Paradise Lost

Cryptic ball: "what hath night to do with sleep?"

If this is your first time stomaching crypto panic, welcome. This volatility is what this space is all about, as it creates extraordinary opportunities for you to grow personally and financially. As Rudyard Kipling famously said, "if you can keep your head when all about you are losing theirs and blaming it on you", you'll be a crypto boss, my readers. And the answer for the next days comes next in the poem: "If you can wait and not be tired by waiting" then "yours is the Earth and everything that’s in it" This may sound cryptic, but it's right advice.

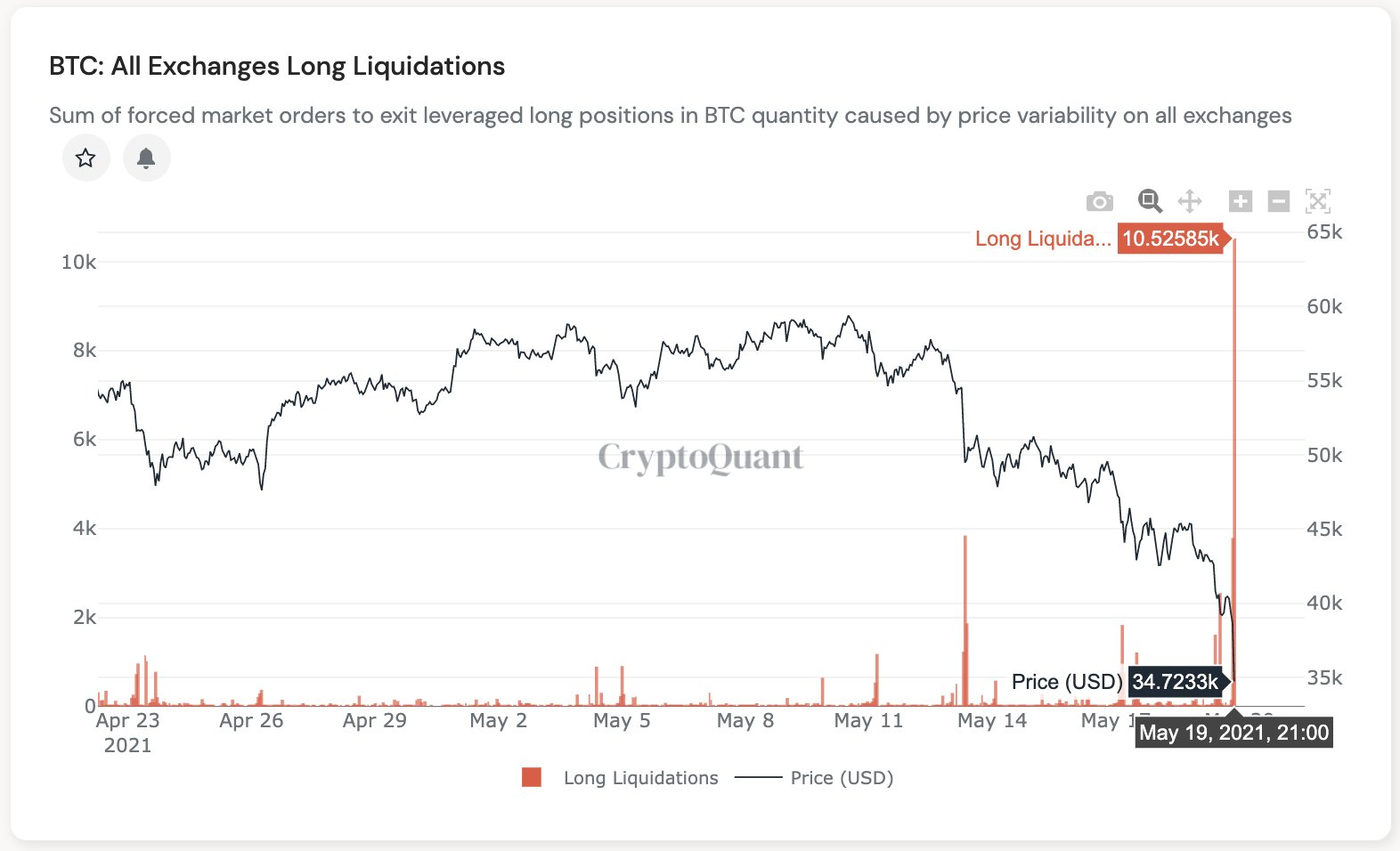

As you might have seen by now, total crypto market cap dropped 20% since yesterday. Bitcoin and ether are down 15% to 20% as of now, having sustained 35% to 45% drops earlier today, in a typical liquidation cascade that caused massive panic among crypto markets. For now, it's clear we've finally found a short-term bottom given the V-shaped bounce BTC saw at $29k and ETH saw at $1.8k. Even if a trip to $20k isn't out of the cards yet. But why did this crash happen, is the bull market over, and what can we expect next? As usual, read along!

Chart art: "better to reign in Hell, than to serve in Heaven".

