We're going double down on the strong weakend ahead

Cryptic ball: some of you may still be confused.

How you're doing today? Still perplexed at at the fact bitcoin has tested $42k again today after hitting $30k yesterday? Which is curiously a 42% increase in price in a day? And ether bounced in a similar fashion, while the total market on average recovered up to 55% since yesterday's bottom? If so, then crypto will make you a jedi of financial markets. You're likely young, so trust me you'll soon be at a great place to achieve financial freedom in your 40s or 50s. Again, welcome to crypto if you're new - we're sure you'll enjoy the ride! If you're not new, hit reply to this email and share your feedback on how we've been doing so far so we can get better.

Anyway, you must be anxious about the days and weekend ahead, so let's talk about it. It's not Friday yet (except in India, sorry for the delay, dear readers), but this way we can focus tomorrow's newsletter on the fundamentals of this market. So, to put it it simply and crisply, our strong conviction is that the weekend will continue to be volatile, but nothing as aggressive as this now historical Black Wednesday. As said yesterday, the V-bounce at $30k clearly signalled a local bottom - at least for now. What does now mean? It starts with a day and can last weeks to months. So as time goes by, we can better understand if the recovery is a bullish trap (or complacency in that market cycle meme shared in the end of April) or, conversely, if this is a legitimate bounce, or a disbelief rally in other words.

Chart art: some regressions can provide quite the hope.

Market musings: some dips are more obvious than others.

Overall, we're becoming more convinced the dip was an anomaly caused by things we had been covering for weeks in this newsletter, which are all nicely summed up by Nicholas Merten in today's tweet tip. It had nothing to do with those sexy 4chan narratives (link below) about China trying to liquidate Justin Sun - they are nice stories, but even if they are plausible, the market was simply overheated. Note also the amount of liquidations was only the second highest in the year. This is massive, but doesn't necessarily scream full capitulation - even if, as Alex Krüger greatly explains in today's double tweet tip, it is sufficient for the bear trap we need to get back to the crazy alt season dreams by June. So, we're anticipating two scenarios:

We'll feel bullish as long as bitcoin remains above $35k, which was today's higher low, and especially if we recover $40k (we're now back below it) and confidently conquer $42k again. However, watch out for a failed higher high at $46k. We need to break upwards of that level for the bullish narrative to rapidly resume, otherwise we'll remain sideways for a while. Anyway, the blockchain fundamentals, explained in the visual block below, clearly support this view, which is also backed by today's year-high fear levels on the very helpful fear and greed indicator.

