The Great Inflationary Crisis

Cryptic ball: bring back the brrrr.

The weekend is here and, as anticipated Thursday, US stocks kept falling and found a new yearly low this Friday, with the S&P 500 briefly entering official bear market territory - which is when an index falls 20% below its all-time high.

- However, mainstream media seem to forget the Nasdaq is already +30% below that level, having first entered bearish territory in February, then in March again and again in April - making it clear this was a dead cat bounce.

- That's why it's a bit pointless when people are rejoicing because stonks managed to bounce slightly off the lows before Friday's close. Still, we can't forget the S&P 500 is facing its "longest-losing streak since the dot-com crash".

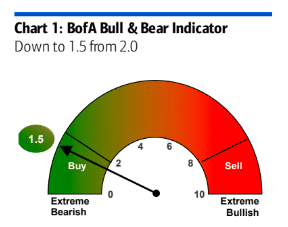

- As explained yesterday, and provided that bitcoin doesn't stop hovering around $30k, I'm expecting the world to experience some relief in the week ahead as buyers get ready to buy this oversold dip. Keep monitoring BTC for clues!

Lastly, remember that even amid this extreme fear I'm still expecting June to provide some additional negative emotions to traders around the world. I hope I'm wrong but one thing is clear: there's no rush to buy as of yet.

Chart art: bring back buying the fear.

Three things: bring back the gaming days.

- Matthew Kaye argues the bottom will coincide with peak inflation.

- The DeFi Edge aggregated great advice for "the newbies experiencing their first Crypto bear cycle". What a thread.

- Jason Levin explains Vitalik Buterin's plan for "soulbound tokens". A must!

Tweet tip: bring back the friendly Fed.

Meme moment: bring back the Elmo gif.

Yug Network: education is key.

Get started: download the B21 Crypto app!