Market musings: "the mind is its own place",

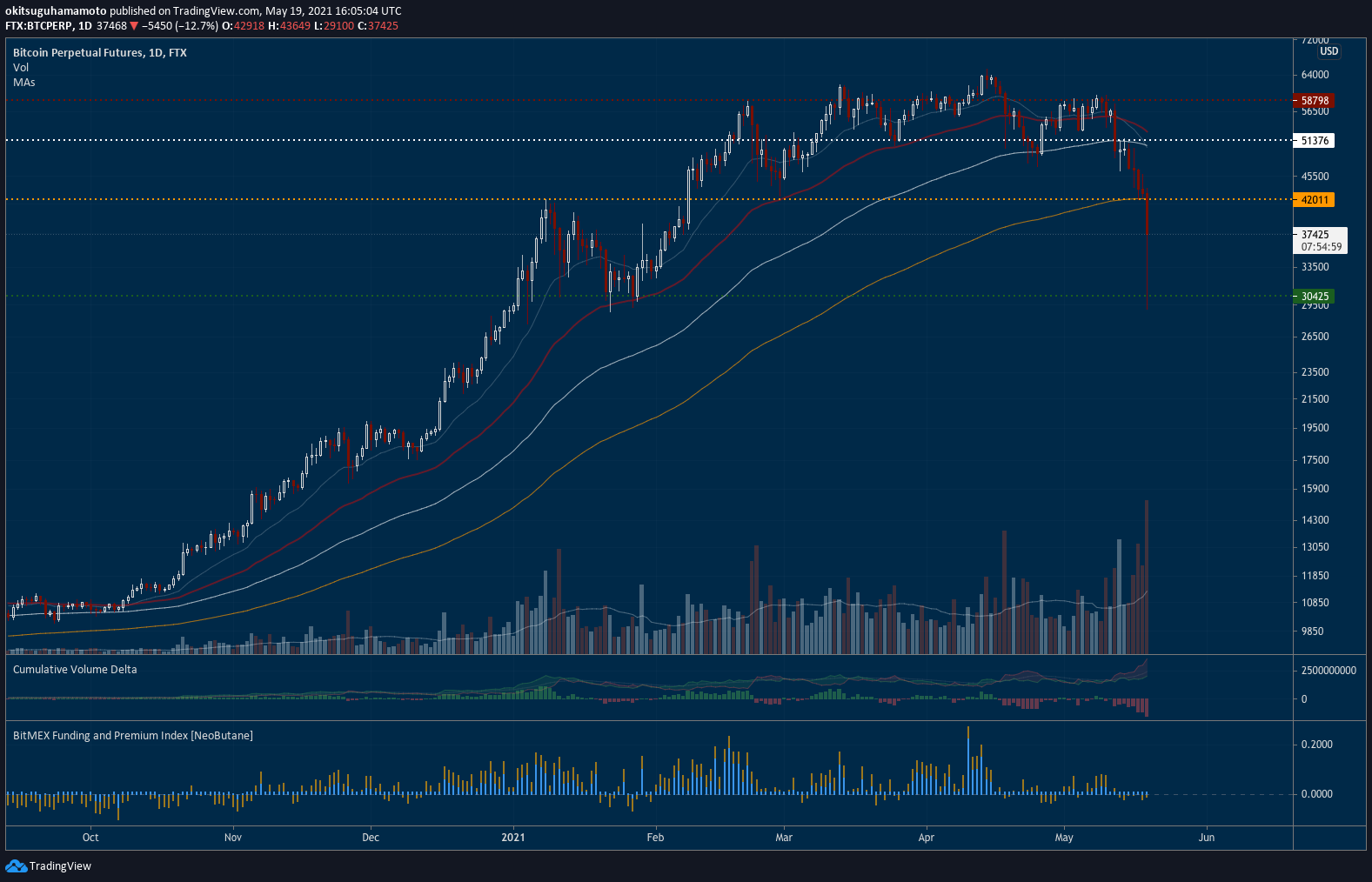

As shared Monday, if bitcoin was to fall below $42k panic would ensue. Not we, not even some major bears, expected this to happen so quickly. Still, we reinforced such a risk yesterday, explaining how institutions were likely selling the BTC they recently accumulated (note Musk just tweeted that Tesla is still hodling, if that's of any comfort) and explaining how baseless China FUD was hitting the market.

