The bear who cried wolf

Cryptic ball: "pray, do help me, the wolf is killing the sheep".

If you're new to crypto markets, you should know by now that weekends are particularly interesting, if not outright maddening - in a positive way, we mean! After all, volatility is a trader's best friend, so don't shy away from it. And, if you're petitioning for Elon Musk to sell his bags, after his cryptic attempts at market manipulation, then you need to understand the rules of this game: it's all about accumulating sats and anyone's welcome. Blockchain is about the people against centralisation, not about people against people - no matter how loud they are.

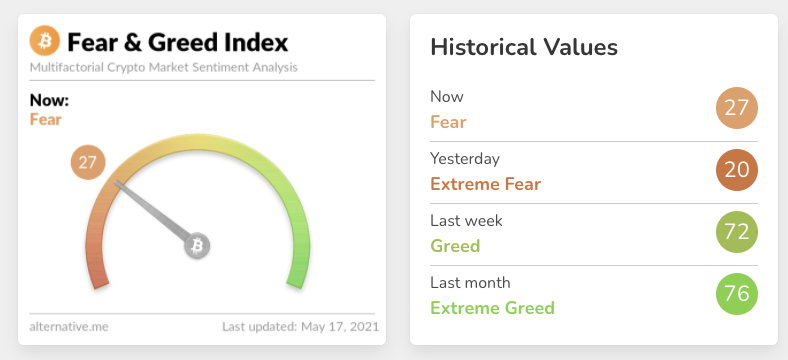

So, what happened? To begin, remember that last Wednesday we hit a (not yet the) top, which started with Vitalik Buterin donating part of his unwarranted meme coins to several charities, including India's COVID Crypto Relief Fund, and with Elon Musk announcing Tesla was stopping bitcoin payments. The market has corrected 21% since then, currently sitting at the same average level where we spent all of July. But now something is different: fear. Fear from what?