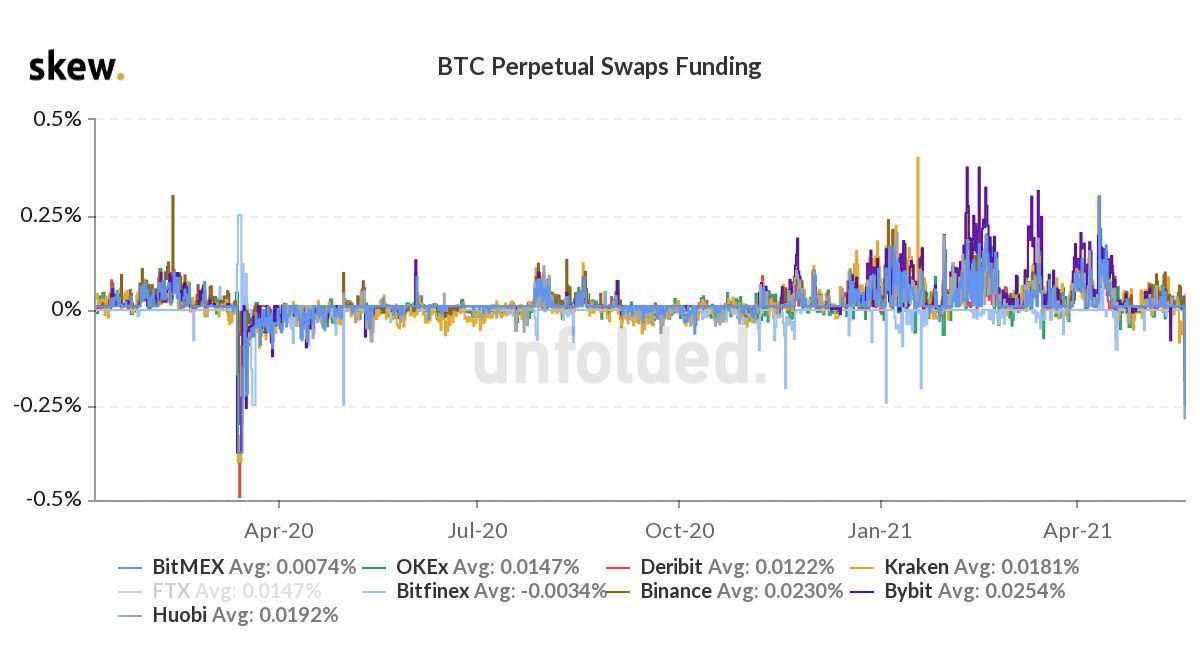

And we'll feel bearish if bitcoin closes any any day below $35k, with any failed support at $30k meaning we'll instantly test $20k, the previous cycle's all-time high, because all the new leveraged traders will have stop losses right at $29.9k. Right now, funding rates reached negative levels, which incentivise longs. But they are also a sign of bearish interest in the market. So, if bears can continue driving price down while funding remains negative, then it's time to prepare for the worse. Particularly given the all the fresh, concerted FUD reaching the market the US.