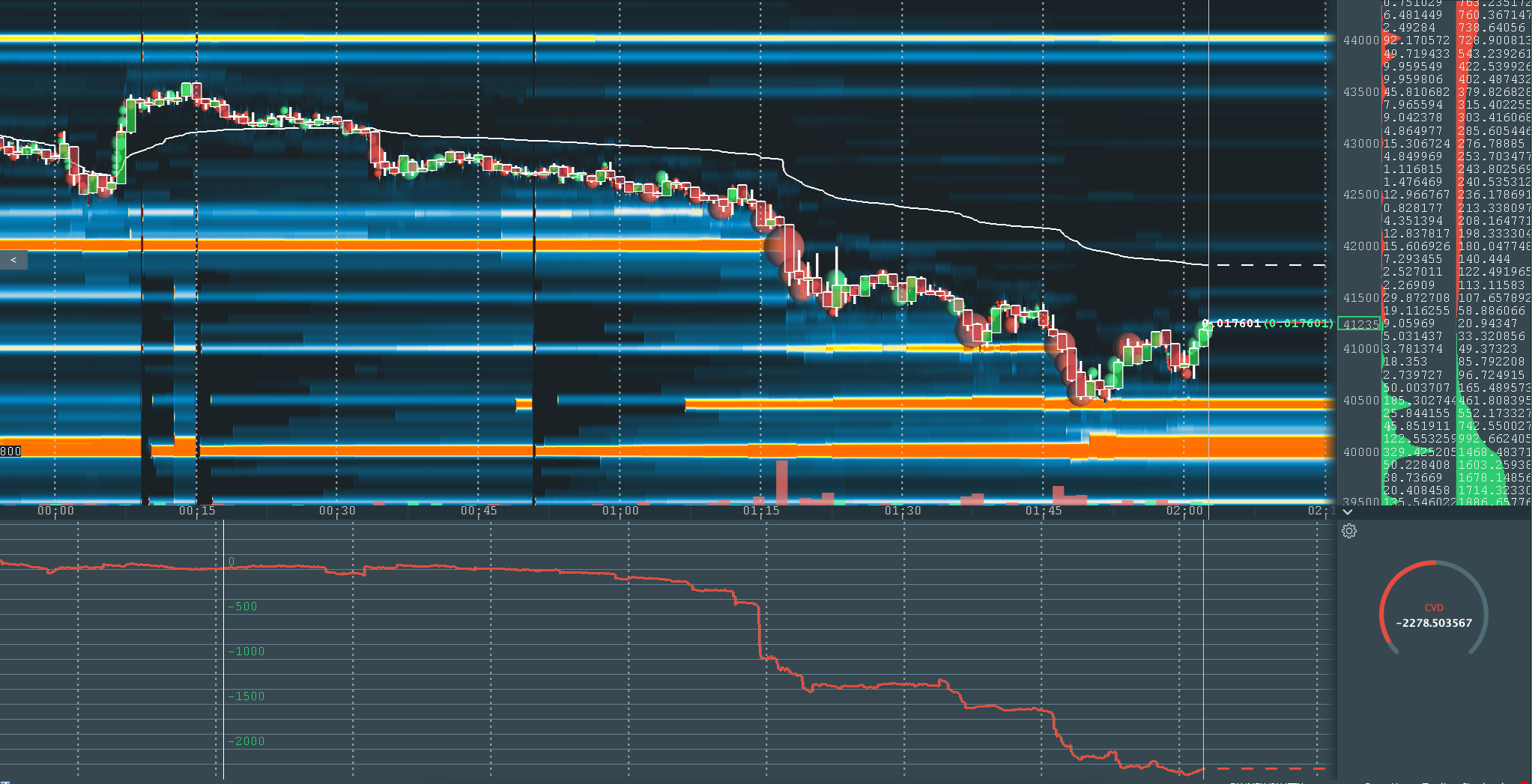

But what did you do when we incentivised you to devise a plan if BTC retested $42k again? It's normal if you didn't to anything. It's hard to plan what to do in such an event. So let's analyse what happened so you can better prepare for future crashes like this. Firstly, note this fall was purely technical and compounded by stop losses and liquidations forcing long positions to sell and further dropping price. Even if Musk and FUD played a role in the overall bearish environment, by looking at the charts above, it's clear that right after yesterday's daily close, bitcoin failed to break above the 5-minute 200-period moving average (check the hammer), and roughly one hour after it fell below $42k to never test it again. This was a major support level, as shown above, so after breaking it bulls lost all hope.

Now, the fear is that these top-to-bottom drops of +50% to 70% spread doom for this bull market. That has been the case in previous bull markets. But, as we've been analysing over the past few weeks, we've noted that euphoria levels were rising, even if we're not at full mania. Such increase in bubbly thoughts warrants a reset like this, as those in profit have an incentive to sell into the hands of newcomers. But, for a bear market to start, it must be true that the inflow of new participants drops. Your correspondent believes the stories of riches of this bull run aren't over yet, and very few new people have had a chance to try their luck at crypto profits. But, if you're underwater, it's important to consider that we might still see a wild dip to $20k, further pushing alts down. Be prepared for that!

Visual block: "awake, arise or be for ever fall’n."

Three things: "What is dark within me, illumine".

- If you have had a tough day dealing with your emotions, we recommend Peter McCormack's tale of rags to riches and then rags. It's all about the long-term.

- If you have had a tough time dealing with excess leverage, we recommend Joe McCann's guide on "how to not blow up trading crypto with leverage".

- If you're looking for more analysis on how to figure out where bitcoin's floor is, we recommend ByteTree's take on where that magical level lies.

Tweet tip: "all is not lost"

Meme moment: "our cure, to be no more; sad cure!"

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!