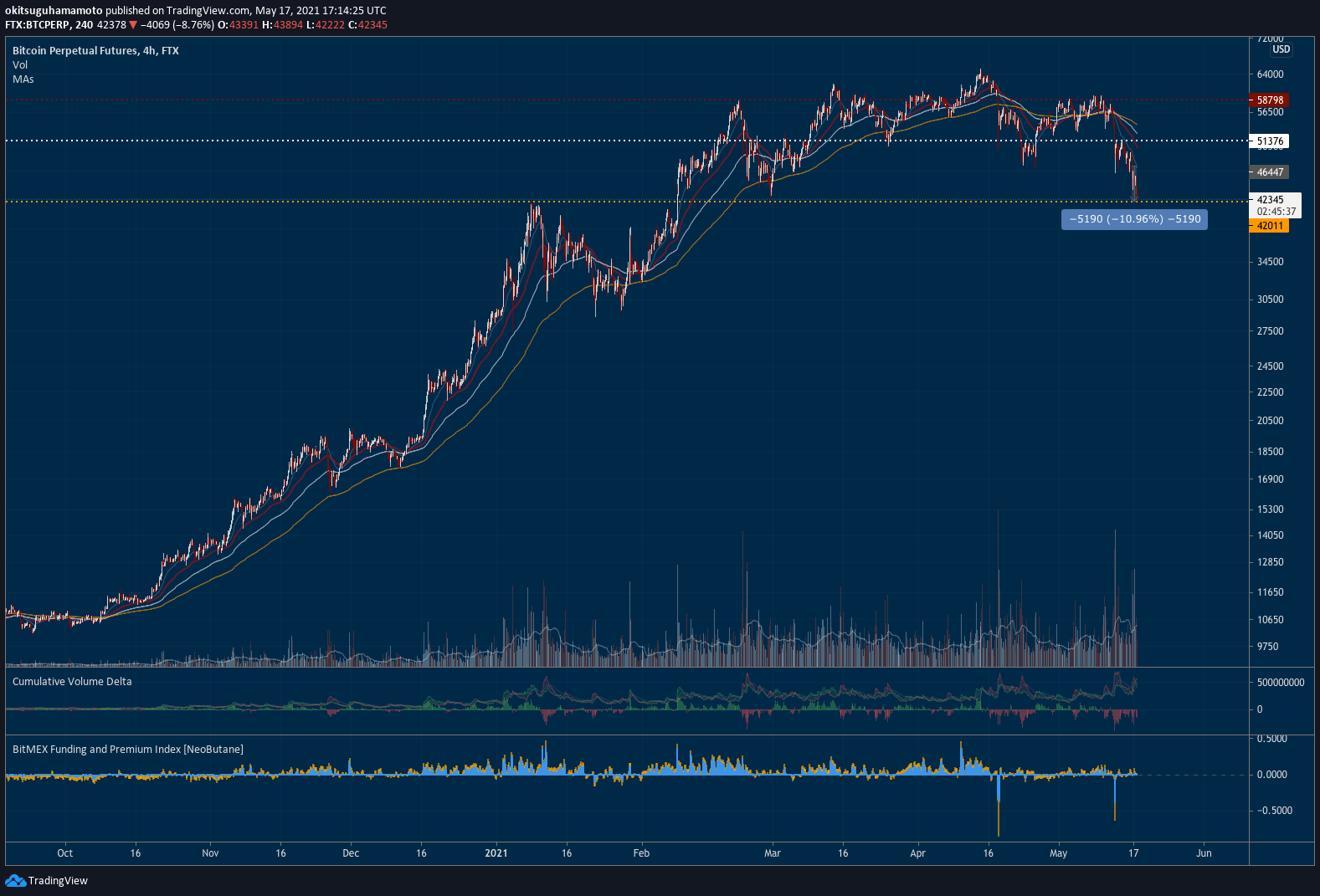

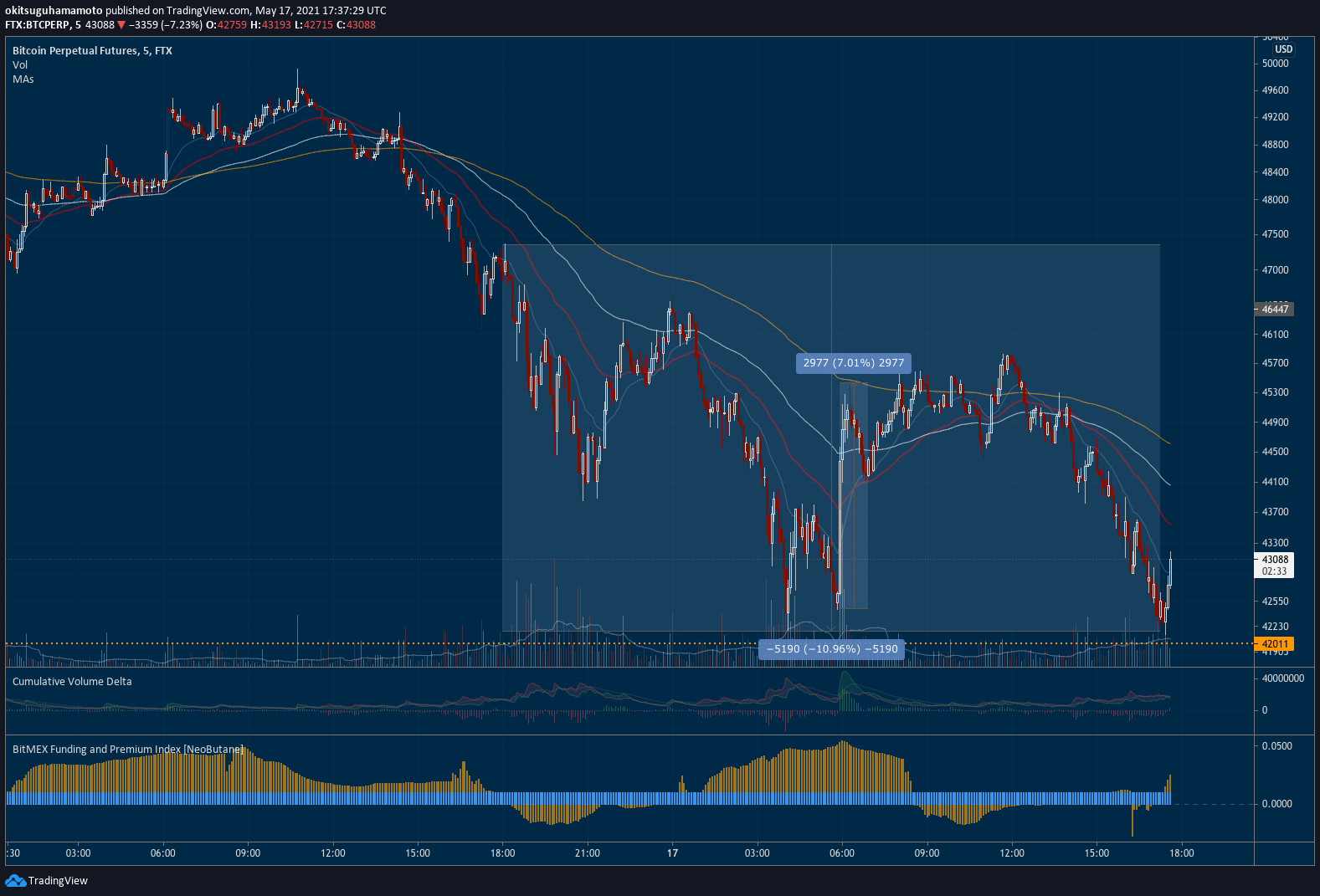

Well, this weekend price was looking feeble across the cryptosphere, even if some alts weren't feeling the gravity. Bitcoin and ether were falling in tandem, on their way to test $43k and $3.5k, the key levels of doubt we mentioned Friday that you should watch for Sunday's close. This weakness was mostly motivated by renewed doubts regarding Tether, the most popular stablecoin, and its recent reserves disclosure. But it was nothing new. Then, Elon Musk simply replied "Indeed" to speculation that Tesla may have dumped their bitcoin. And a 10% crash ensued!

Chart art: trick or treat.

Market musings: don't stop the music.

Then, once bitcoin tested $42k, a key level where bitcoin topped in early January and bottomed in late February, Elon timely tweeted that Tesla hadn't sold any bitcoin after all. The original cryptoasset pumped 7% in less than one hour, but the fear persisted as few are now listening to those who cry wolf. Ether has failed to pump and is algo hanging on for its dear life, right at the 200-period MA on the 4h-chart. Should you be worried? Perhaps. Here are our two satoshis:

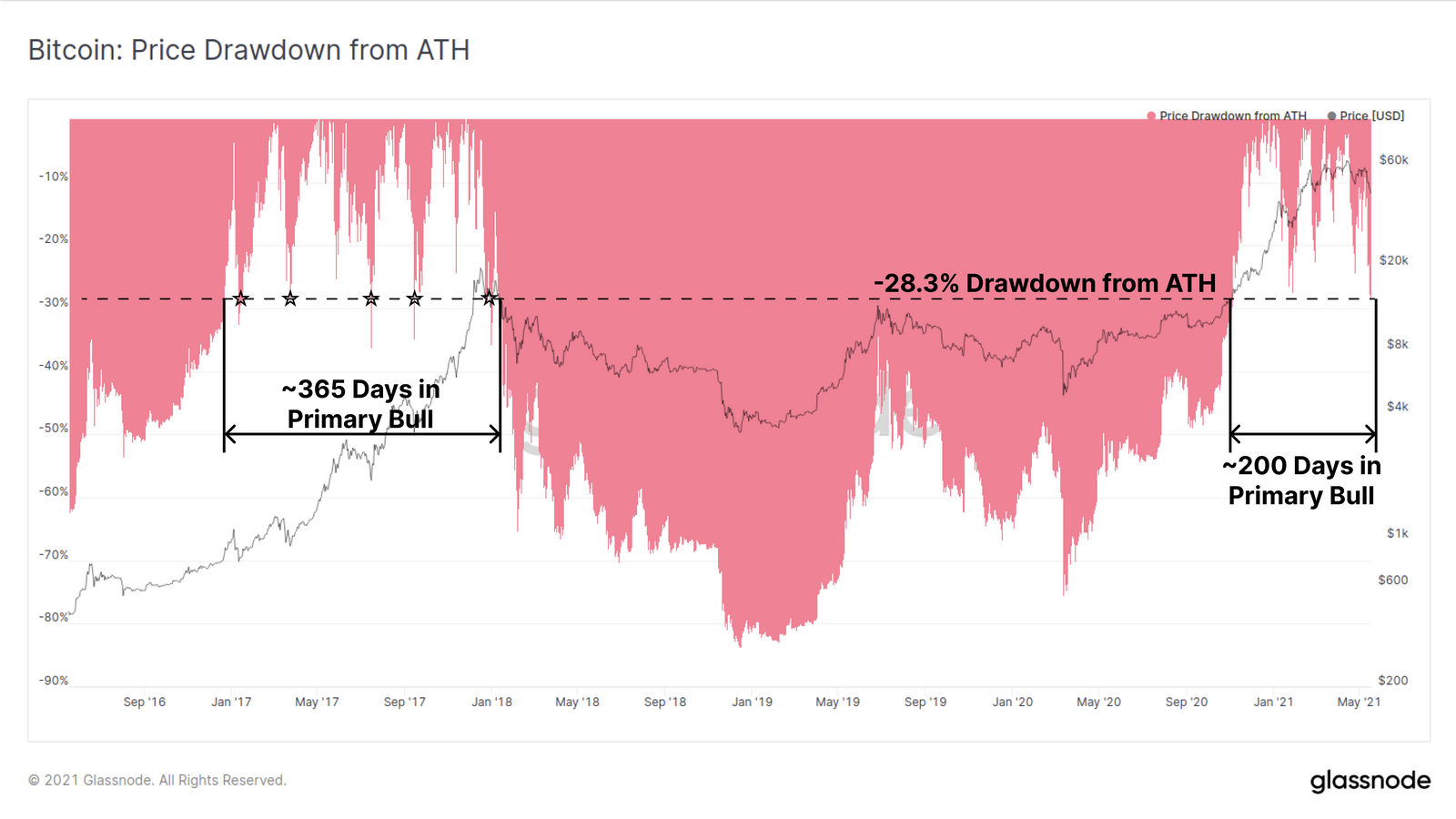

To begin, Elon didn't cause the dip, he merely triggered what was due after the alt mania we've been experiencing, as first considered here on April 30th. This doesn't mean alt season is over, but it's clearly hinging on what BTC and ETH do tonight - and here you may expect a stops hunt on that double dip. Lastly, zoom out on 2017 and see how we had five major dips, averaging +37%, and in this bull market we have only dipped twice, and never in such an extreme way. Although $42k is a key level and falling below it will likely trigger panic, let's first see what happens tonight. For now, the double bottom test hints that a dip is in, but note bears may still manage to gather forces to go lower and test $40k - spreading doom. So, have a plan, scroll down, watch the charts, and remember it's still early to stop dancing.

Visual block: it's all about our collective psychology.

Three things: he cannot fool us again.

- If you want to feel safer buying the dip, we recommend CoinMetrics great analysis of on-chain data showing weak panic sellers and strong hodlers.

- If you want to understand how Elon Musk "Pushed DOGE Up and BTC Down", we recommend Laura Shin's insightful interview with Arca's Jeff Dorman.

- If you want to get the details of the Ethereum 2.0 scaling narrative that is behind the bullish case for the rest of 2021 watch Camila Ruso's interview with Preston Van Loon, a main developer behind the expected upgrade.

Tweet tip: stay in the sidelines if you can't handle the ride.

Meme moment: it's all about attention.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!