Happy Bitcoin Pizza Day recovery

Cryptic ball: here's to a long life.

The weekend was smooth (read dead) for bitcoin and stocks alike. More importantly, today the major EU and US equity indexes are continuing Friday's close bounce. So, as explained Saturday, we can expect that relief rally to play out.

- Firstly, TradFi traders are busy this week following what happens in Davos. Because the World Economic Forum is boring af, we can expect a peaceful week ahead, which shall create the conditions for a decent bounce.

- Then, as the great Lily Francus points out, "probably one of the more bullish scenarios for crypto this year is to stay in this range for a few weeks". Why? Because it consolidates the important $30k support level.

- Moreover, Alex Krüger also believes we're seeing a local bottom in stocks which should be followed by a relief rally, including by cryptoassets. After all, "equities just had their longest losing streak since April 1932"!

- Lastly, while previously I was of the opinion that the June 15th FOMC meeting would spook the markets, I'm now believing the stock market panic is coming to at least a temporary end. Why? Check Ann Bayne's thread shared below!

In brief, it's time for a short squeeze, even if it won't be long-lived!

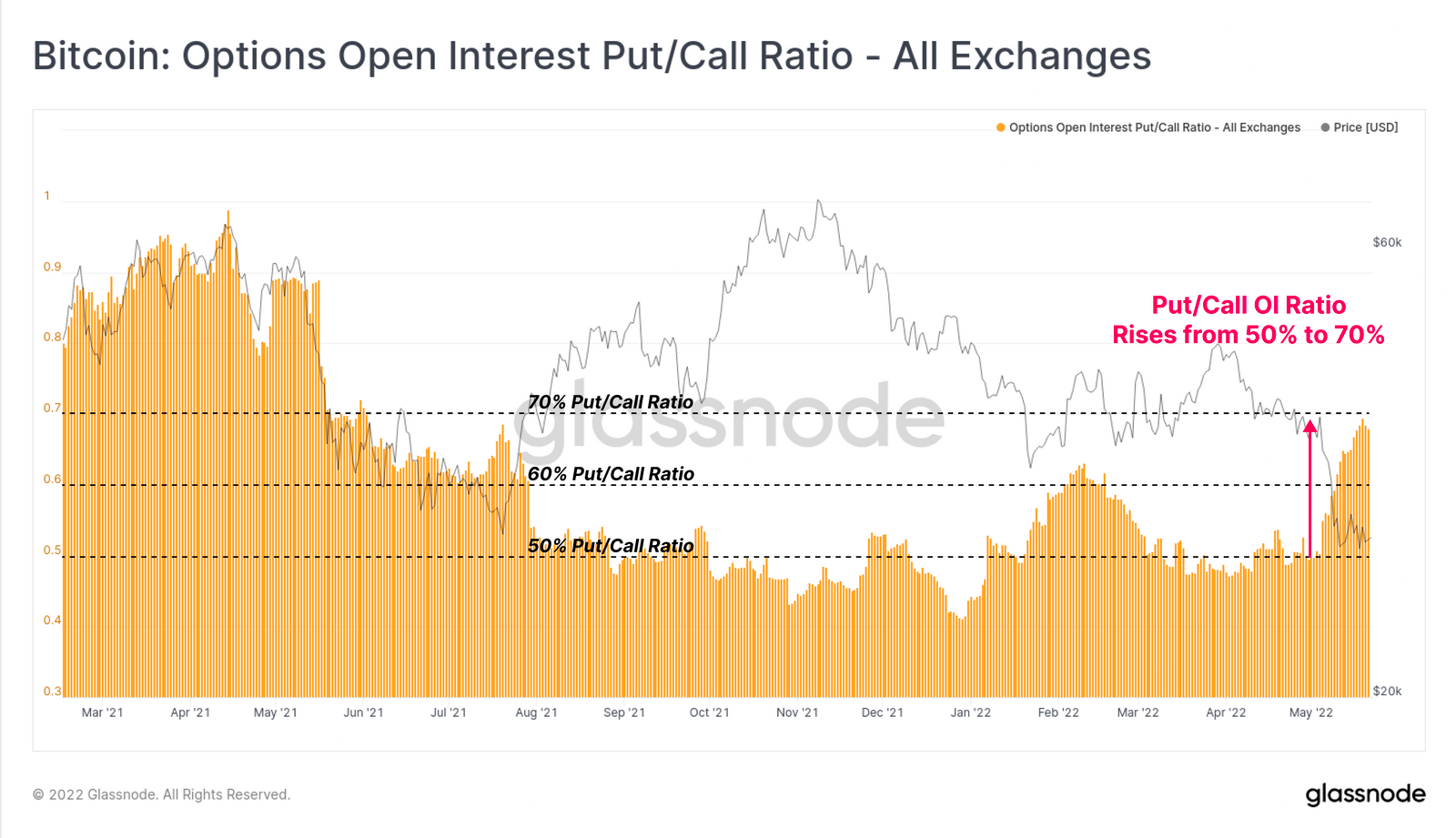

Chart art: here's to hedges.

Three things: here's to extra cheese.

- Alex Krüger explains why we're about to see a relief rally.

- Ann Bayne explains why money managers are done selling stocks.

- Read Laszlo Hanyecz's original pizza exchange on BitcoinTalk!

Tweet tip: here's to reasonable fear.

Meme moment: here's to the future.

FV Bank: new user interface.

Get started: download the B21 Crypto app!