In a free land of our own

Cryptic ball: such consequences.

Are you confused about the fact you're getting this newsletter on a Sunday? Well, remember the world is currently upside down and, unfortunately, it seems everything is possible in this turbulent year of the tiger. So let's recap what has been happening to better prepare for the week ahead. This Friday, US equities had their best day since 2020. The S&P 500 also bounced above correction territory, although it still needs makes a higher high before bulls show up.

Crypto also continued the gains covered in Thursday's newsletter, with bitcoin pumping all the way to $40k. Since then, the market has remained sideways, which is good in times like these. But last week's rally may face some struggles over the next days, as the uncertainty surrounding the war in Ukraine deepens - especially as the nuclear threat escalates. After all, such a major global disruption with unforeseeable consequences can only promote volatility.

To sum up, I expect to see some chop this week. While many believe bitcoin (but not alts) to be a safe haven, the original cryptoasset has still to prove that coveted status - and will continue to behave poorly in risk-off environments. Moreover, tomorrow's monthly close will likely see bears trying to push BTC below $38.5k (to print the fourth monthly candle in a row), with some help from algorithms triggered by Putin's nuclear references. So, keep an eye out unless bulls get brave.

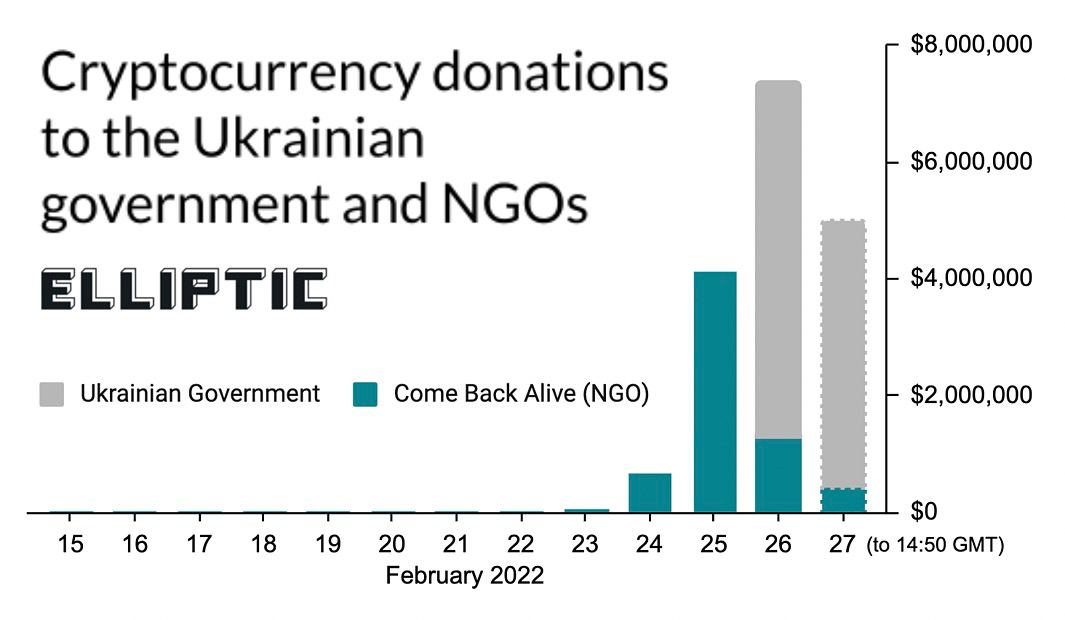

Chart art: such campaigns.

Three things: such musts.

- Niall Ferguson knows a lot about money and expects "this crypto winter soon to pass", followed by a digital gold and DeFi spring. A must-read!

- 0xesg went to ETHDenver and writes about "10 behaviours that will make you money in 2022". Another must-read.

- Jack Niewold shares his "biggest regrets in crypto investing". Yes, a must!

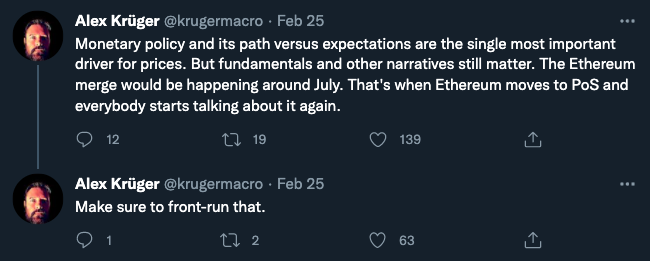

Tweet tip: such a new hope.

Meme moment: such truth.

B21 App: do more with your crypto.

Get started: download the B21 Crypto app!