Go with the flows

Cryptic ball: prepare for sideways this summer.

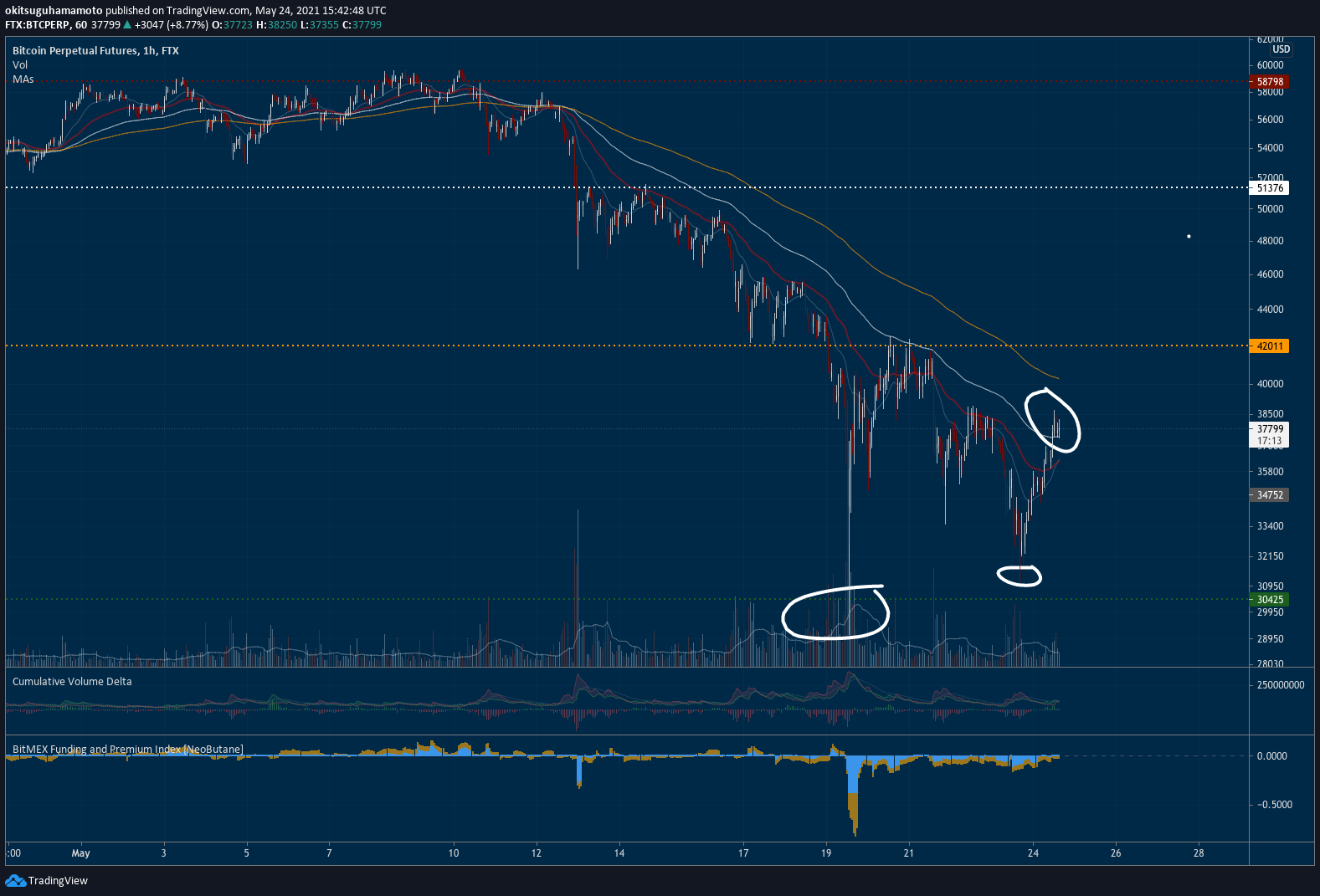

Another weekend, another ride in the crypto roller coaster. Last Friday afternoon, UTC time, bitcoin failed to recover its $42k support, twice. That enticed bears and, later that night night, they nuked the orange coin through the $35k support we mentioned. A weak BTC threaded sideways over the weekend until it found a bottom at $31k, around 4h40pm yesterday. The whole market dipped in tandem, but some coins are bouncing more than others, so let's analyse them all!

