About to snap

Cryptic ball: let's chat a bit.

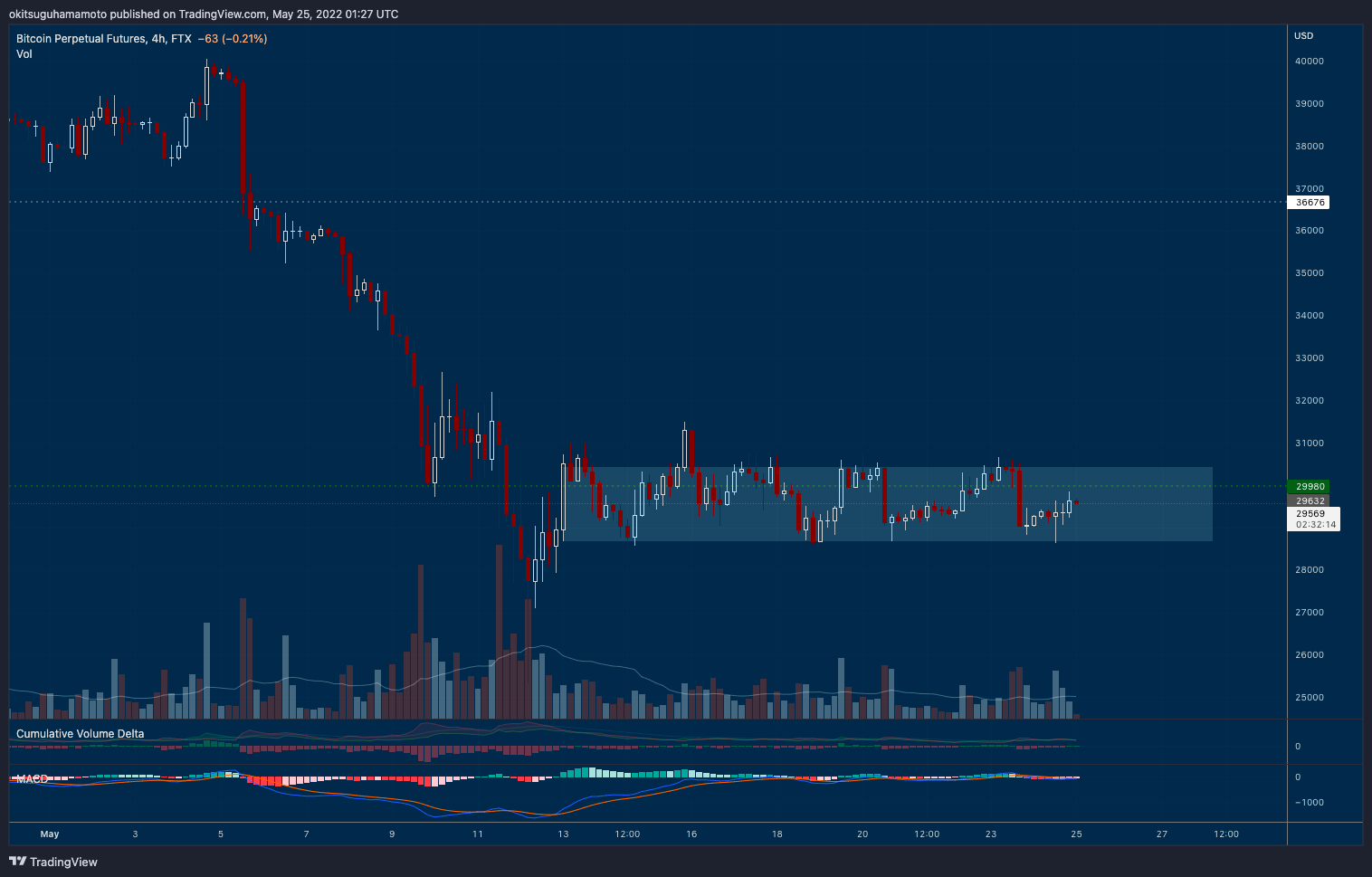

Bitcoin continues to hover around $30k, despite falling to the bottom of the tight range it has been trading for the past ten days, i.e. between $28.5k and $30.5k. Meantime, some stocks are crashing hard. Should we be worried?

- Initially, the equities carnage was confined to companies with poor earnings reports, such as Snap or Abercrombie & Fitch. The first fell 43% today and the former nearly 30%, eventually dragging down the wider stock market.

- Still, we haven't revisited Friday's yearly lows (yet) and the relief rally is still possible - even if that prospect looks quite bleak, especially after Michael Burry (the Big Short guy) tweeted today about some kind of impending doom.

