March comes in like a lion and goes out like a lamb

Cryptic ball: post-invasion bounce.

What a Monday! It seems bulls did get brave and their courage sparked a massive toppling of the bears. Even the most pessimistic accounts I follow - some of whom were calling a top back in November - now believe the double bottom formed around $33k paves the ground for a beautiful year for crypto ahead. However, things may continue sideways for months before the next leg up. Let's see why.

For the moment, BTC needs to conquer $45k and then $52k for us to hope for another test of the $69k all-time highs. Until then, we're still stuck in this range. On the bright side, we can at least see crypto has started to decouple from US equities, as bitcoin's 20% pump over the past 36 hours preceded a small rise in the S&P 500 and the Nasdaq - even if these stock indices still look dreadful.

Moreover, note that the average alt "only" appreciated 11% during bitcoin's pump. Naturally, some outliers exist, like LUNA, which jumped 35% on the same period and is up 100% in seven days! Other alts are waking up from this winter's hibernation, e.g. RUNE which has climbed 30% today, and is up +50% since Sunday - one of the few major projects not taking a breath this morning.

But we can't forget that bitcoin dominance is on the rise. If bulls want to continue the party we need sustained inflows and peace. The war in Ukraine can go sour and sanctions can have unpredictable effects in the West. This could continue to play out nicely for the original cryptoasset and for some select alts, but not necessarily for any shitcoin - at least until the wider environment allows some euphoria.

Yes, the equinox is just 20 days from now and spring will bathe all of the Northern hemisphere. But remember that in 2018, a year where the crypto market fell 88%, we also experienced some respite around this time, and then crashed again. I agree things are different now, but yesterday's relative success of BTC vs. alts can only propel us to a generalised UpOnly context if people use BTC profits to buy alts.