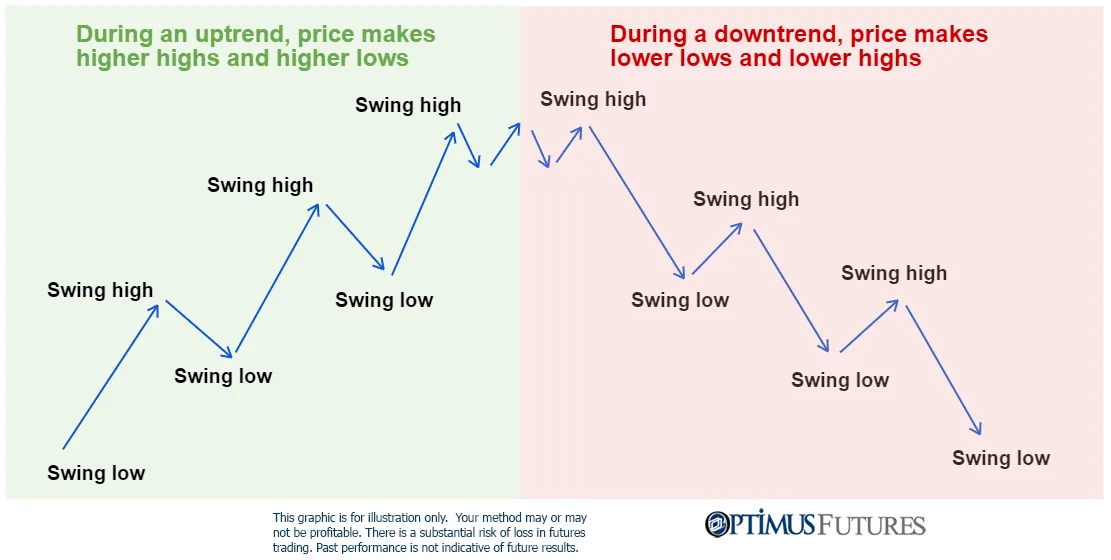

To begin with the leader, bitcoin managed to achieve an higher low during the dump (it had reached $29k on Wednesday) and this is a potential reversal sign for those who appreciate trend analysis (check today's chart art for more on it). If you managed to bought that dip, you would be up 25% by now. Moreover, even if bitcoin manages to keep just moving sideways for the week that wouldn't be bad, as this could mean alts were able to keep pumping: most have jumped +50% from the bottom and others, like MATIC, are about to do a 2x in a day!

Chart art: this is a good sign but nothing bullish yet.

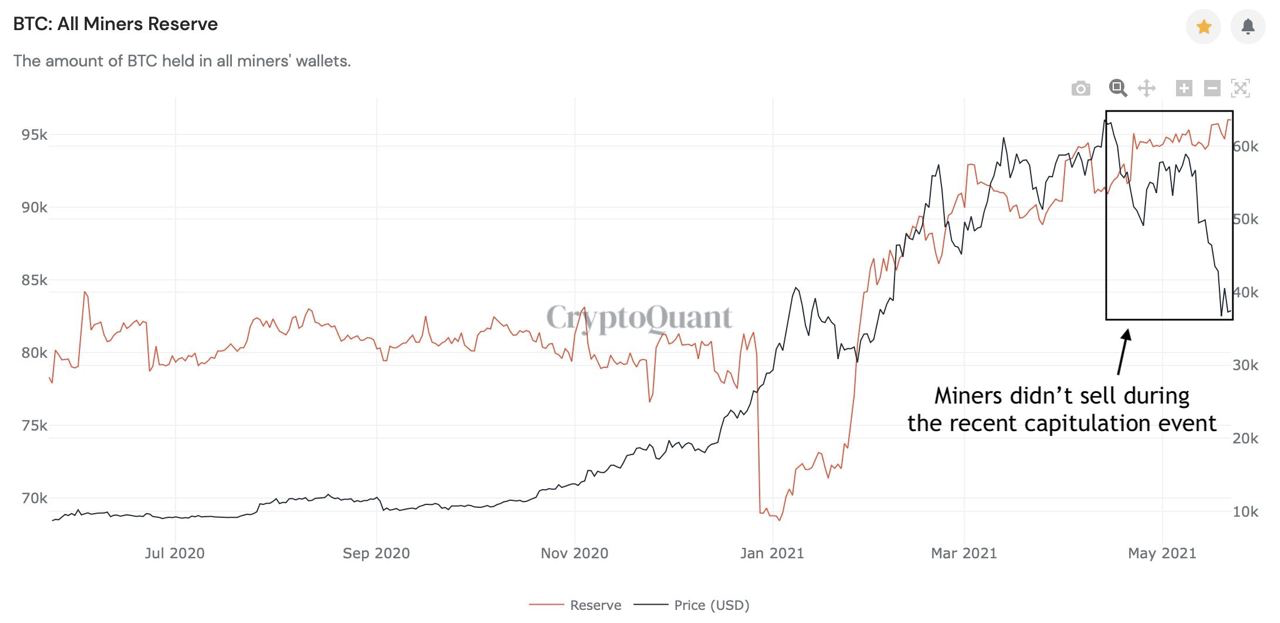

Market musings: miners and institutions haven't sold, yet.

Moreover, because in the end it's still pretty much everything about how bitcoin performs, note that the original cryptoasset has also confidently recovered the 100-hour MA, since that key moving average was lost on May 12th. For now, the FOMO currently experienced by those who failed to buy the dip will likely enhance the bounce. But, until bitcoin turns bullish on different timeframes, things can continue to remain scary - at least if altcoin profits don't save the party.

