Long leash, short kennel

Cryptic ball: it was a game of musical chairs, but a brief one.

Volatility was the word of the day. What a great time for traders have bought the fear felt by some weak hands. But is this a dead cat bounce, i.e. a bounce that then fails to resolve positively and, instead, price keeps dipping? Or is this a wake-up call for the greed felt by sh*tcoin degenerates over the past weeks? Let's see. To begin, it all started yesterday, two hours after this newsletter was sent. It really seems Vitalik Buterin read our copycats (or shall we say dogs) warning! As we haven't found any good explanation of what happened, we'll provide you one:

Vitalik is the co-founder of Ethereum (note, this is the blockchain whose currency to reward miners is called ether, or ETH). He received 50.5% of SHIB's supply last year (and more from other clones of the Shiba Inu project too, e.g. AKITA) as a token of gratitude akin to a permanent burn. But one thing is burning tokens to a lost or invalid wallet. Another is sending them to a hyper rational human being!

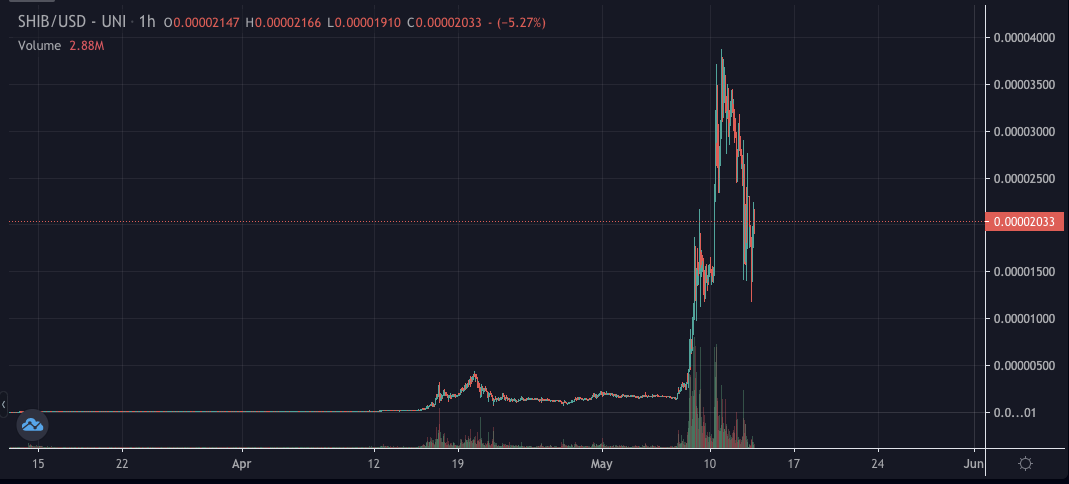

After the meme coin pumped more than 400x in a couple of months and even more since 2020, it was only natural that Ethereum's darling boy would do something about its more than half a quadrillion shibas. And so he rugged those projects, meaning he removed a large amount of the liquidity that exists in a decentralised exchange, prompting a crash in price. But he did more than that!

Because Vitalik had not only received the 50.5% of SHIB, but also the Liquidity Provider shares that Uniswap granted when the other 49.5% of the supply was locked in the DEX back in 2020. These shares accrue trading fees and allow its holder to remove liquidity. As of yesterday, these shares amounted to nearly 13,300 ETH (roughly $50 million) and the equivalent amount in SHIBA (as liquidity pools in a DEX work with a pair of tokens of equivalent value). So, Vitalik also decided to remove said liquidity from Uni and cash out the proceeds in ETH.

Then, the 27-year old sent those ethers to Givewell, a US-based charity, and donated 500 ETH plus a "small part" of his SHIB tokens, still worth $978 million as of now, to India's COVID Crypto Relief Fund - the one we've been announcing in the bottom of this newsletter for a couple of weeks (really, Vitalik, are you reading this?). So, this gift (some other foundations also received some) was the catalyst that helped crash total crypto market cap by 10%. A little bit weird, right?

