Tinfoil hat crisis

Cryptic ball: the tin crisis of 1985.

Bitcoin is more or less where it was when yesterday's newsletter was sent out, but it has clearly printed a higher low around $37k - which is good for now. However, the S&P 500 had its worse day since March 2020 and fear is through the roof!

- What next? Well, as before, if the situation in Ukraine improves, expects stocks and crypto to bounce and commodities to calm down. Naturally, the opposite is likely in case matters escalate even further. After all, that oil ban will work, right? Especially after Europe is cut off its biggest gas supplier. Small stuff...

- In the meantime, the mother of this year's short squeezes took place. Nickel, a key ingredient in stainless steel and EV batteries, pumped ~250% in two days and at least one Chinese billionaire who was short is currently owing billions. If you are thinking of trading that shiny new shitcoin note trading is now halted.

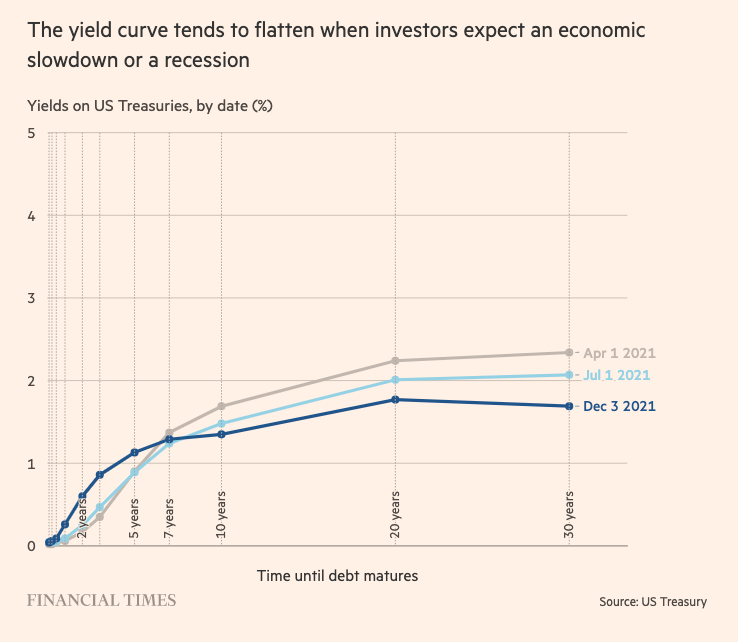

- Lastly, bonds are also signalling a recession, with the Treasury yield curve about to invert. That typically happens when investors flock to very liquid long-term assets after selling their stocks, as they are not very optimistic about the future and thus don't demand high yields on longer-dated maturities.

All-in-all, the situation isn't rosy. Nothing can be predicted for the year ahead, but it's clear my scenarios have been affected by these events. While I'm pretty sure bitcoin, in particular, and crypto, in general, will benefit from this instability in the long-term, remember my recent warnings about the ides of March.

Hopefully, that's the date bears get greedy, the US dollar starts falling again (because it's being sold to buy stonks and crypto) and we finally bottom. But let's be cautious, there's no rush to buy now. Especially with BTC below $41k.

Chart art: the false-positive chance.

Three things: the wanagmi.

- Ted Talks Macro talks about the current geopolitical impacts on crypto.

- Lyn Alden muses about "what is money, anyway?". Good intro.

- Zoomer Oracle explains the "unwritten rules of the (crypto) wild west".

Tweet tip: the resilient corn.

Meme moment: the Ted effect.

B21 Card: the global reach.

Get started: download the B21 Crypto app!