Take the case of ether, the leader of the alts. Despite having bounced 45% since yesterday's lows, it made a lower low instead of a higher low, dumping all the way to $1.7k from Wednesday's $1.8k. The difference isn't major, which - backed by a rise in funding rates - makes us think this still indicates a bottom, at least for this week. And it could also be a typical case of hunting stops below the previous low, a typical occurrence that's succinctly explained by Cuban in this Twitter thread.

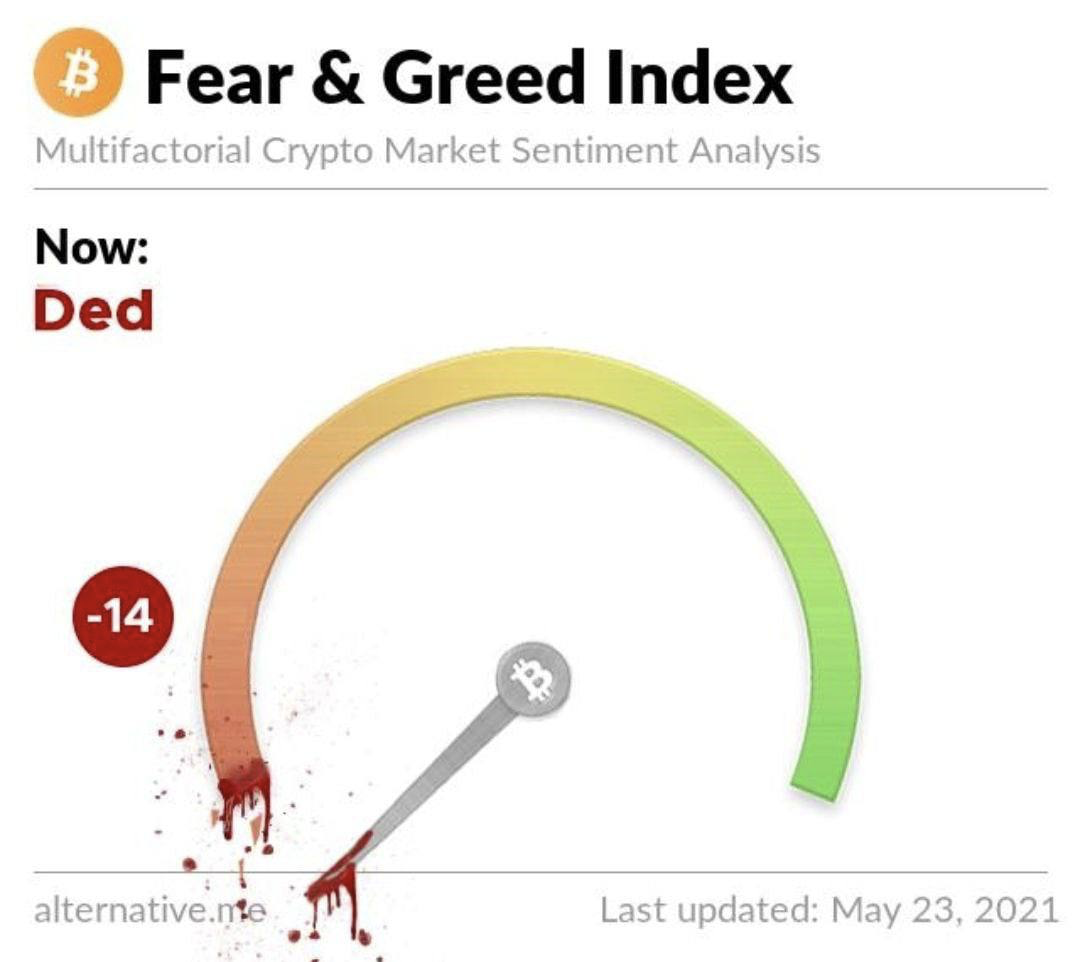

Still, right now it can either be a bear trap or a dead cat bounce that will trap bulls for weeks or even some months to come. While the bullish narrative wasn't at all destroyed, and the fact miners haven't sold yet is, in theory, positive (they can still sell, right?), you should know by now that sentiment changes fast in the cryptosphere. So make a plan and trade in advance instead of out of panic. Use limit orders to bid at interesting levels and protect yourself with stop orders!

Visual block: but they need to pay bills, right?

Three things: summer of DeFi is the meme we need.

- Paul Krugman wrote a new critique of Bitcoin, which isn't even good so we don't recommend it. But Lex Sokolin's rebuttal is great and warrants a read.

- Interested in knowing more about crypto hedge funds? Check PwC's third annual report on the mythical topic. Some nice 51-pages of hopium there.

- Still believe we'll see a summer of Decentralised Finance? Listen to Meltem Demirors interview on Azeem Azhar's Exponential View podcast.

Tweet tip: this is just the beginning, right?

Meme moment: how were you feeling yesterday?

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!