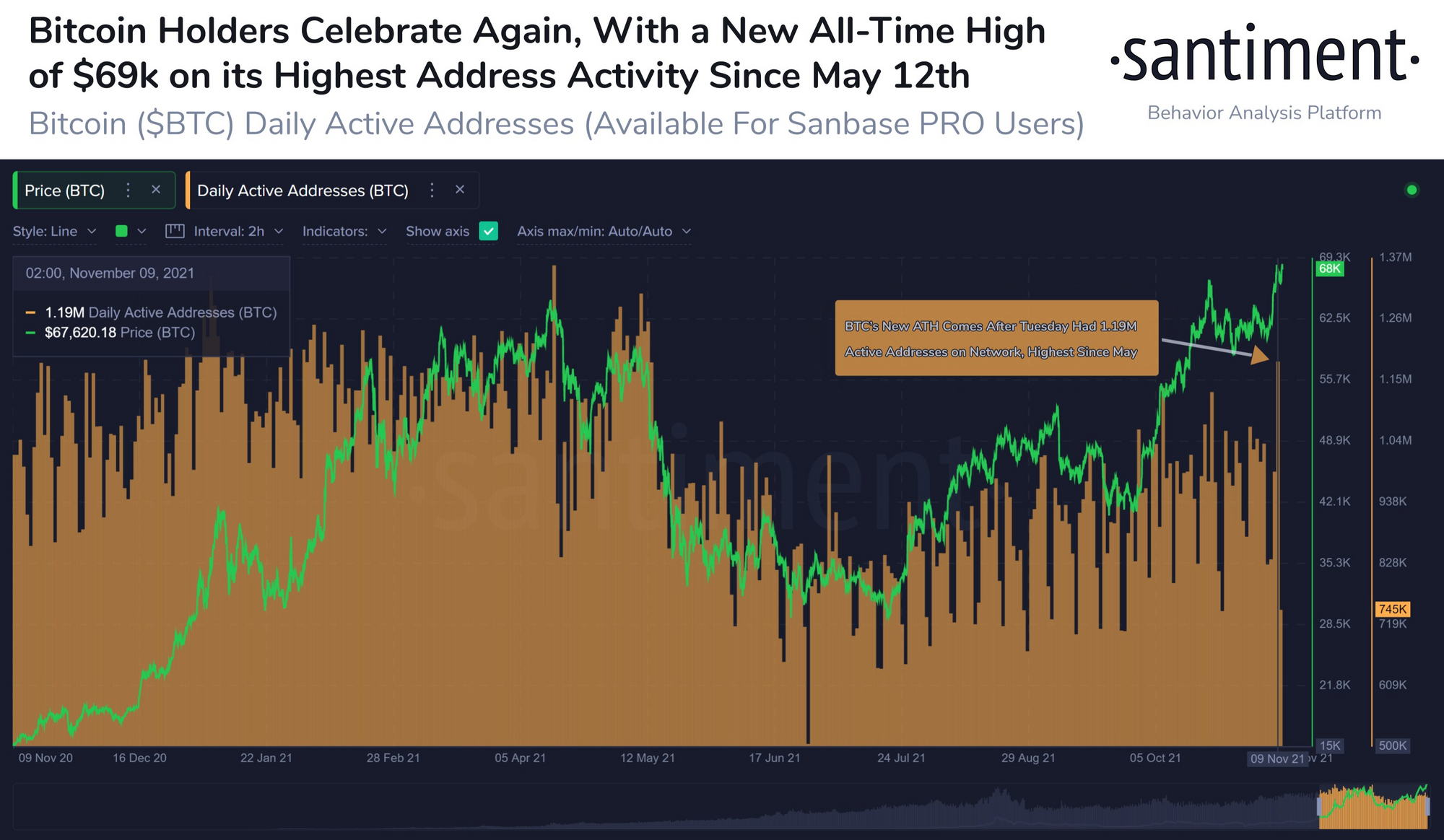

Another day, another all-time high - that's what Moonvember is all about! Following yesterday's news from Tim Cook, and on top of today's aggressive inflation reports, dubbed "the biggest surge in 30 years", it's no surprise to see the total market cap, according to CMC, is now about to break $3 trillion. Bitcoin itself finally touched $69k and looks poised to test $70k's symbolic resistance level. Ether also hit a new ATH today, but failed to get close to $5k so far.

Overall, as explained Monday, I feel Taproot's activation this weekend has the potential to be an iconic moment in this bull run, with two very different outcomes: a) it ignites the final parabolic phase typically seen in the late stages of crypto cycles, or b) it halts the bullish momentum, potentially enabling a supercycle instead of the classic four-year periods that have dominated this market so far (note we just had two so far: Nov. 2013 - Dec. 2017 and Dec 2017 until now).

How would b) look like? Let's say Taproot is not that much of a success, or it is a sell the news event that - aligned with the traditional Thanksgiving and Christmas selling activity - produces a smaller bearish phase, like the one seen from late May to August. That could curiously allow this crypto cycle to end later than expected, i.e. maybe mid-2022 or even after. As I don't have a crystal ball and can't predict the future, these scenarios will help us navigate any volatility over the next weeks.

For now, I believe scenario a) is more likely and I'll continue reviewing this regularly, eventually even adding a third alternative. Meanwhile, remember that some alts may start dipping a bit now. Solana's Breakpoint conference has just come to an end and SOL is nearly 6% down since Saturday's all-time high. More worryingly, the record inflation is spooking stock market investors, who may start to feel even more fearful if rumours that Evergrand is officially bankrupt are true. So far, it seems the real estate giant has paid the overdue interest, but let's see.

Chart art: celebrating or selling?

Three things: yes, my friend, wagmi.

- CryptoCacus tells the story of how he turned $2k into $2 million in 16 months. It's all about buying low and selling high; easy, right?

- A bitcoin whale who bought 2,200 BTC in 2013 has just moved them for the first time ever. David Puell analyses whether this is a top sign or not.

- Sotonye, a popular blogger, interviewed Chris Dixon, "the king of Web3". Learn why this VC is betting the future of the internet is (more) decentralised.

Tweet tip: just never forget.

Meme moment: and don't forget May.

B21 TV: about Nyan Cat.

Get started: download the B21 Crypto app!