Doominance

Cryptic ball: not that calm.

Another wild weekend in the world arena, even if crypto markets seem to be weathering the storm quite reasonably - at least given the tragic circumstances and the major oil pump. But what does that mean for this week's trades?

- Bitcoin lost the $40k support right after last Friday's newsletter was sent out. It was implied that if such was the case, then bears would wake up and make things brisk. As a result, no buyers showed up until some capitulation was achieved yesterday around midnight UTC: the always important weekly close.

- So far, there's been some demand since Europe woke up. Fortunately, bulls showed up before bitcoin printed a lower-low, so not all is lost for longs. But until bitcoin conquers $41k the bias for any trade should be short - unless there's any major geopolitical development that suggests a local bottom, e.g. de-escalation in case Russia and Ukraine find agreement (unlikely).

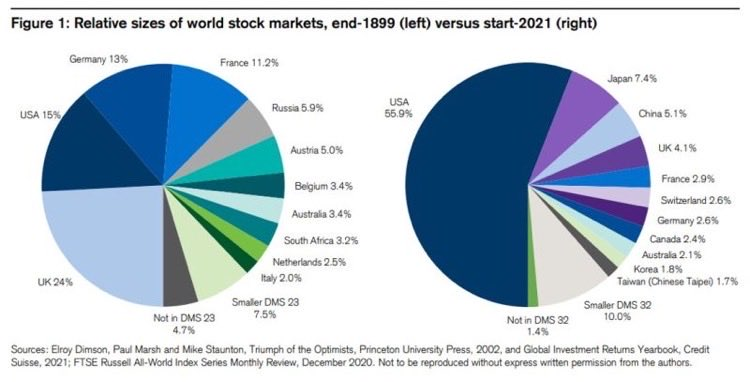

- Global equities continue to get pounded as commodities follow oil into potentially $200. On the bright side, one of the biggest bears of 2021 now believes the bottom is almost in, with the market potentially capitulating by the end of March as fear peaks with all the doomers out there. Conversely, these doomers see a "perfect storm forming", which could cause a prolonged bear market even if the war ends - as corporate profits struggle with inflation.

Why are we still talking about inflation? Wasn't that under control? I, too, thought soo. But its ripples stretch far into the misty fog. For example, Doomberg, a nice green chicken I've referenced here before, argues the current volatility and rise in energy prices may have stunning effects on the world's economy.

The silver lining is that all this chaos should, eventually, promote the price of digital gold. Just remember two things: it takes time for such a narrative to materialise in a pump, and, if that's the case, remember it's likely alts will fail to catch up with the orange corn for a while. Keep watching that dominance!

Chart art: not that dominant.

Three things: not that difficult.

- Chris Dixon shares some "reasons to build your startup in web3".

- Nat Eliason digs deeper on "tokenomics 102".

- LoFi Brian shows you the day if you're "looking for a job in crypto/web3".

Tweet tip: not priced in.

Meme moment: not that easy.

FV Bank: not that traditional.

Get started: download the B21 Crypto app!