About that Goethe

Cryptic ball: "to think is easy, to act is hard".

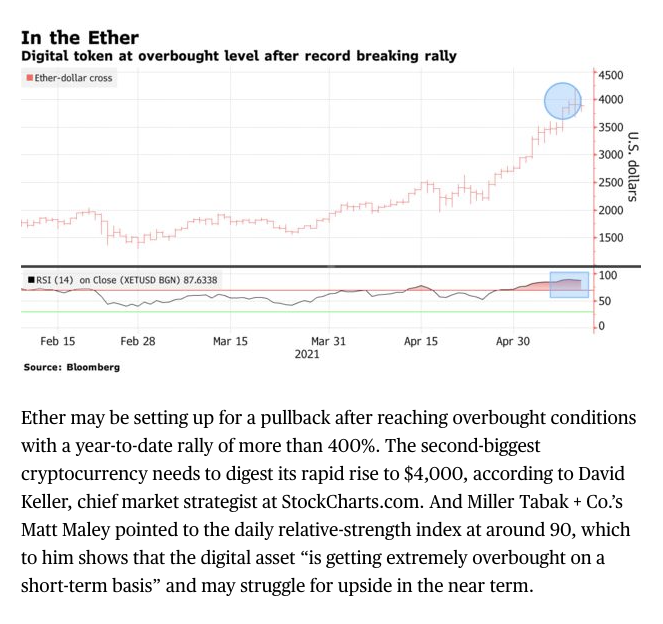

Many felt a scare over yesterday's daily close, as ether flash dumped nearly 9% in just 15 minutes, causing the rest of the crypto market to skip a beat. The leading alternative cryptoasset has recovered to that level, but it's still 2% below its recent ATH of $4.2k. Meanwhile, bitcoin also fell bit, and it's also 2% down over the past 24 hours. This has lead many analysts to call for this market to dump more.

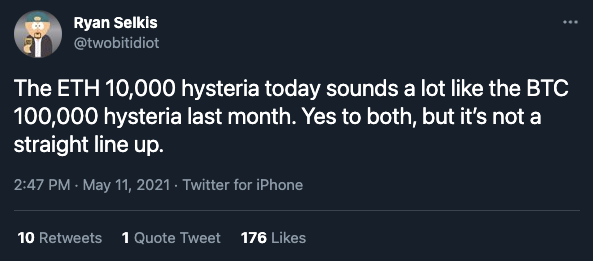

Is that right? We don't agree, at least for now. Why? On the one hand, ETHBTC reached a key resistance - as you can see below - which prompted many to take profits. On the other hand, bitcoin is safely moving sideways while ether and alts are continuing to pump. This can last for some months and, in between, aggressive dips typically happen to reset funding rates (even though funding remains high for now, which warrants some reflection). Meanwhile, note the target timeline for this leg to pop is sometime around July 14th - when Ethereum's highly anticipated London hardfork is implemented. This update will finally bring gas fees down to sane levels, which is good news. But what do you do with rumours and news?

Chart art: "enjoy when you can, and endure when you must".

Market musings: "a person hears only what they understand".

Meanwhile, the shiba-related hype continues. After millions were made with dozens or a few hundred dollars, everyone and their mother are trying to cash-in on the canine ride. As talked yesterday, one really needs to be aware of rug pull risks and other smart contract-related scams. But there's more to this which can affect the wider ecosystem. As more and more people make millions overnight, this puts increased selling pressure on BTC and ETH, which impact the wider market.

Furthermore, the number of bitcoin whales - holders of cryptoasset wallets with more than 10k bitcoins - has fallen to a 5-month low. This could mean these millionaires are either sending their assets to exchanges so they can sell for a stablecoin in anticipation of a major crash, or are using their holdings to buy alts. Lastly, we're seeing more signs of euphoria as Coinbase has overthrown TikTok to steal the #1 spot on the US App store. Guess when it had reached that spot before?

Visual block: "we must always change, rejuvenate ourselves".

Three things: "by seeking and blundering we learn".

- Nic Carter is one of the best writers in the cryptosphere. His latest must-read explains "The Virgin Bitcoin Fallacy".

- Matt Levine is one of the funniest writers in the cryptosphere. His latest must-read explains that "Dogecoin Is Up Because It’s Funny" If that's not enough, check Galaxy Digital Research's take on "The Most Honest S*hitcoin".

- Nikhil Shamapant is one of the most bullish writers in the cryptoshere. His latest 77-pages must-read explains how ETH can reach $50k to $150k!

Tweet tip: "everything is hard before it is easy".

Meme moment: "behaviour is a mirror that shows our image".

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!