Six days for the real three

Cryptic ball: just wait for ETH.

What a weekend! Total crypto market cap rose +6% and looks poised to break $3 trillion this week (according to CMC, as CoinGecko's calculations already put the market above this milestone). Bitcoin finally woke up and pumped 11% to $66k and is also menacing conquering a new all-time high over the next days - and hopefully enter price discovery mode this time. All this despite a bad update in the US political scene, as the House of Representatives approved the infamous Infrastructure Bill with a crypto provision that not only "paves the way for extra crypto taxes", but also "would effectively kill DeFi and NFTs if it comes into effect".

What does that mean? That the market is not yet near the top. When things get overheated, any piece of credible FUD creates havoc. To be fair, this US crypto provision is being discussed for a while, but Congress finally passing it is a major step that would have spooked the least anxious of the bulls if things were getting out of control. What next? Remember Bitcoin's Taproot upgrade will happen this weekend, so I'm expecting increasing volatility around that time - which varies according to the time Bitcoin's blocks are actually produced by miners.

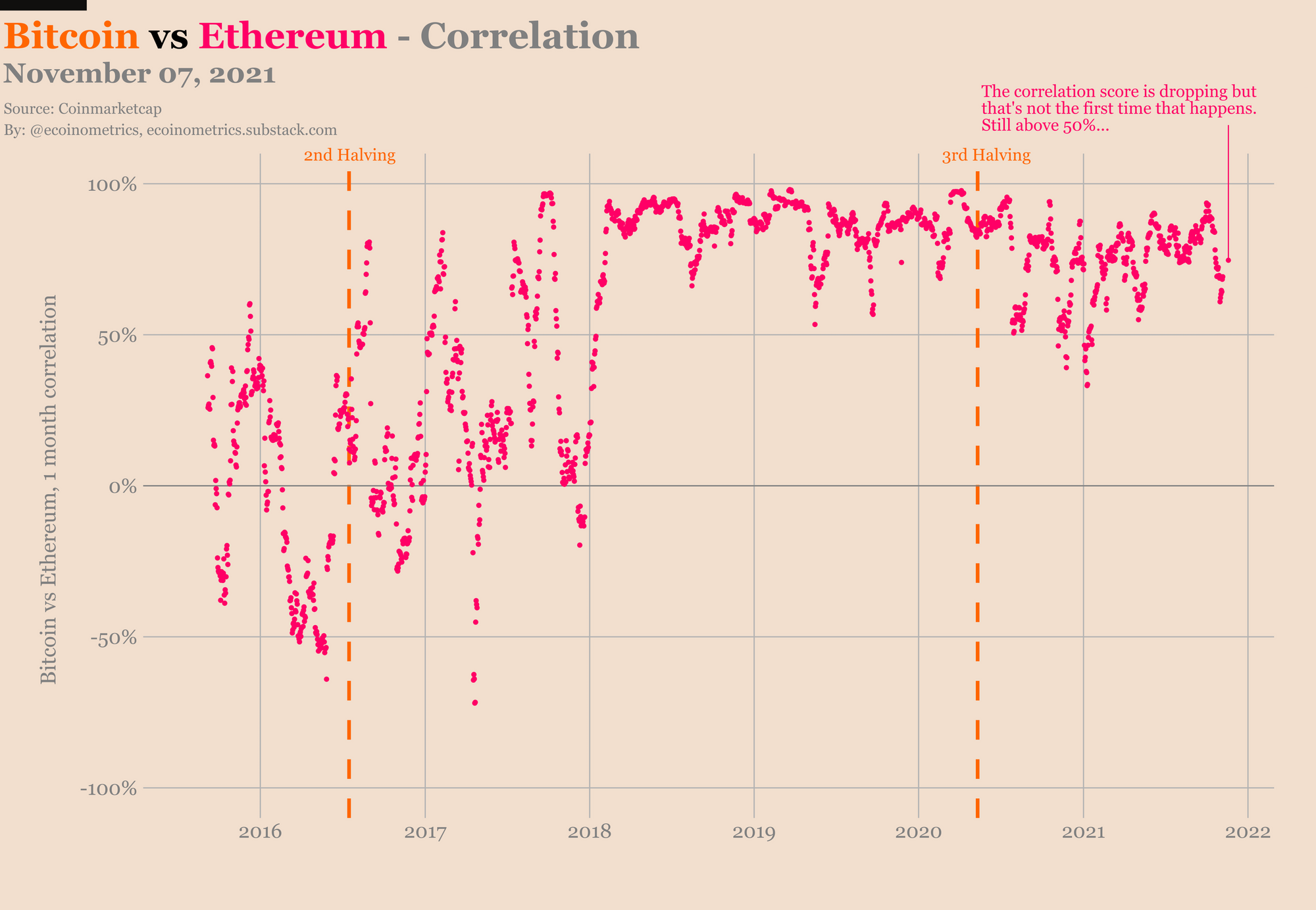

Finally, US equities continue to rally towards new all-time highs, perhaps inspired by Ethereum's ether - which is nearly hitting the mythical $5k level. What's interesting regarding the second most valuable cryptoasset is that it continues to be very coupled to BTC, a relatively new relationship in its not-so-short history. My view is that both assets have matured to a point where we won't see the kind of totally independent pumps among the two like we used to. In other words, every crypto investor should measure their performance against these two projects, which implies one needs to look for other projects if they want to outperform!

Chart art: but don't wait too much.

Three things: researching atom.

- Cosmos is one of the projects with the most interesting developer communities. They are now developing a DEX that prevents front running.

- Galaxy Digital just released "Ready Layer One", a report on Ethereum and other smart contract platforms competing with the original house of dApps.

- Punk 6529 argues "the European Union could be the natural home of crypto, but it won't". Learn why in this great thread.

Tweet tip: what about Web 5.0.

Meme moment: it doesn't even need to be fresh.

B21 Card: new countries.

Get started: download the B21 Crypto app!