Not necessarily, given the uncertainty and euphoria felt recently. But what now? Well, everyone was worried the COVID fund and other receivers of Vitalik's charity were going to liquidate as much as they could, forever destroying the Shiba Inu project and its clones. But at least Sandeep Nailwal, co-founder of Polygon (behind the MATIC token) and of India's relief fund, has claimed they "do anything which hurts any community specially the retail community involved with $SHIB".

That's nice, but the reason behind it is also because right now the SHIB pool on Uniswap has less than $10 million in available liquidity. Since Monday, the dogecoin replica was listed on multiple exchanges, but liquidity there is also quite limited. So the fund has no chance but to slowly use these funds - which is also great! Meanwhile, it's important to note Vitalik still owns 45.6% of the supply.

Moreover, Vitalik had already donated $600k to the Relief Fund and is known for regularly funding similar community projects. So this creates a lot of pressure on another crypto billionaires to take care of their petcoins (hear this, Elon?), especially when blockchain makes transparent giving so convenient and easy! For example, Sam Bankman-Fried, another 28-year old crypto billionaire who founded the popular Alameda Research market maker and the FTX exchange, is a famous supporter of Effective Altruism movement and wants to give his $10 billion away!

In other words, all this to say that while many meme tokens are certainly dead, a few ones may suffer the same astronomical fate as dogecoin. That is, being adopted by celebrities as a tool for charity work, pumping as a result. After all, dogecoin is known not only for being useless, but for being a popular tool for giving. This means that this crash was likely much ado about nothing. But you'll have to keep following doge for hints on the future of Shiba et al - as it's all about the leader!

Chart art: it was a bad crash, but SHIBA is still up 10x since May.

Market musings: it was a rough day, but what about the week?

Let's get back to analysing whether this is a dead cat bounce or not. Shortly after the Vitalik-induced volatility, Elon Musk joined the party to announce Tesla would go back in its decision to accept payments through the Bitcoin protocol, due to environmental concerns (or the need to please the US Government which funds the car maker). This happened at 10pm UTC, prompting the original cryptoasset to crash 15% in just two hours. Initially, ether jumped on the news, but at 11pm UTC it also crashed 16% in what looks like a typical concentrated move by whales to cause a dip. We infer this given the high volatility in funding rates last night, which hints at the fact powerful traders were using leverage to move the market.

