Everybody was Kung FUD fighting

Cryptic ball: for the battle of the fists.

The statistical concept of regression to the mean is one of hallmarks of finance. It posits that extreme moves tend to gradually correct to average levels, whatever that means, as averages keeps changing and this can be applied on many different timeframes. Still, it can be used for long-term value investing as well as short-term scalps. But it's often wrong, as when an asset is experiencing strong momentum (think about bitcoin over the past months!), when there has been a major change in the fundamentals (think about bitcoin post July 2017 civil war), or when the underlying lacks stability (think about the bubble popping in January 2018).

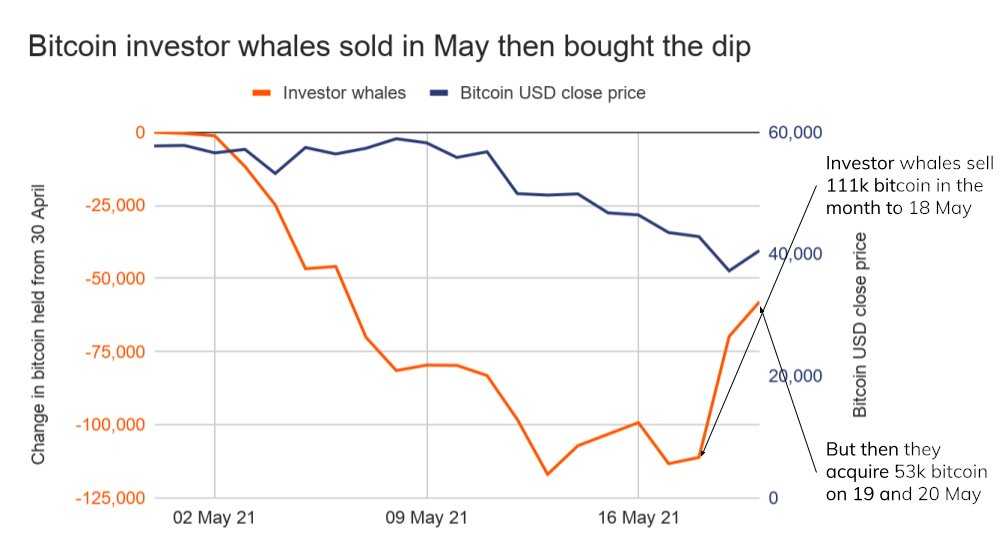

Nevertheless, it's an useful concept to grasp. Especially now that bitcoin is falling towards $35k in what will be the first test of the support level it found there earlier this crash) after spending the past 24 hours oscillating around $40k. All this to reinforce the scenarios we've outlined yesterday: if bitcoin remains above $35k, we can expect a regression to the ~$50k meme. Conversely, if we fail to hold $35k, it's likely the existing support at $30k weakens and it's time to zoom out even further to find that the 100-week moving average is lying at $23k. So keep an eye out!

Chart art: comes the battle of the mind.

Market musings: we know it's a little bit frightening.

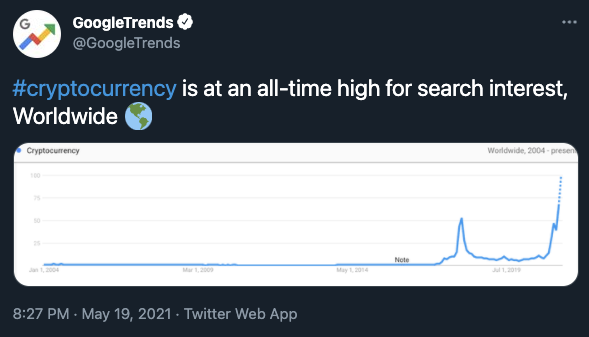

Meanwhile, there's even fresher China FUD around.. In Hong Kong, legislators are debating whether or not exchanges can only offer crypto trading services to professional investors. And China's vice premier is calling for a country-wide crackdown on miners. While such sentiment is frequent, now it's different given the high-ranking official who emphasised it. However, it seems what they want is to ban coal-based mining to incentivise those players currently operating on renewables. This is very bullish given the recent Musk-induced debacle that has been improperly covered by media outlets we used to trust.

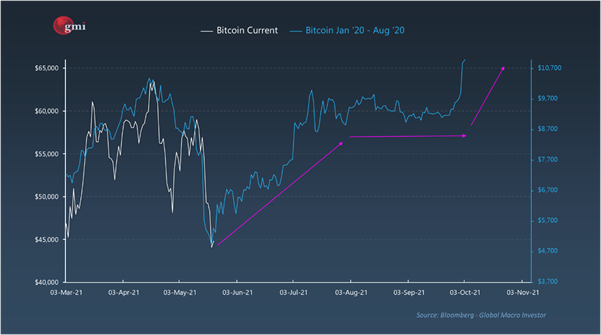

And it means bears don't have much firepower left. Could they still win? It's possible, but only if they are able to sustain an ongoing barrage of FUD for some months, which will be difficult unless new information hits the market. Otherwise, contemporary mean reversion points up, given that Bitcoin and Ethereum's fundamentals are only getting stronger. This makes us think we're experiencing a sort of crash akin to the one felt in March 2020 due to COVID. If that's the case, a similar recovery would put us back at $60k by July, in line with a 2013-like rally!

Visual block: oh, but it's so enlightening.

Three things: you can walk or you can row.

- Are you trying to avoid the next crypto crash? Check CryptoQuant's advice on three on-chain indicators you can follow to stay ahead of the whales.

- Are you trying to successfully manage multi-asset portfolio? CoinShares just updated its piece about bitcoin's diversification and performance benefits.

- Are you trying to know more about us? Nitin Agarwal, B21's founder, will be a guest in Celsius Network AMA as we type! Join or check the recording here.

Tweet tip: hunger for justice.

Meme moment: let's make it grow.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!