- Overall, tech stocks are still overvalued and continue to display historically high P/E ratios. That's why they are displaying the volatility associated with shitcoins in the 2013 bull run! Let's just hope ARK doesn't go bust for now.

- Back to crypto, it's clear the whole market is waiting for bitcoin and the original cryptoasset is waiting for the S&P 500. Keep a close eye on the range highlighted in today's chart and be patient: an opportunity will present itself!

Chart art: let's range a bit.

Three things: let's survive a bit.

- Fuse Pass made a playbook for landing a non-dev web3 job.

- Zach Davidson breaks down the key ideas from Vitalik's latest essay.

- The DeFi Edge curated the top 20 tips to survive a crypto bear market.

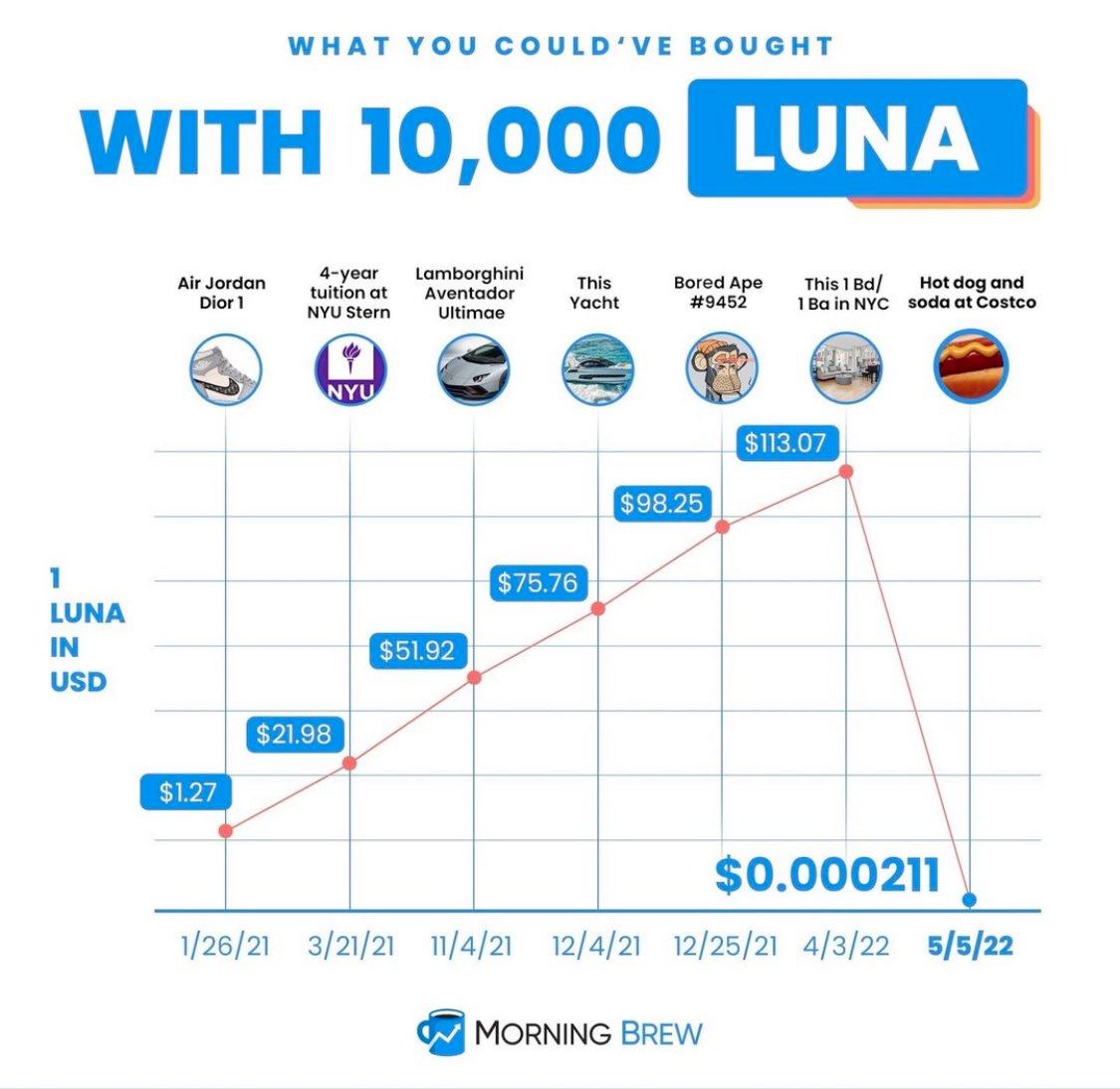

Tweet tip: let's laugh a bit.

Meme moment: let's moon a bit.

FV Bank: let's talk a bit.

Get started: download the B21 Crypto app!