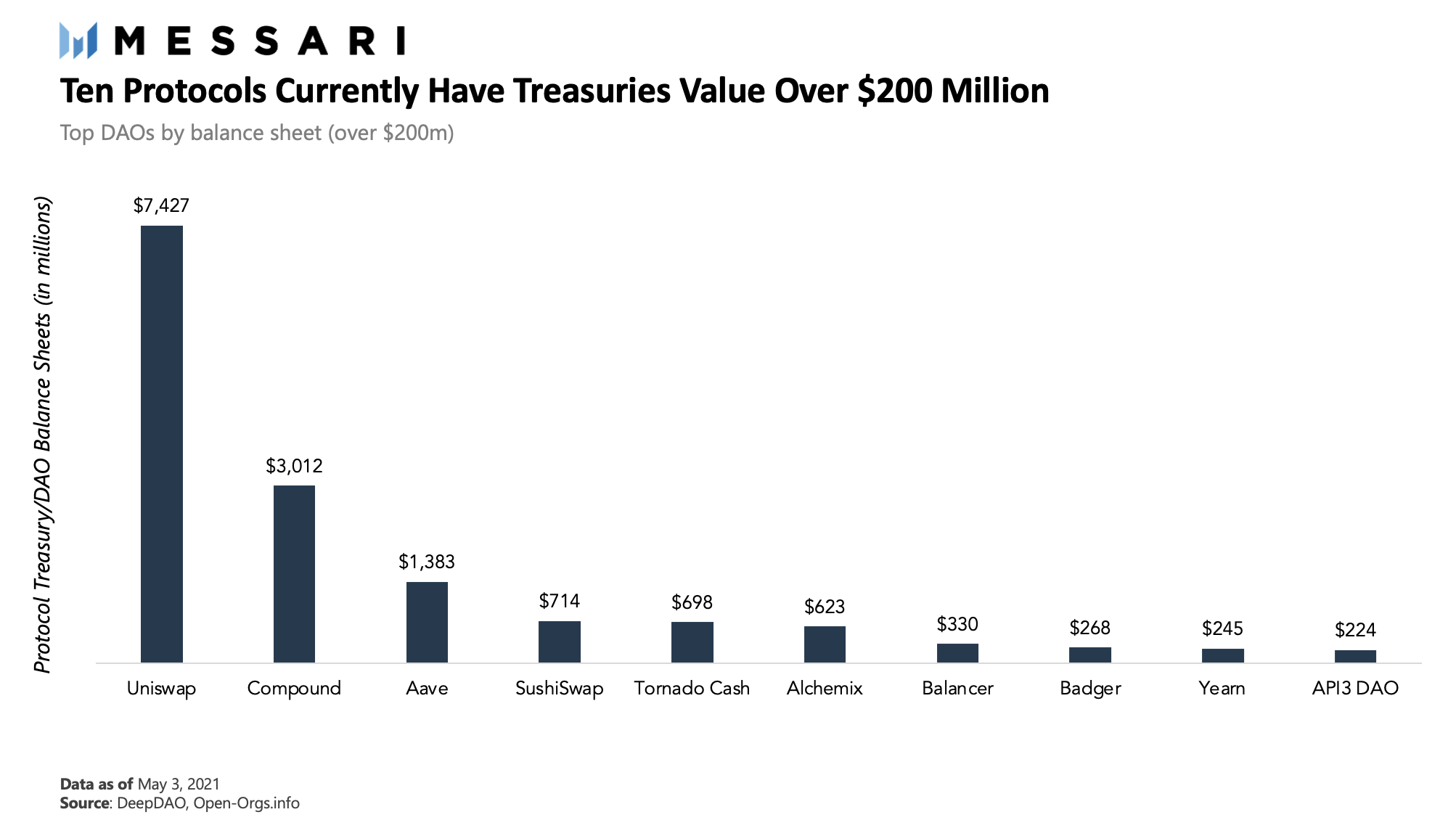

After the daily close, both BTC and ETH have since recovered 8%, but many fear the worst is not past us and this dip is not to be bought. One thing is certain, in a bull market it's dangerous to be leveraged short - even if it's okay to be neutral, i.e. not holding any position - as bears keep getting trapped (and vice-versa in a bear market). For now, the cryptosphere's consensus is that this isn't the end for the bulls. However, as told yesterday, there are many warning signs. One of the new things we want to call your attention to is to the increasing value of assets held by decentralised blockchain projects, as you can see below. Once things turn south, it's only responsible for these Decentralised Autonomous Organisations to vote to liquidate their positions, further putting selling pressure on the market.

For now, it doesn't look like a dead cat bounce - at least for short-term trades. ETH can pull back all the way down to $3k without damaging the bull trend - and even if it continues falling it would likely stop around $3.4k first. On the other hand, bitcoin looks poised to test $41k in case it fails to confidently remain above $51k today, and ideally close the week above $55k. If it doesn't do so, it can trigger a wave of institutional selling that cuts the party short or at least scares everyone more. So watch those levels, keep an eye on the overall sentiment associated with stock markets (which is trending south), define your trading plan, and plan your stop orders! Remember to buy fear and sell greed. If you don't know what this means, then don't trade, focus on the long-term and consider how exposed you are to cryptoassets. This is a great playground, but it can turn risky quite fast.

Visual block: it was decentralised, but it wasn't management.

Three things: it was only one today, but a very good one.

- Alex Gladstein reminds western elites, which typically criticise Bitcoin, about its financial privilege. This is a must-read, so it takes the spotlight!

Tweet tip: it was tweeted, but also redacted.

Pupper prize: it was honourable, but also lack of liquidity.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!