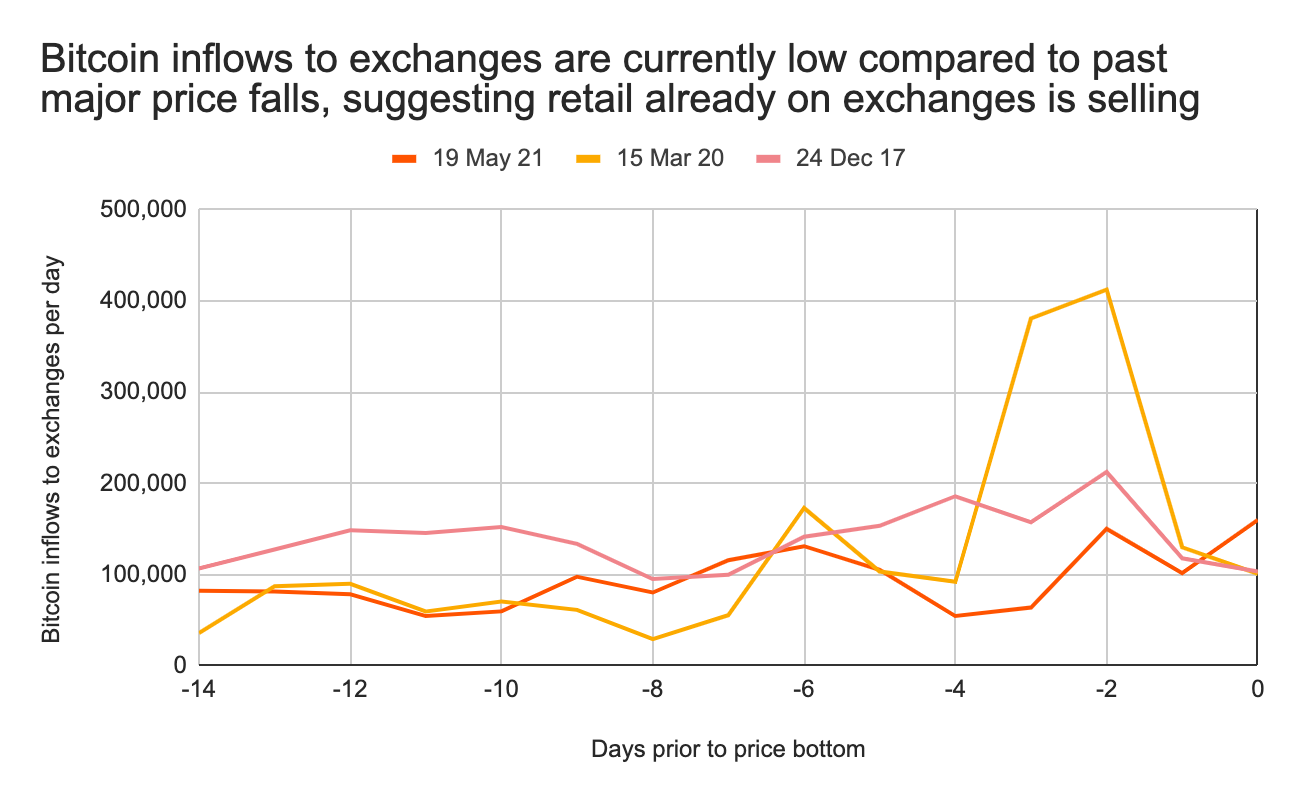

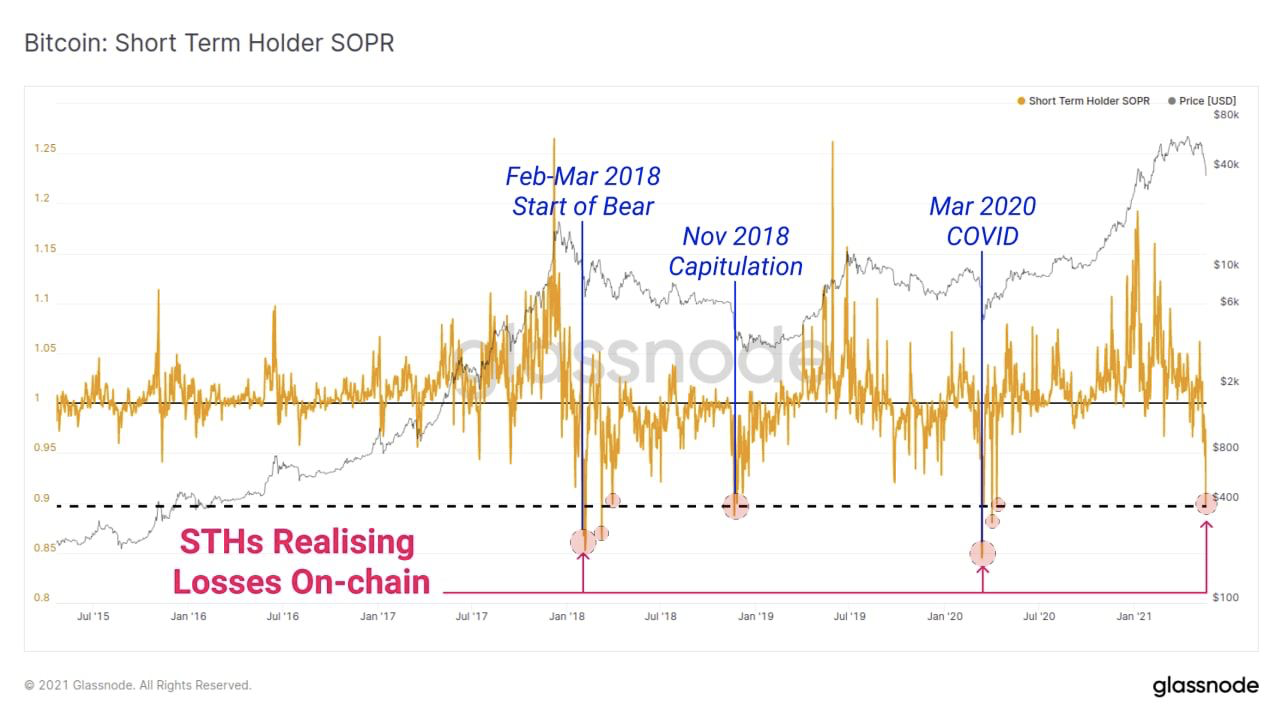

Visual block: some fundamental indicators are so clear.

Three things: some institutions are buying the dip.

- If you want entertainment, learn about the 4chan theory which claims the Chinese government was trying to liquidate a $1 billion position held by Justin Sun, Tron's infamous founder, then check Jacob Canfield's thread.

- If you want a bullish take on this recovery, Willy Woo, a popular analyst and former fund manager (sadly, yet ironically, he was liquidated last year), just shared today's edition of his paid newsletter with two optimistic scenarios.

- If you want a rational take on this recovery, Philip Gradwell, chief economist of Chainalysis, a popular blockchain investigation tool, also publicly shared an excerpt of his report, arguing he is inclined to say the bull market isn't over.

Tweet tip: some pieces of advice are never enough.

Meme moment: some memes are difficult to understand.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!