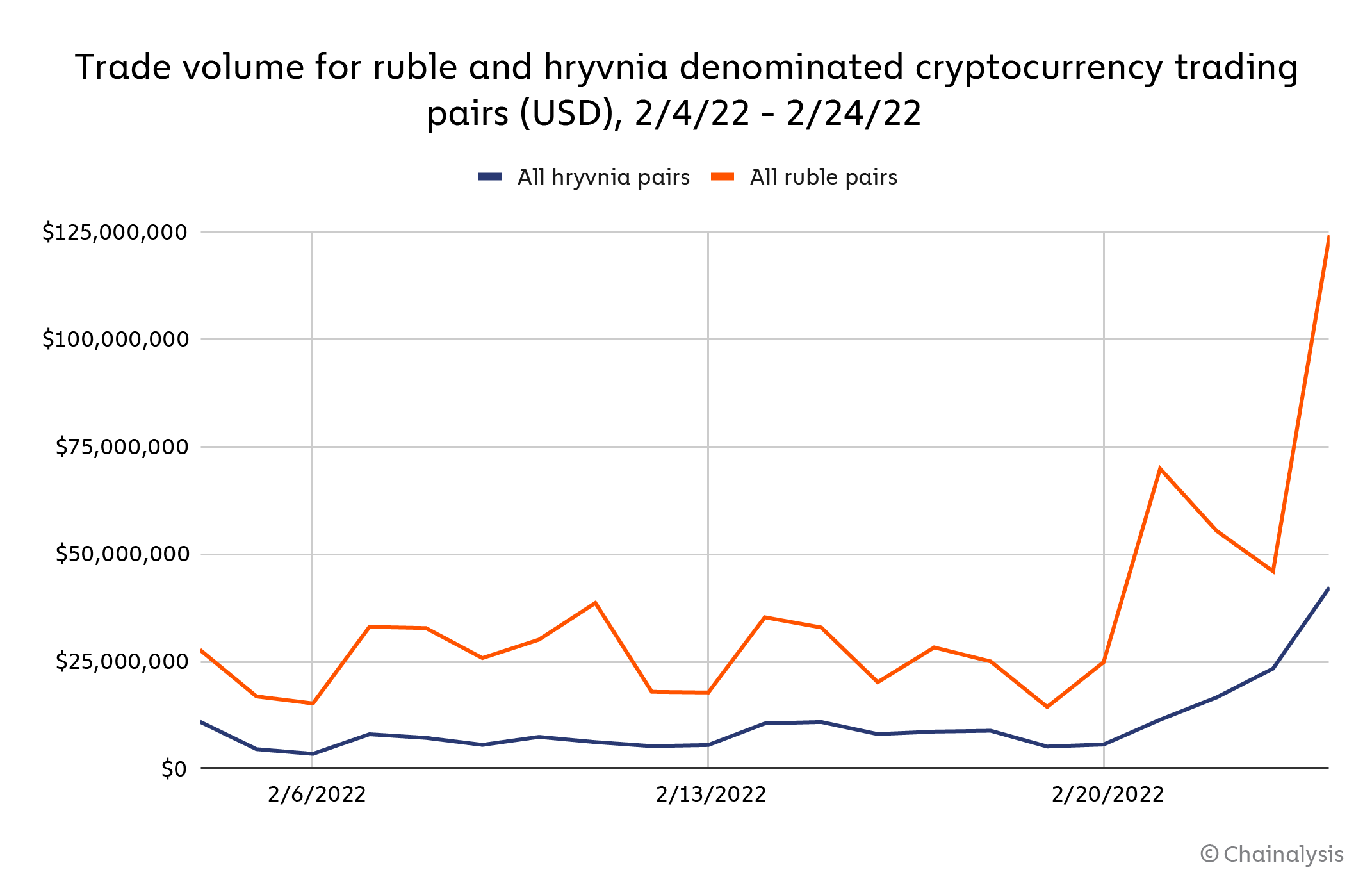

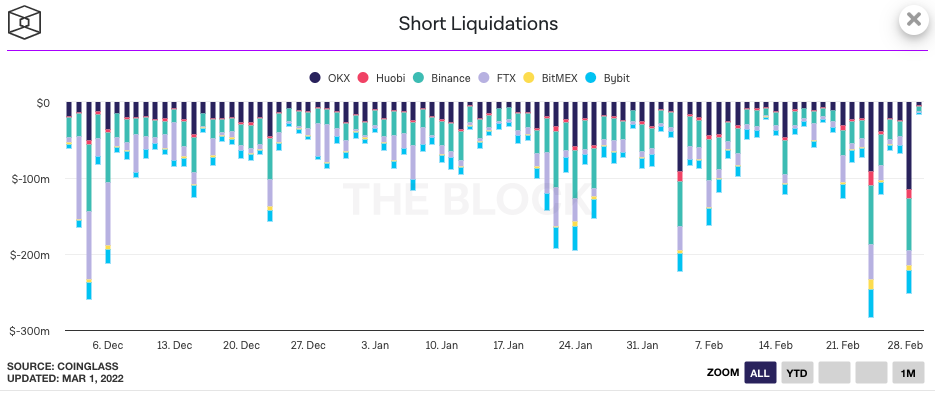

And that's not likely, as the pump was a consequence of Russians trying to protect their wealth (provided they already had money in exchanges), even if some institutions also added to their bags (see Morgan Stanley's latest purchase). This pressure then led to a decent amount of short liquidations across the board. In other words, these buyers won't sell BTC for DOGE now. In the meantime, we can expect the next days to be calmer - at least until the next major breaking news.

Chart art: running from wolves into bears.

Three things: quiet coin purchase.

- Chainalysis explains why bitcoin won't be used to circumvent sanctions.

- QCP Capital published its trading plan for March. They urge caution, arguing this war may be analogous to the Afghan one (remember last Monday?)

- BowTiedNightOwl shares why "institutional investors approach markets completely differently from retail investors". Another must.

Tweet tip: buffet best served cold.

Meme moment: hope not!

FV Bank: new API.

Get started: download the B21 Crypto app!